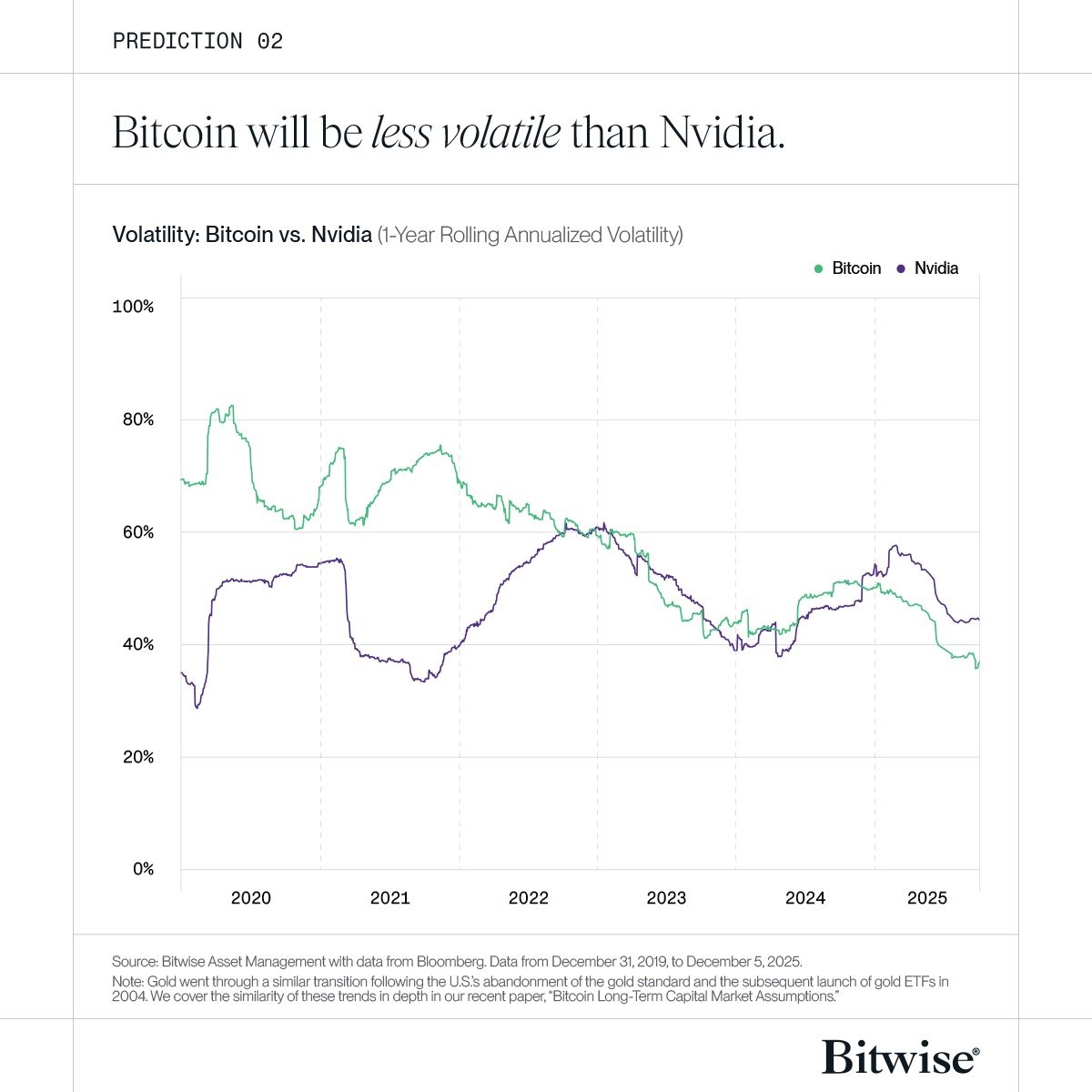

Bitcoin’s volatility appears to be like to be diminishing as its actions in 2025 fetch been more subdued than shares in Nvidia (NVDA), which Bitwise says displays its investor heinous is diversifying.

Bitwise acknowledged on Wednesday that Bitcoin (BTC) will continue to be less unstable than Nvidia in 2026 as “Bitcoin’s volatility has gradually declined over the past ten years.”

It added that the shift alerts a “derisking” of the asset as its investor heinous has diversified attributable to the emergence of institutional funding merchandise.

“This shift displays the basic derisking of Bitcoin as an funding and the diversification of its investor heinous attributable to mature funding autos luxuriate in ETFs.”

Nvidia will be more unstable than Bitcoin in 2026

Bitcoin has seen a 68% designate alternate from its lowest level this 365 days, when it fell to $75,000 in April, to its highest level, which was the all-time high of $126,000 in early October.

Comparatively, Nvidia has seen more volatility with a 120% designate swing from a low of $94 in early April to a 2025 high of $207 in behind October.

Shares within the chip giant fetch also outperformed Bitcoin this 365 days and are up 27% 365 days-to-date. Bitcoin, within the period in-between, has fallen 8% since the starting of this 365 days as crypto markets fetch decoupled from shares.

Bitwise bets on recent all-time high

Bitwise also made several bullish predictions for the arriving 365 days, at the side of a recent all-time high for Bitcoin and a damage of the four-365 days cycle.

“Forces luxuriate in the Bitcoin halving, pastime rate cycles, and crypto booms and busts fueled by leverage are weaker than in past cycles,” it acknowledged.

It acknowledged institutions luxuriate in Citigroup, Morgan Stanley, Wells Fargo, and Merrill Lynch entering crypto, allocations to repute crypto alternate-traded funds (ETFs), and onchain constructing “will tempo up in 2026.”

Eventually, the pro-crypto regulatory shift will continue to enable companies to undertake crypto at a faster rate, Bitwise acknowledged. It also predicted that crypto equities will outperform tech equities.

“Tech shares fetch done properly, up 140% over the past three years, nonetheless crypto equities are doing even higher.”