Bitcoin costs plunged or traded sideways after the halving, prompting opinions that BTC label project may doubtless well well cool as site ETF outflows proceeded.

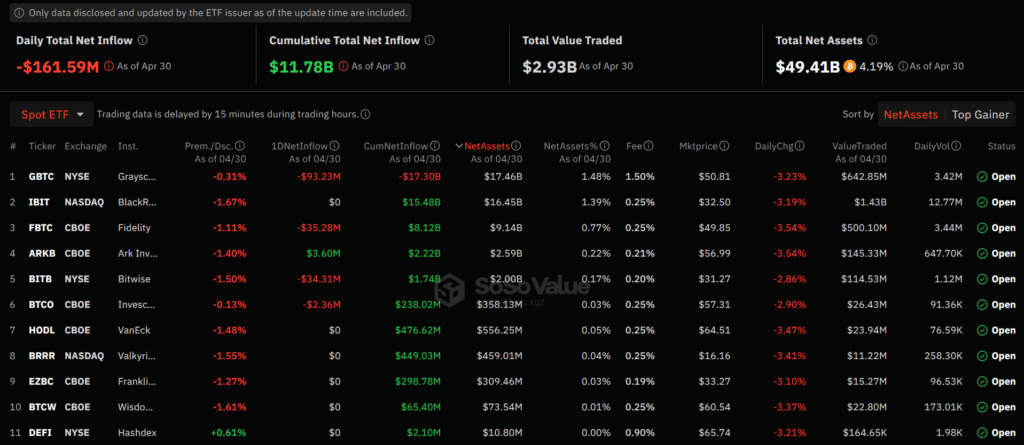

The U.S. site Bitcoin (BTC) ETF recordsdata from April 30 confirmed that GBTC single-day ranking outflows amounted to over $93 million, contributing to a cumulative outpour price more than $162 million from four tradable funds.

Grayscale’s Bitcoin ETF outflows maintain lately decelerated, but historical GBTC exits live staggering at over $17.3 billion since its conversion in January.

Grayscale CEO Michael Sonnenshein beforehand stated outflows ought to decline as the year unfolds and addressed GBTC’s exchange-high rate by announcing the associated rate would also lower with time.

In varied areas, six funds recorded zero ranking inflows, but specialists maintain pressured that the pattern is frequent on Wall Avenue as there are over 2,000 ETFs procuring and selling in The US. One product provided collectively by ARK 21Shares diverged from the day’s station quo and attracted over $3 million in ranking inflows.

Total, the total ranking asset value of resources below management (AUM) in site Bitcoin ETFs fell below $50 billion per SoSoValue. Data suggests that the decline in AUM is split between Grayscale outflows and Bitcoin costs.

Plan ETF project correlates with Bitcoin Prices

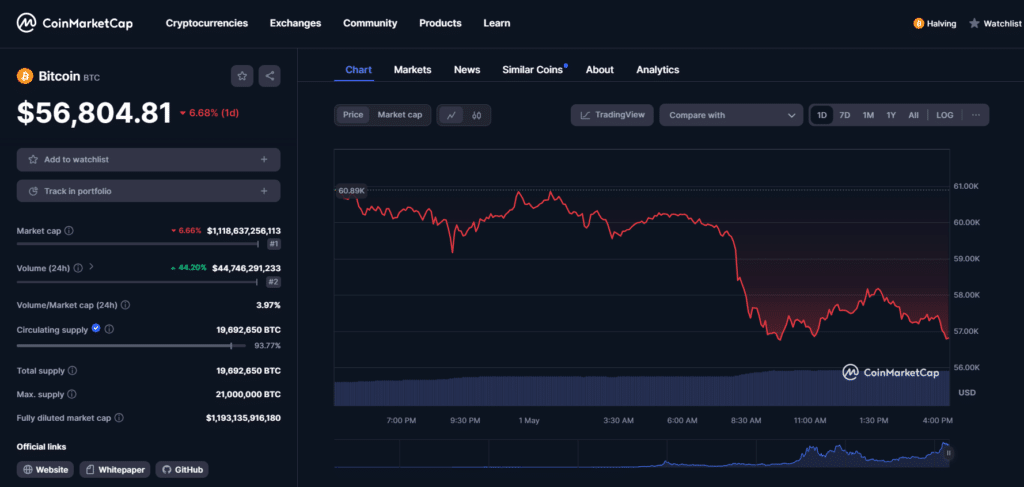

Per CoinMarketCap, BTC modified fingers below $57,000 after plunging over 6% in 24 hours. Nuklai CEO Matthijs de Vries suggested crypto.news that markets will likely skills a hiatus from better costs for some time following the Bitcoin halving.

“The off-chain speculatory procuring and selling label discovery will likely be a long way from easy: distorted provide dynamics kind a brand contemporary classic equilibrium, and a brand contemporary consensus label corridor is gradually constructed up. This uncertainty creates a length of the sideways market; the habits we maintain now seen after the previous halvings.”

Matthijs de Vries, Nuklai L1 blockchain CEO

Many speculated that site BTC ETF demand would withhold rising costs for the leading cryptocurrency. Nonetheless, the blockchain expert opined that a couple of on-chain indicators maintain signaled flat costs and market retraces.

“Originally, the initiate passion on Bitcoin futures has fallen from $39 billion in notional value to $30 billion, indicating much less certain wager on future label direction. Secondly, the procuring and selling project in each Bitcoin and altcoin swimming pools has fallen, whereas the USDT swimming pools, on the contrary, are experiencing better quantity. It’s a ticket that traders are flying to safety and cashing out earnings from the bull jog.”

Matthijs de Vries, Nuklai L1 blockchain CEO

Nonetheless, the consensus components to obvious sentiment referring to the long-term influence of U.S. site ETFs and the halving. As crypto.news beforehand reported, Bitwise CIO Matt Hougan pressured that taking out $11 billion of annual BTC provide due to the the technological tweak around block rewards and token emissions ought to bolster market costs internal a year.