Bitcoin’s (BTC) volatility meltdown continues because the cryptocurrency stays stagnant, with tiring impress action between $110,000 and $120,000.

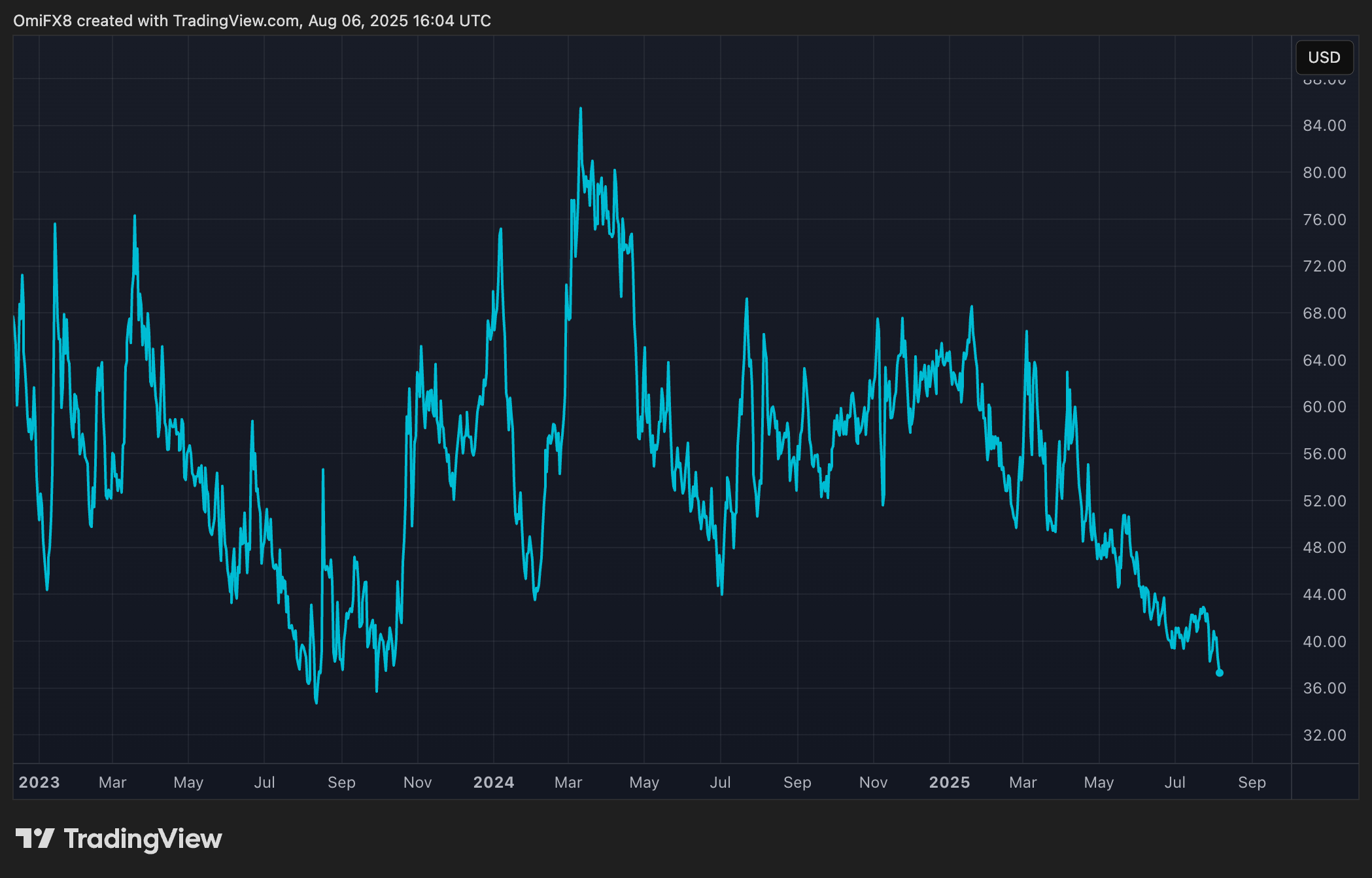

The cryptocurrency’s 30-day implied volatility, as represented by Volmex’s BVIV index, fell to an annualized 36.5% slack on Wednesday, reaching levels final considered in October 2023, when BTC became shopping and selling under $30,000, in accordance with files source TradingView.

The contemporary multi-year low in implied volatility suggests that alternatives traders are likely to be now not but speeding for hedges, no matter U.S. financial files elevating concerns about stagflation. The ask for alternatives, which can well be contracts extinct to hedge against or advantage from impress swings, is a predominant driver of an asset’s implied volatility.

The an identical ingredient might be said about stocks, the put the VIX index has reversed Friday’s spike from 17 to 21. The VIX measures the 30-day implied volatility in the S&P 500.

BTC mirrors stock market volatility patterns

BTC’s implied volatility has been in a months-lengthy downtrend, interesting in the reverse course of the cryptocurrency’s impress, which has surged from $70,000 to over $110,000 since November.

The detrimental correlation marks a profound shift in bitcoin’s market dynamics. Traditionally, BTC’s volatility and its location impress moved in tandem, with volatility rising in each bull and endure markets.

The factitious in this location-volatility correlation is attributed, in segment, to the growing repute of structured products that possess the writing (selling) of out-of-the-money call alternatives, analysts suggested CoinDesk.

This contemporary dynamic suggests that bitcoin is increasingly extra mirroring patterns on Wall Avenue, the put implied volatility incessantly dwindles in the future of regular bull runs.

Read: Bitcoin’s ‘Low Volatility’ Rally From $70K to $118K: A Memoir of Transition From Wild West to Wall Avenue-Bask in Dynamics