Bitcoin’s mark has lately experienced a vital decline, crashing beneath $90,000 after slipping by means of serious toughen stages. The descend came as BTC struggled to care for momentum, straying farther from the $100,000 effect.

The continuing downtrend could well even be influenced by the habits of transient holders (STHs), who seem like altering their stance because the market shifts.

Bitcoin Investors Anxiousness Losses

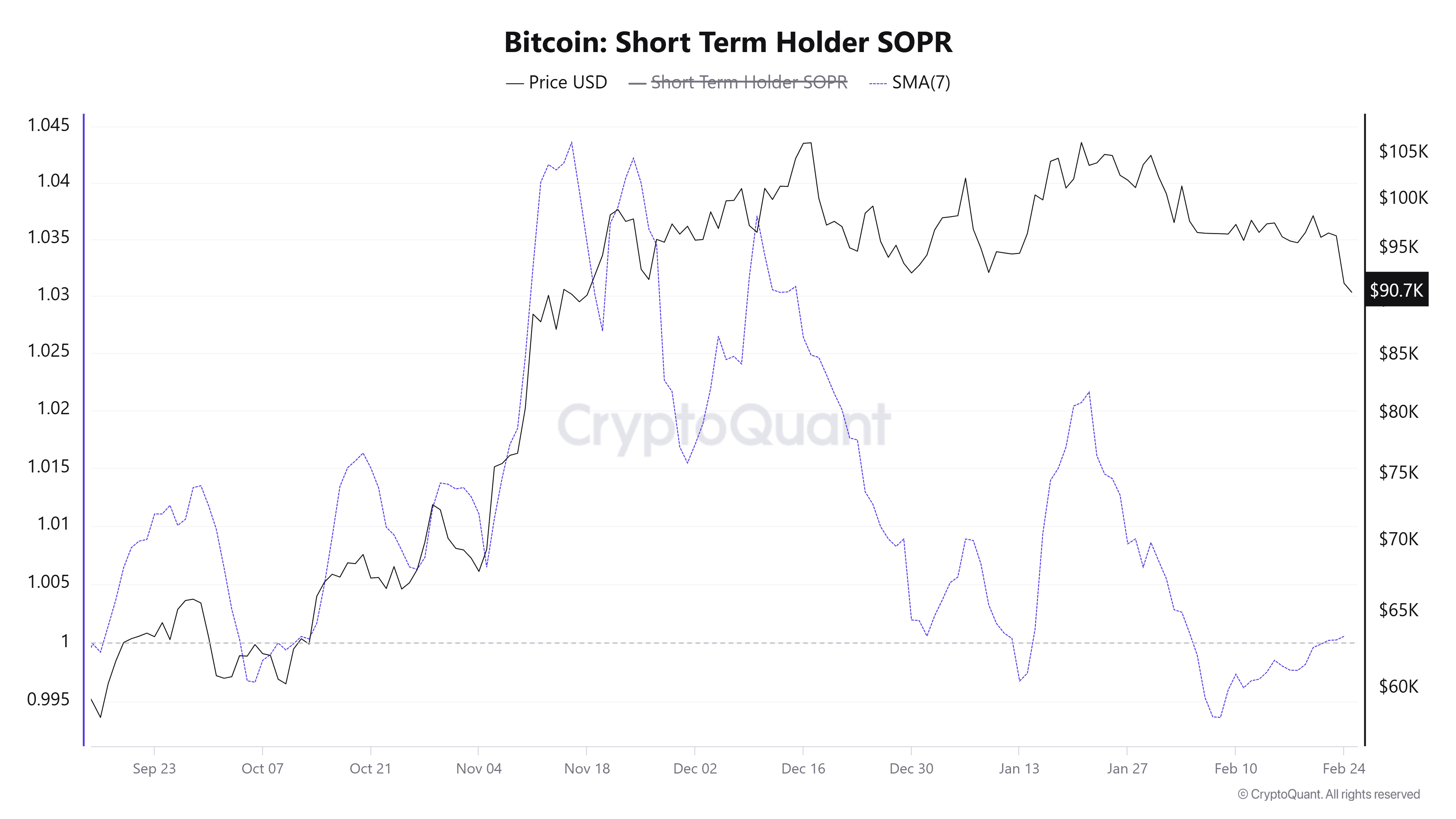

The transient holder (STH) Spent Output Income Ratio (SOPR) indicator is struggling to reclaim the bullish threshold of 1.0. While staying above this level means that STHs are winning and willing to care for, the indicator’s failure to carry out so could well also signal an form bigger in sell stress. If the SOPR remains beneath 1.0, extra STHs are inclined to sell, more than seemingly main to extra losses for Bitcoin merchants.

Essentially the most in style allege is pertaining to, as STHs are known for his or her fleet shopping and selling habits. After they open to sell in immense volumes, Bitcoin’s mark can descend fleet. The incapacity of the SOPR to end above the serious threshold indicates that bearish sentiment could well also form bigger, which could well also carry Bitcoin’s mark beneath $90,000, prolonging the market downturn.

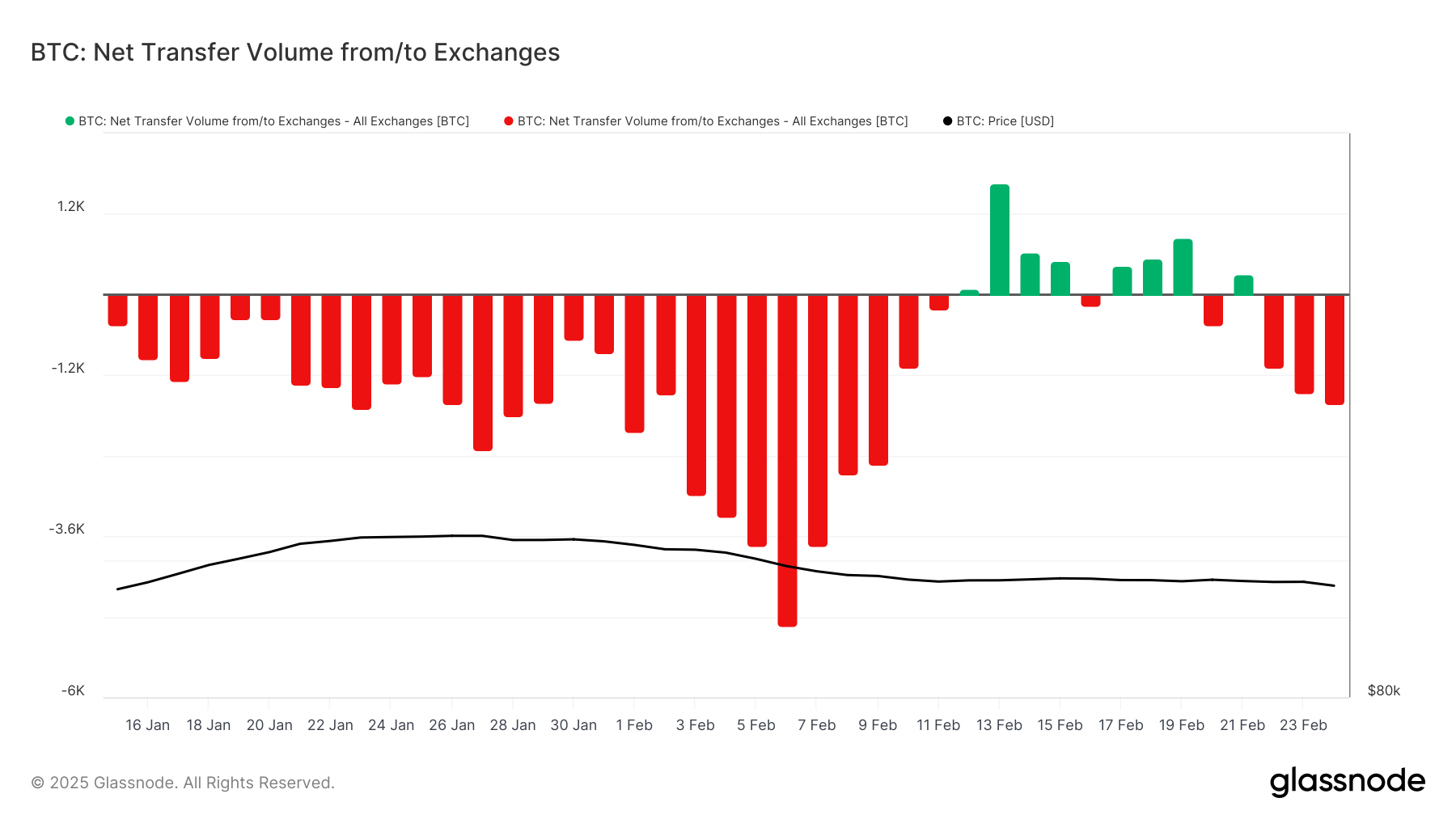

No topic the heavy smash Bitcoin has persisted within the previous 24 hours, commerce netflows present that there hasn’t been a principal amount of BTC leaving exchanges. All the way by means of the final 24 hours, exchanges saw preferrred 157 BTC worth $14 million in outflows. This minor outflow just isn’t aligned with the expected fear-pushed sell-off that will in total occur after this form of drastic descend.

The relative lack of immense withdrawals means that transient holders (STHs) could well even be hesitating to sell no topic essentially the most in style downturn. This might well also expose that many merchants are holding on, attempting forward to a doable reversal. With out a huge wave of sell-offs, Bitcoin could well also earn a route to restoration as market prerequisites toughen.

BTC Label Continues To Fall

Bitcoin’s mark on the 2nd stands at $88,449, the lowest it has been since November 2024, after experiencing a practically 8% descend within the final 24 hours. The smash precipitated Bitcoin to lose its downtrend line toughen, which had been intact for over a month. If Bitcoin’s mark can care for above its next significant toughen at $87,041, it will also stage a soar serve.

Bitcoin’s mark is anticipated to check the toughen level at $87,041 earlier than attempting a restoration. If the toughen holds, it would give Bitcoin the replacement to breach the following resistance at $89,800, sooner or later persevering with its traipse against $92,005. These doable moves could well also signal a reversal and spark off a certain pattern.

On the opposite hand, if Bitcoin loses the $87,041 toughen level, the sell-off could well also intensify, and Bitcoin could well maybe tumble to $85,000. This form of descend would invalidate essentially the most in style bullish restoration outlook, main to a extended downtrend and extra losses for merchants.