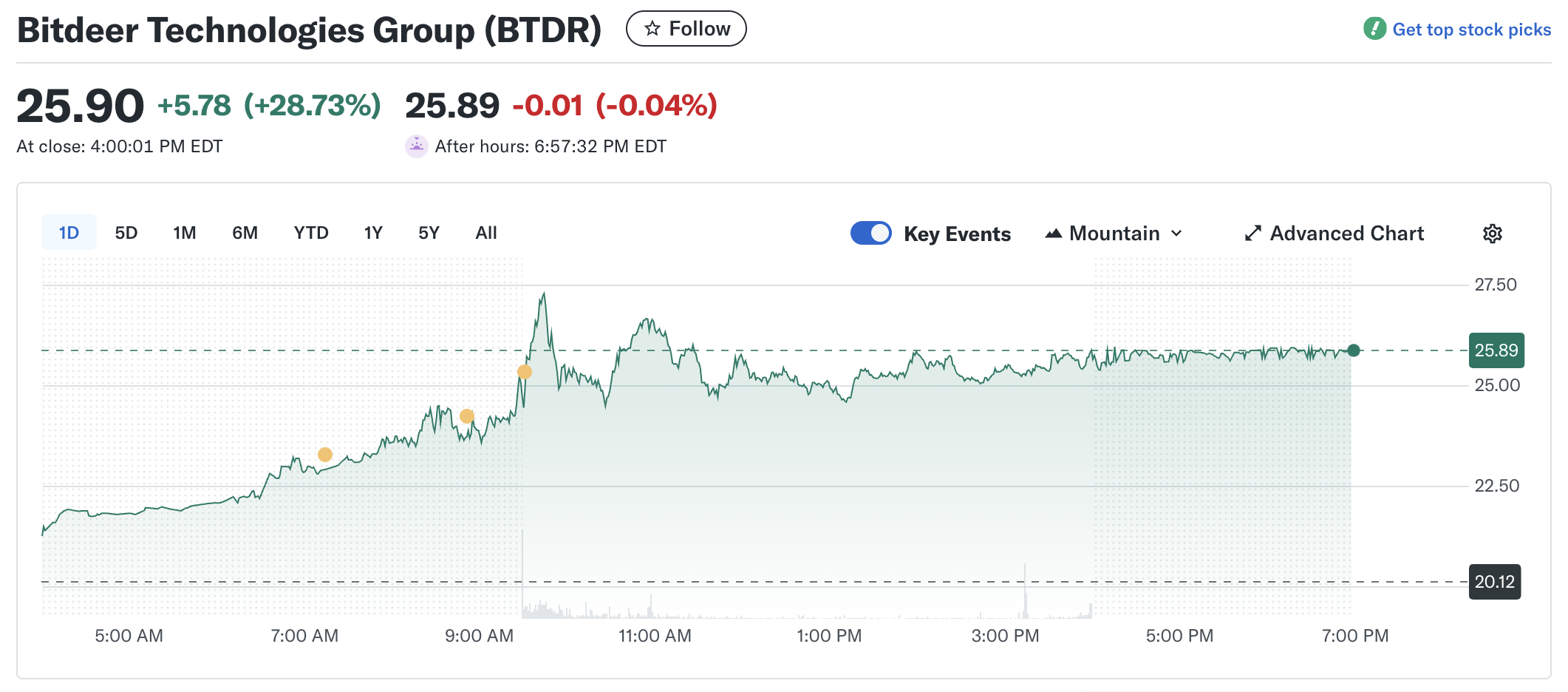

Crypto mining firm Bitdeer Applied sciences’ inventory surged as regards to 30% on Wednesday to an all-time high of $27, extending a two-day rally fueled by stronger mining output and formidable AI files‑middle plans.

The rally coincided with Bitcoin’s standard preserve approach $110,000, signaling resilience after contemporary gains and boosting self belief at some point soon of the mining sector. The mixed market capitalization of listed miners has now exceeded $90 billion — extra than double the extent recorded in August.

Mining Output Hits Novel Records

Bitdeer mined 452 BTC in September, up 20.5% from August, pushing its self‑mining hashrate to 35 exahashes per 2d. Management expects 40 EH/s by the cease of October. These gains observe the rollout of new SEALMINER A2 and A3 rigs, which dwell effectivity beneath 10 joules per terahash.

“Our growth is fueled by increasing quiz for computing energy,” said Chief Industry Officer Matt Kong. “This has grow to be a solid catalyst for accelerating both our mining and AI initiatives.”

Bitdeer’s entire energy pipeline has reached around 3 gigawatts, with contemporary potential online in Norway, Bhutan, and Ohio. Its Clarington, Ohio plot will bring 570 megawatts by insensible Q3 2026 — as regards to a year sooner than schedule.

$BTDR September 2025 Mining & Operations Replace:

🔹 452 $BTC self-mined, +20.5% MoM; 35 EH/s deployed for self-mining hashrate, no longer off route to reach 40 EH/s by Oct.

🔹 #SEALMINER A3 series launched with Pro versions boasting 12.5 J/TH effectivity, and started mass manufacturing.

🔹… pic.twitter.com/9rGI23w2oN— Bitdeer (@BitdeerOfficial) October 15, 2025

AI Recordsdata Companies Poised to Turn out to be Improve

The firm plans to dedicate over 200 MW of potential to AI computing by 2026. Management estimates that, in an optimistic danger, annual AI‑linked earnings may perchance well exceed $2 billion. Extra conversions in Washington Negate and Tydal, a region in central Norway, are underway to enhance GPU‑intensive workloads.

The initiative helps Bitdeer steadiness cyclical crypto revenues with standard AI provider quiz. Its AI facilities provide flexible potential for purchasers in cloud computing, self reliant techniques, and vast‑scale model practicing, allowing the firm to monetize excess energy at some point soon of Bitcoin downturns.

The broader model presentations miners diversifying into AI internet hosting as GPU quiz surges. Bitdeer’s vertical integration — from ASIC safe to self‑mining and files facilities — positions it as a “one‑cease” blockchain computing provider. Its AI cloud provider generates about $8 million in habitual earnings at 86% GPU utilization.

$BTDR initiating its maintain crypto miner -> HPC/AI transistion supplied this day trading at the very perfect quantity ever.

Some Notes:

*Ohio facility with 570 MW by Q3 2026

*Rep GPU,s plan AI factory, seemingly producing an annualized earnings bustle-price (ARR) exceeding US$2 billion at… pic.twitter.com/2oU6N6I8ZO— Ted Zhang (@TedHZhang) October 15, 2025

Analysts Note More Upside Forward

Wall Boulevard remains optimistic. Cantor Fitzgerald raised its effect goal to $50 with an Obese rating, whereas Roth Capital reaffirmed a Aquire at $40. BTIG, a US‑essentially based investment bank, build of living its goal at $25. Institutional holdings get furthermore climbed sharply, with hedge funds boosting stakes by as much as 70% in contemporary quarters.

Serene, the sphere faces challenges. Bitcoin’s community hashrate has surpassed 1 zettahash, pushing mission to sage highs and lowering hashprice to about $47 per petahash per 2d. Even so, investors secret agent Bitdeer’s mix of AI growth and efficient mining as a uncommon twin‑engine growth yarn in the digital infrastructure growth.

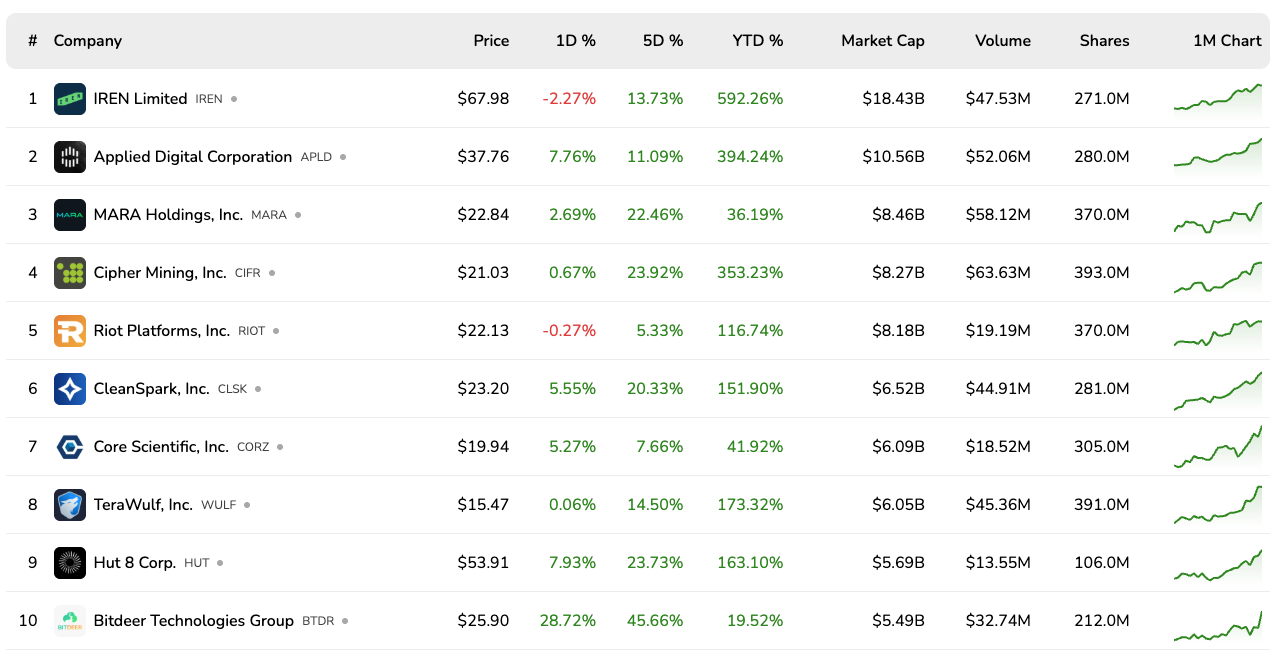

Broader Market Rally Amongst Public Miners

The rally has spread at some point soon of the mining sector. Marathon Digital closed the day at $22.84, declaring upward momentum, whereas Riot Platforms carried out approach $22.13, reflecting a identical model. Each shares are trading approach their contemporary 52-week highs. Within the intervening time, CleanSpark improved 5.5% to resolve on at $23.20, as analysts pointed to improved cost effectivity and contemporary facility expansions.

Utilized Digital, which is furthermore pivoting toward AI files‑middle products and companies, climbed 14% amid rising enthusiasm for GPU infrastructure plays. Hut 8 and Cipher Mining posted smaller gains of 6–8%, whereas Canaan Applied sciences jumped extra than 10% after securing an limitless command for its Avalon A15 Pro miners.

These parallel gains spotlight renewed self belief in vertically built-in miners that mix self‑mining, hardware safe, and AI internet hosting capabilities. With Bitcoin prices stable approach sage phases and institutional funds rotating into digital infrastructure equities, the mining sector appears to be like poised for a brand contemporary part of growth driven by diversification and scale.

The mixed market capitalization of fundamental public miners has surpassed $90 billion.