Bitcoin’s drop below the $50k impress became the consequence of quick holders losing their chilly and panicking. These of us, who’re newer to the game, couldn’t handle the heat and began dumping their cash on the first signal of disaster.

The irony? Bitcoin’s dominance available within the market is stronger than ever, nonetheless the actions of these jittery traders created pointless chaos. Glassnode data shows that since November 2022, Bitcoin has climbed its technique from a 38% market allotment to 56%.

Within the meantime, Ethereum, stablecoins, and altcoins delight in viewed their shares shrink. Ethereum’s allotment slipped from 16.8% to 15.2%, while stablecoins plummeted from 17.3% to 7.4%. Altcoins didn’t fare significantly better, losing from 27.2% to 21.3%.

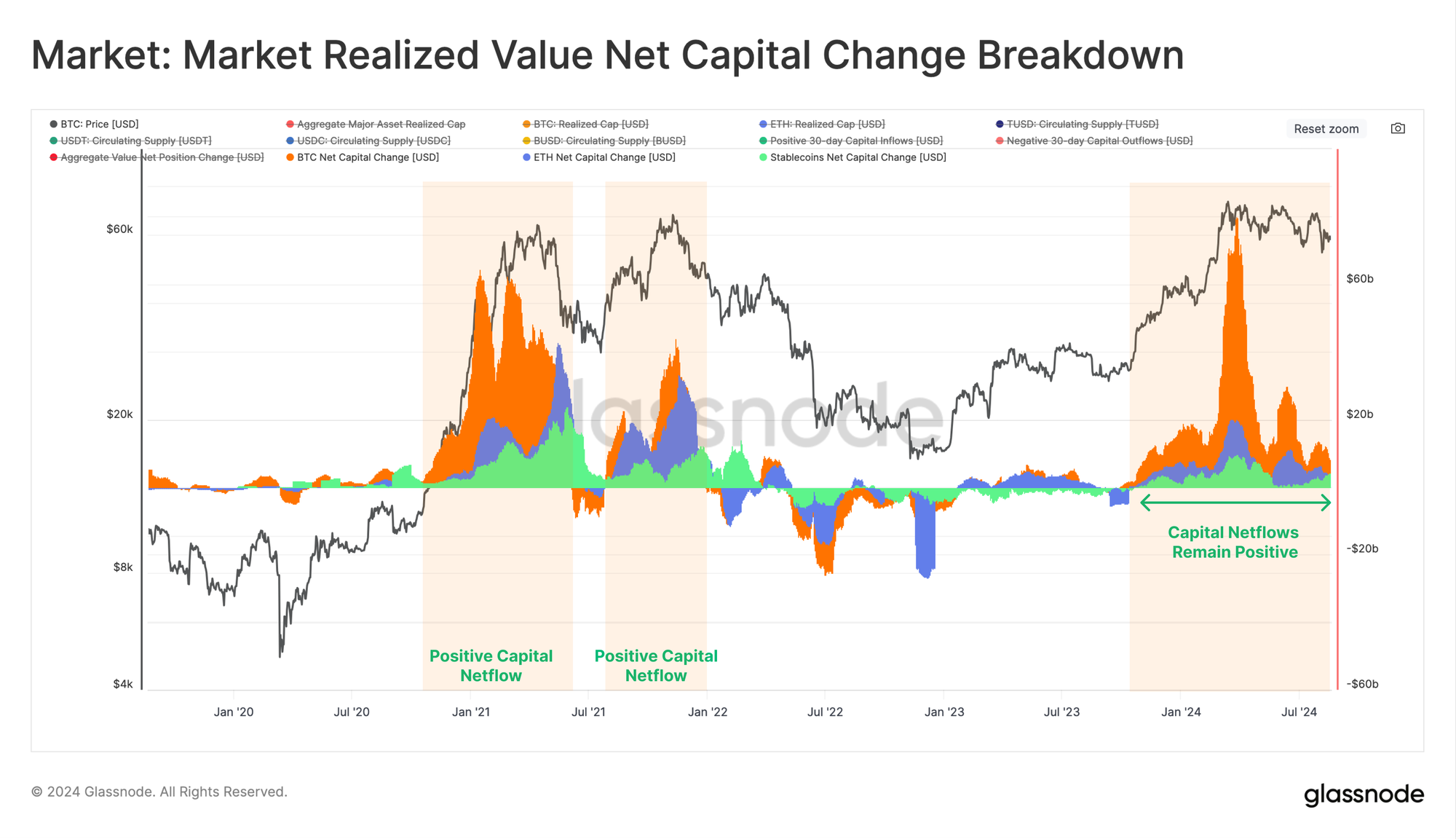

Capital inflows and market changes

Let’s ruin it down. Capital retains flowing into Bitcoin, Ethereum, and stablecoins, even supposing the market has in most cases gotten smaller since March’s ATH. Handiest about a third of the procuring and selling days seen extra cash coming in than fashioned, nonetheless that’s mute a tight signal.

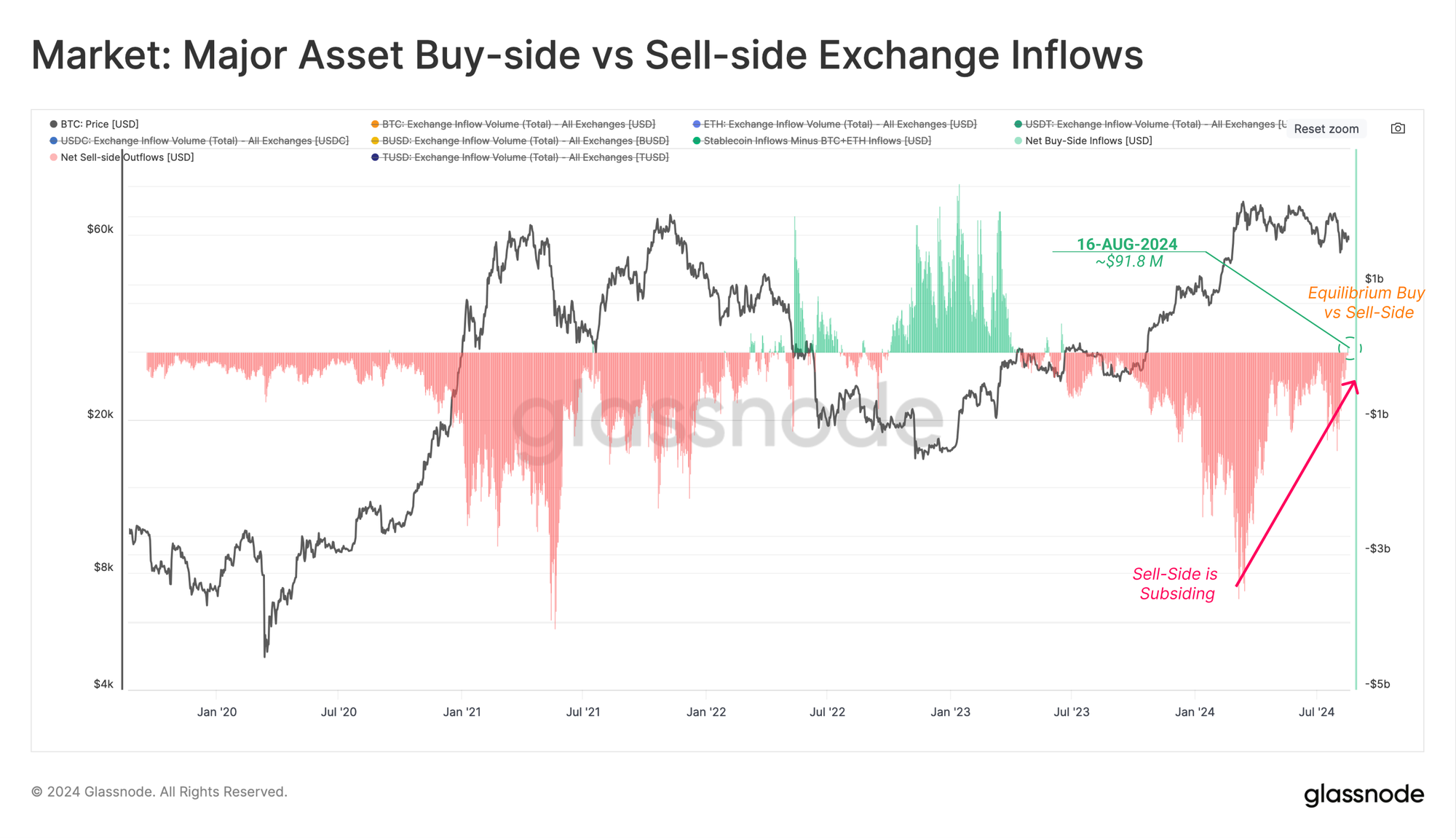

What’s attention-grabbing is the shift in buy-aspect versus promote-aspect metrics. These numbers describe us the put the money is moving, whether or no longer of us are shopping for more stablecoins or promoting off their Bitcoin and Ethereum.

When the market hit that ATH, the stress to promote began to ease. For the first time since June 2023, we seen some bullish movement, with a fetch inflow of round $91.8 million per day. However the injure became already performed by quick holders, who got spooked and began offloading their resources.

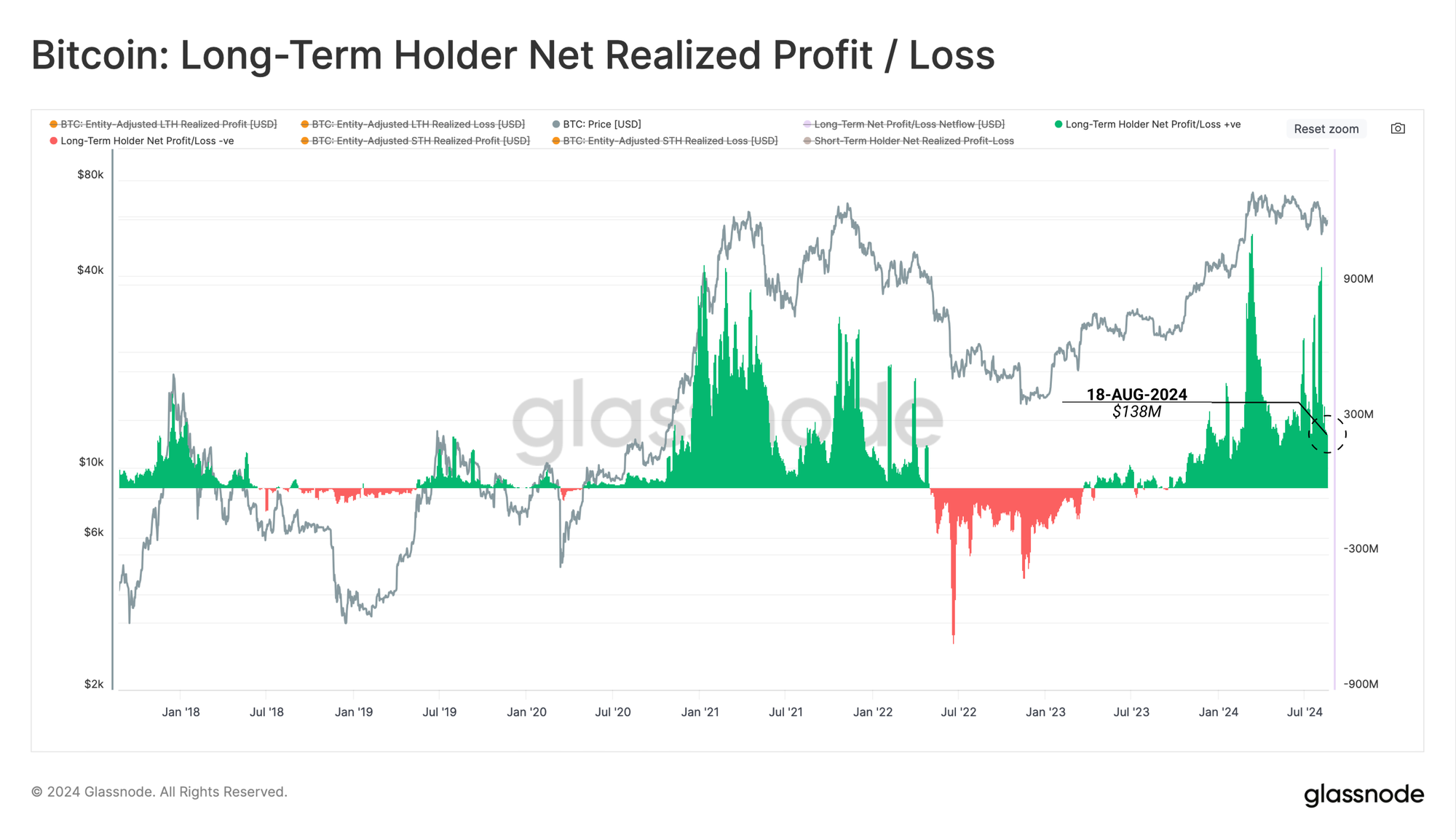

Glassnode says this overreaction is a textbook case of why these holders want to relax. Long-term holders, on the different hand, had been making bank.

They’ve been cashing in at a on daily basis payment of $138 million in profit on daily basis, balancing out the provision and ask of. This has saved the market from fully collapsing, nonetheless it’s also saved costs somewhat flat.

The market’s behavior

Whenever you survey on the Realized Income/Loss Ratio for long-term holders, you gaze that they’re mute doing alright, despite the indisputable truth that they’ve began to slack down on the profit-taking.

During the ATH, this metric became during the roof, the same to what we seen in previous market peaks cherish 2013 and 2021. It’s cooled off now, which is appropriate attributable to it technique we’re no longer headed straight into a undergo market cherish in 2017-2018 when everything went to hell.

Long-term holders are mute sitting moderately, with a median profit margin of round 75%. Their spending has slowed down, which technique they’re maintaining onto their cash rather than promoting them off in a scare.

This HODLing behavior is a giant deal attributable to it shows that these traders factor in in Bitcoin’s long-term set up.

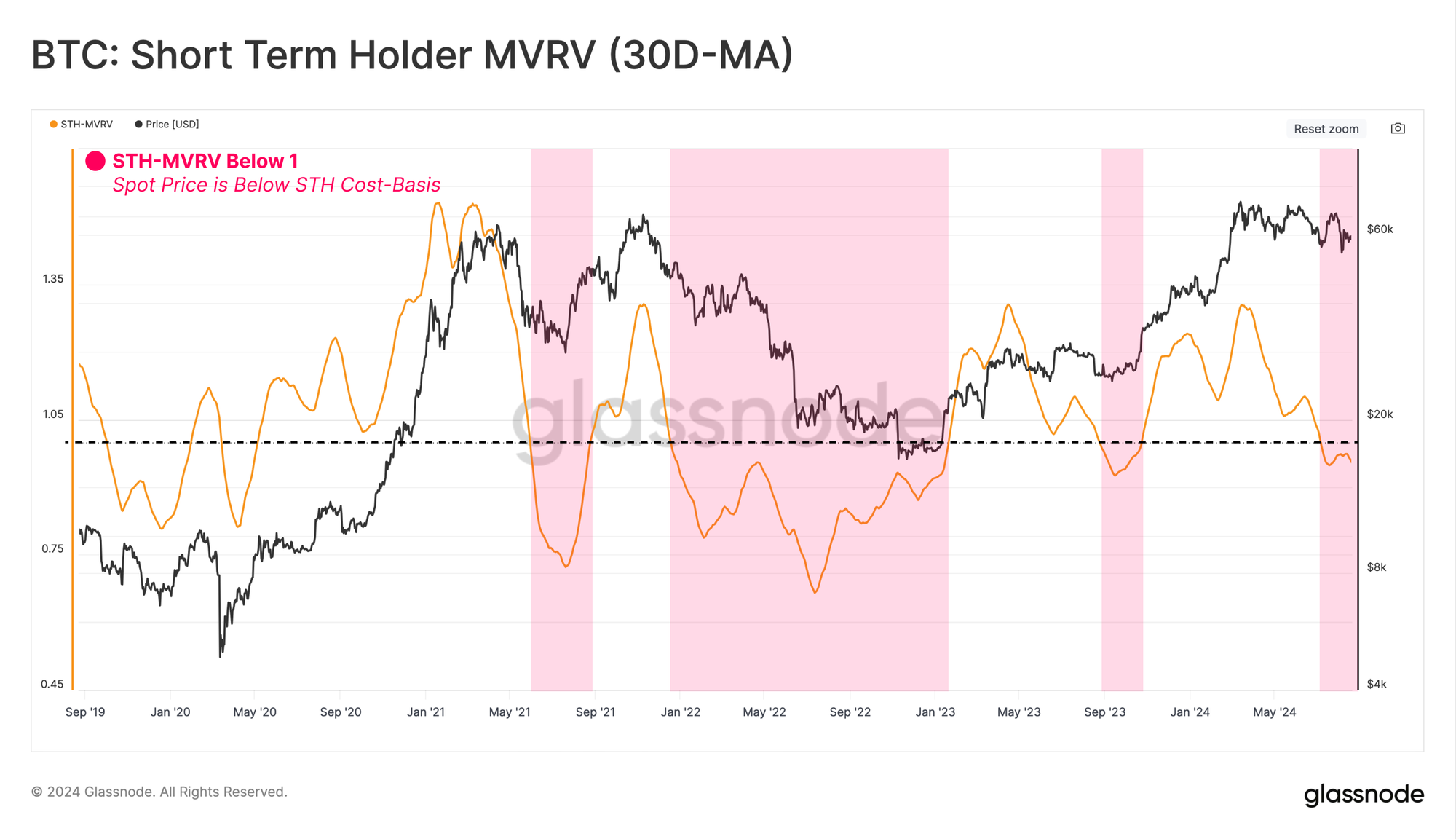

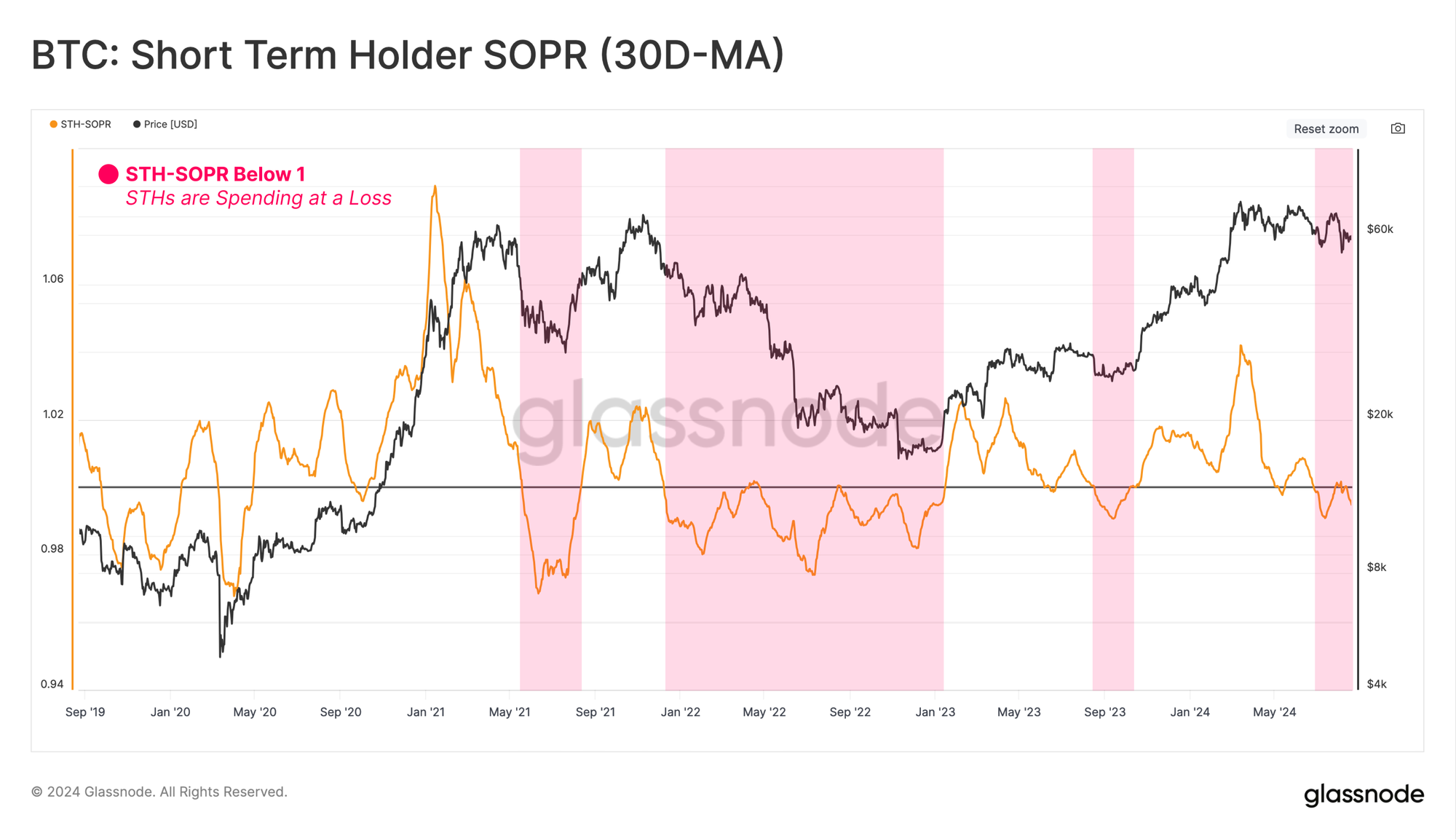

The quick holders are feeling the heat upright now. The Short-Term Holder Market Price to Realized Price (STH-MVRV) ratio has dipped below 1.0, which technique every body amongst these most unique investors are sitting on losses.

On the entire, all through a bull market, you’d ask of a snappy dip cherish this, nonetheless if it drags on, it ought to trigger elephantine-on scare promoting. And that’s precisely what we’ve been seeing.

The expectation of a promote-off grows as these quick holders begin realizing their losses. The Spent Output Income Ratio (STH-SOPR) for this community has also dipped below 1.0, confirming that every body amongst these cash are being supplied at a loss.

This creates a solutions loop, the put the more they promote, the more costs drop, ensuing in even more scare promoting.