Bitcoin slack restoration continues, with the asset in the meanwhile trading at $95,409 after posting a 1.7% accomplish all the absolute top plan throughout the final 24 hours. Within the final two weeks, BTC has climbed close to 15%, getting better gradually from its newest duration of correction.

Whereas the momentum looks measured in contrast to previous breakouts, the underlying market files suggests that structural shifts are underway that can maybe also impact the following predominant circulation.

So a long way, several indicators are pointing toward making improvements to sentiment, notably within the derivatives market, which now dominates Bitcoin’s overall trading quantity.

Fresh observations from analysts highlight a shift in the balance of trading relate, hinting that prolonged positions are regaining strength over shorts. Meanwhile, up up to now cycle objects suggest Bitcoin could maybe maybe have to aloof aloof have room to lengthen its fresh fashion, with structural similarities emerging between the unique market and the 2017 cycle.

Bitcoin Get Taker Quantity Turns Certain, What Does It Trace?

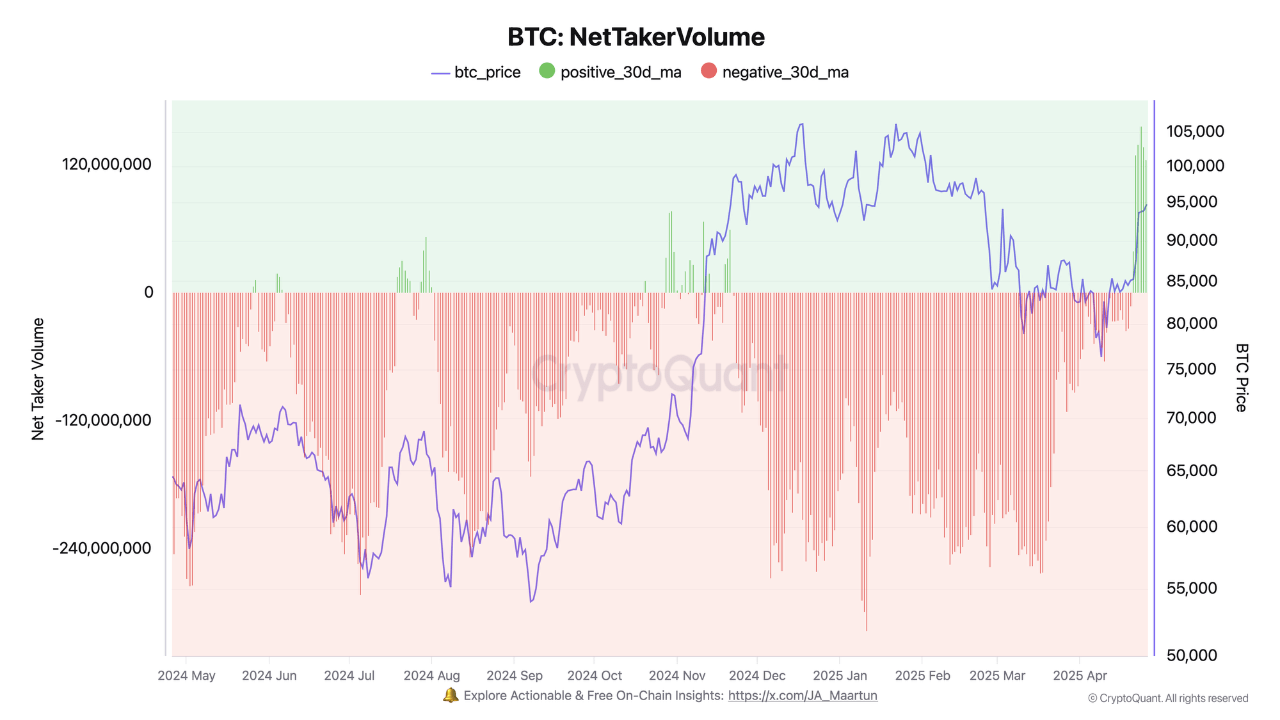

Per CryptoQuant analyst Darkfost, the 30-day transferring moderate of Bitcoin’s Get Taker Quantity has returned firmly to certain territory.

Get Taker Quantity is an indicator that compares the relative size of prolonged and short positions in the derivatives market over a given duration. A certain reading indicates that shopping for strain (prolonged positions) outweighs promoting strain (short positions), whereas a adverse reading suggests the opposite.

Darkfost notorious that derivatives markets now story for roughly 90% of total Bitcoin trading quantity, surpassing set and alternate-traded (ETF) volumes. As a consequence, shifts in derivatives sentiment can recurrently foreshadow broader establish movements.

The return of the Get Taker Quantity into certain territory suggests that speculative participants are positioning for continued upside. This realignment in the derivatives market, if sustained, can even act as a catalyst to enhance Bitcoin’s newest positive aspects and jam the stage for further establish discovery.

Cycle Mannequin Adjustments Conceal Uptrend Continuation

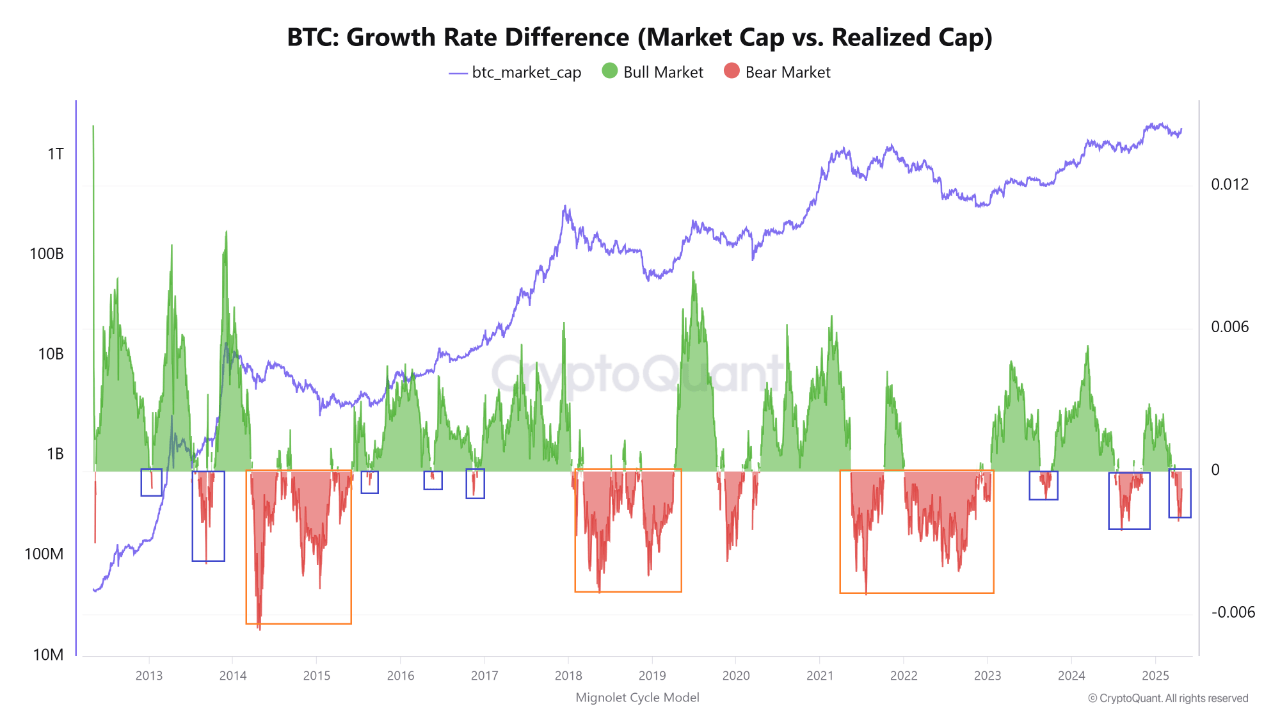

In a separate analysis, CryptoQuant analyst Mignolet equipped perception into Bitcoin’s longer-term fashion outlook. The utilization of a subtle cycle model in line with market capitalization files, Mignolet suggested that passe cycle indicators have been slack to replicate the most fresh restoration.

To deal with this tear, adjustments have been made to the model’s time series to detect earlier shifts in market conduct. Mignolet seen that what looked as if it would be a “endure market” zone underneath passe objects used to be, truly, a shopping for opportunity within an ongoing upward cycle.

The unique market structure, in line with Mignolet, resembles the later phases of the 2017 bull market in probability to the early phases of a brand unique downturn. If this parallel holds, Bitcoin can even aloof have considerable upside seemingly sooner than coming into a considerable correction fraction.

Featured bid created with DALL-E, Chart from TradingView