The Bitcoin (BTC) Network Rate to Transaction (NVT) golden irascible means that the cryptocurrency’s most modern surge previous $93,000 could perchance perhaps also not worth the peak of this cycle. BeInCrypto seen this after inspecting the present notify of the metric.

At press time, BTC trades at $90,893. Right here is why this tiny drawdown could perchance perhaps also not final: as every other, Bitcoin’s tag could perchance perhaps also rally nicely above its all-time excessive.

Knowledge Shows that Bitcoin Stays Undervalued

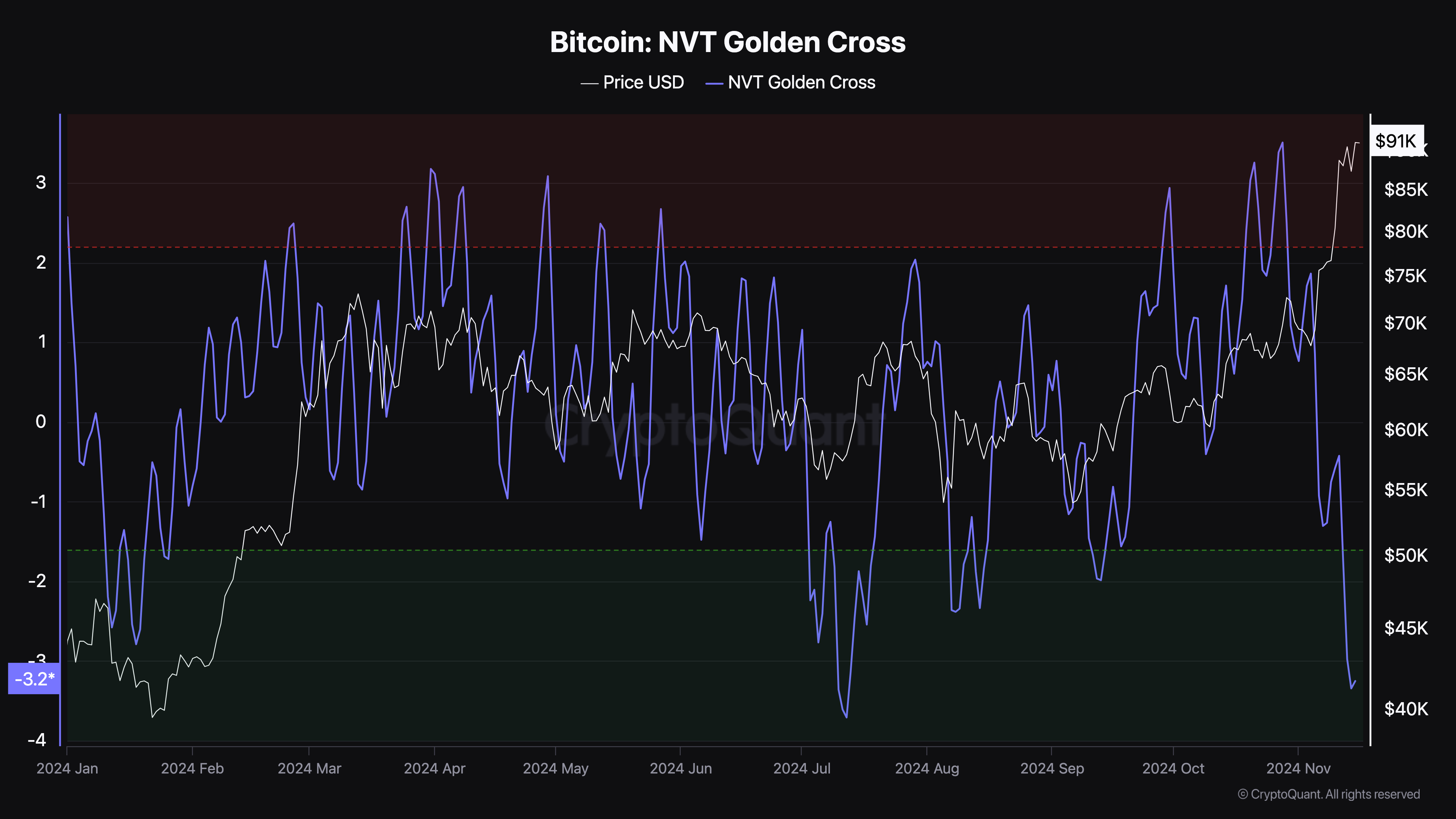

Bitcoin’s NVT golden irascible is a metric that helps space tops and buttons right thru a cycle. When the NVT golden irascible surpasses 2.2 facets (crimson self-discipline), it signifies a transient model of tag overheating, doubtlessly signaling a neighborhood top.

Conversely, a plunge below -1.6 facets (green self-discipline) suggests the worth is cooling excessively, pointing to a doubtless local backside. Primarily based fully on CryptoQuant, the metric’s discovering out is -3.25 as of this writing, suggesting that Bitcoin’s tag aloof has room to handle.

As an instance, when the metric changed into as soon as -2.60 in January, BTC traded below $42,000. About two months later, the coin went on to hit $73,000. Due to this truth, all for historical files and the present self-discipline of the metric, it’s doubtless for BTC to climb in direction of $100,000 outdated to the Three hundred and sixty five days closes.

This outlook also aligns with that of Crypto Kaleo, an analyst. Primarily based fully on Kaleo, Bitcoin’s doubtless rise to $100,000 could perchance perhaps also relate benefit retail traders and perhaps push the worth higher.

“I relish Bitcoin surprises each person when it crosses $100K, sends straight previous it and doesn’t plot benefit. It’s been such a mental milestone for thus long that it’ll relate retail FOMO benefit in elephantine force when it occurs,” the pseudonymous analyst wrote on X.

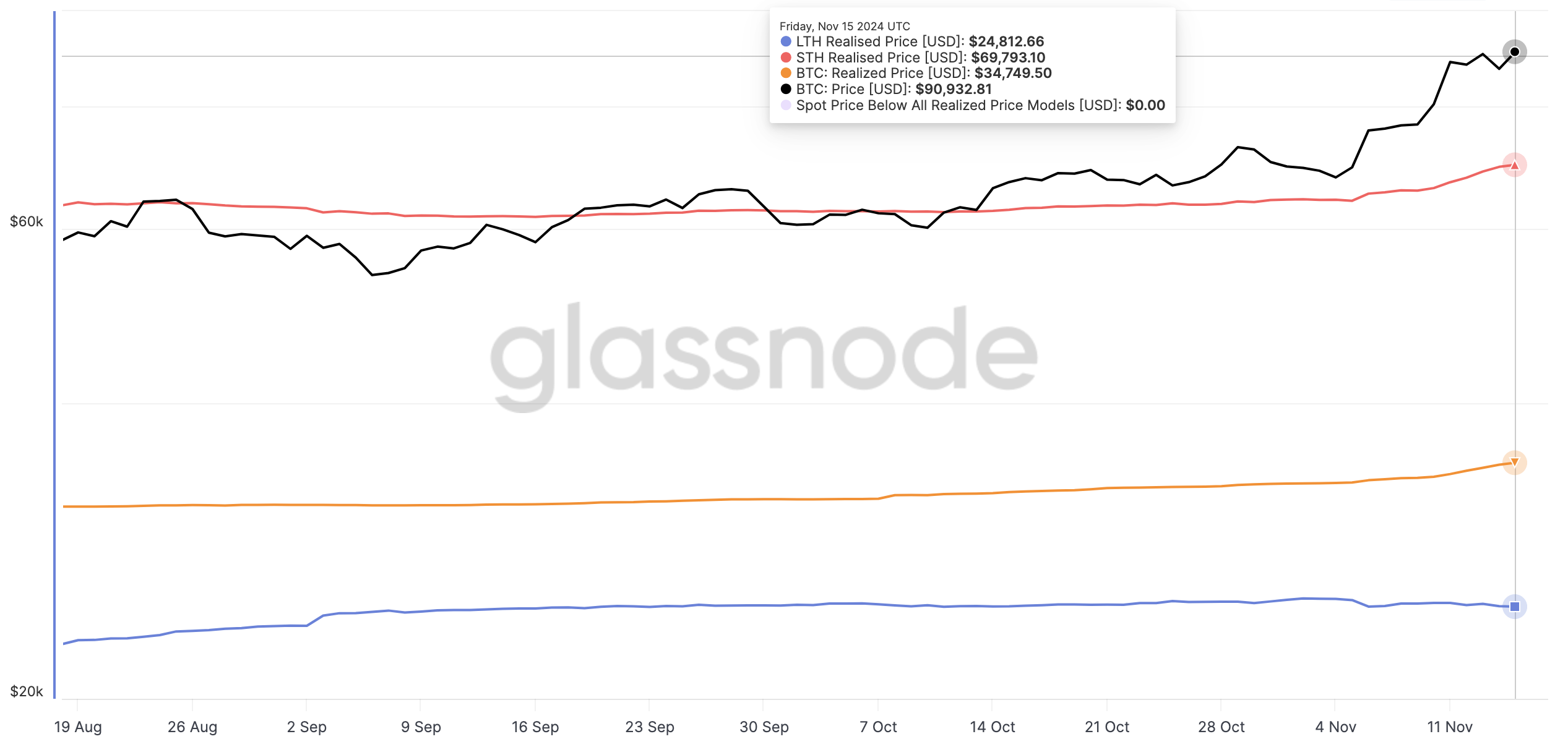

Furthermore, Glassnode files reveals that Bitcoin is within the period in-between trading above the realized tag of Short-Duration of time Holders (STH) and Prolonged-Duration of time Holders (LTH). The realized tag represents the provision-weighted realistic tag that market contributors paid for his or her money. It serves as an on-chain indicator of doubtless give a grab to or resistance ranges.

On the total, when the realized tag is above BTC, the cryptocurrency faces resistance. Due to this truth, the worth could perchance perhaps earn it not easy to climb. On the opposite hand, as seen above, the STH realized tag is below BTC’s price at 69,793, indicating that the worth could perchance perhaps also continue to rise.

BTC Be conscious Prediction: May perhaps well also $104,000 Be Subsequent?

On the three-day chart, Bitcoin has formed a bullish flag. A bull flag is a bullish chart sample characterized by two rallies separated by a transient consolidation segment. The flagpole kinds right thru a pointy upward tag spike as traders overpower sellers.

Right here’s followed by a retracement segment, right thru which tag motion creates parallel higher and decrease trendlines, forming the flag shape. Pondering the present outlook, Bitcoin’s tag could perchance perhaps also rally in direction of $104,228 as long as shopping for stress will increase.

On the opposite hand, if the Bitcoin NVT golden irascible hits a very excessive price, that could perchance perhaps also worth a neighborhood top for BTC. If so, the coin’s tag could perchance perhaps also face a vital correction.