Bitcoin (BTC) remains in a soft steadiness following the Federal Reserve’s rate decrease decision, where holding $115,200 is key to defining the next stir.

Glassnode reported on Sept. 18 that derivatives markets and on-chain data revealed a market poised for its subsequent directional pass.

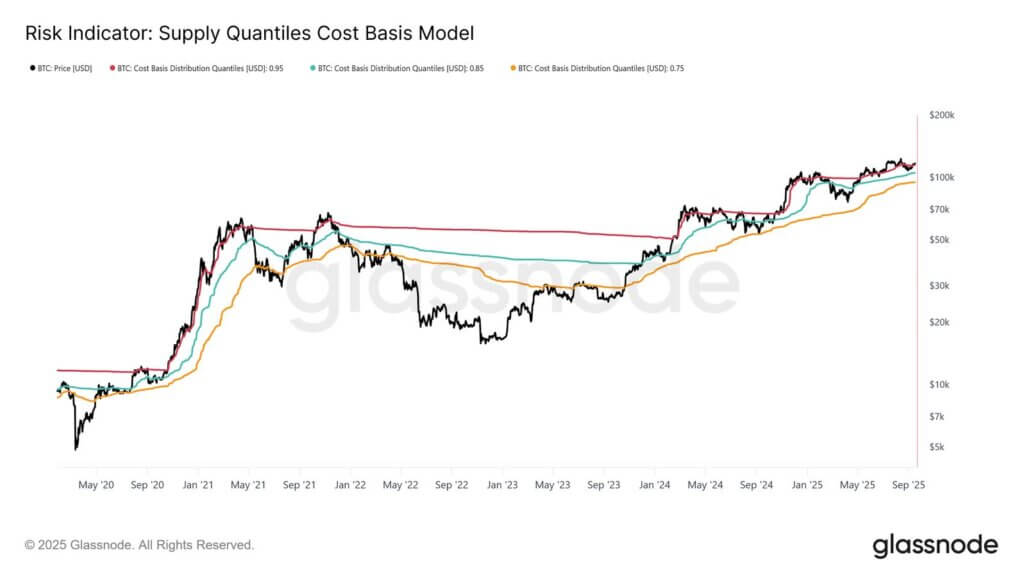

BTC became trading at $117,649.40 as of press time, positioning above the trace foundation of 95% of Bitcoin provide at $115.2k.

This threshold represents a essential line for affirming search data from-side momentum. Failure to preserve this stage dangers a contraction towards the differ between $105,500 and $115,200, which can presumably well well additional entrench selling rigidity.

Derivatives markets signal fragile positioning

Perpetual futures markets have proven stabilization after a length of volatile pre-FOMC positioning.

Birth ardour declined from a cycle excessive of 395,000 BTC on Sept. 13 to 378,000 BTC following choppy trace stir, nonetheless has since stabilized between 378,000 BTC and 384,000 BTC.

The pullback to $115,000 after the rate decrease triggered essential long liquidations, pushing liquidation dominance to 62%.

Unique positioning shows a fragile market structure with long-side max effort at $112,700 and instant-side max effort at $121,600.

This narrow differ suggests Bitcoin sits precariously between doable liquidation cascades, where map back strikes possibility triggering long positions while upside breaks could presumably well well gas instant squeezes.

Memoir choices job highlights volatility

Bitcoin choices originate ardour has reached a fable 500,000 BTC, with Sept. 26 marking the top expiry in Bitcoin’s historic previous.

The contract’s strike distribution spans $95,000 places to $140,000 calls, with max effort arrive $110,000 performing as a doable gravitational pull unless expiry.

Alternatives positioning reveals fixed build selling below whine and intensified call attempting to gain above recent ranges.

This structure forces dealers to procure liquidity in both instructions, doubtlessly cushioning declines while fueling rallies through hedging flows.

Market structure shows cautious optimism

The whine market cumulative quantity delta reveals soft detrimental deviations all one of many top ways through essential exchanges, indicating cautious sentiment despite the optimism surrounding the rate decrease.

On the opposite hand, perpetual markets conceal a notable shift from low selling to balanced stipulations. This stir shows returned liquidity as buy-side flows offset persistent August promote rigidity.

The convergence of fable choices positioning, stabilized perpetual flows, and Bitcoin’s subject above serious trace foundation ranges suggests a market waiting for affirmation of its subsequent essential pass.

Bitcoin’s ability to extinguish above $115,200 will outline the next essential post-FOMC stir