Bitcoin

has been trading in an excruciatingly tight vary real below $120,000, but the rally is fleet losing momentum because the market enters what has historically been a comfy month for the crypto, a enlighten from 10x Study warned.

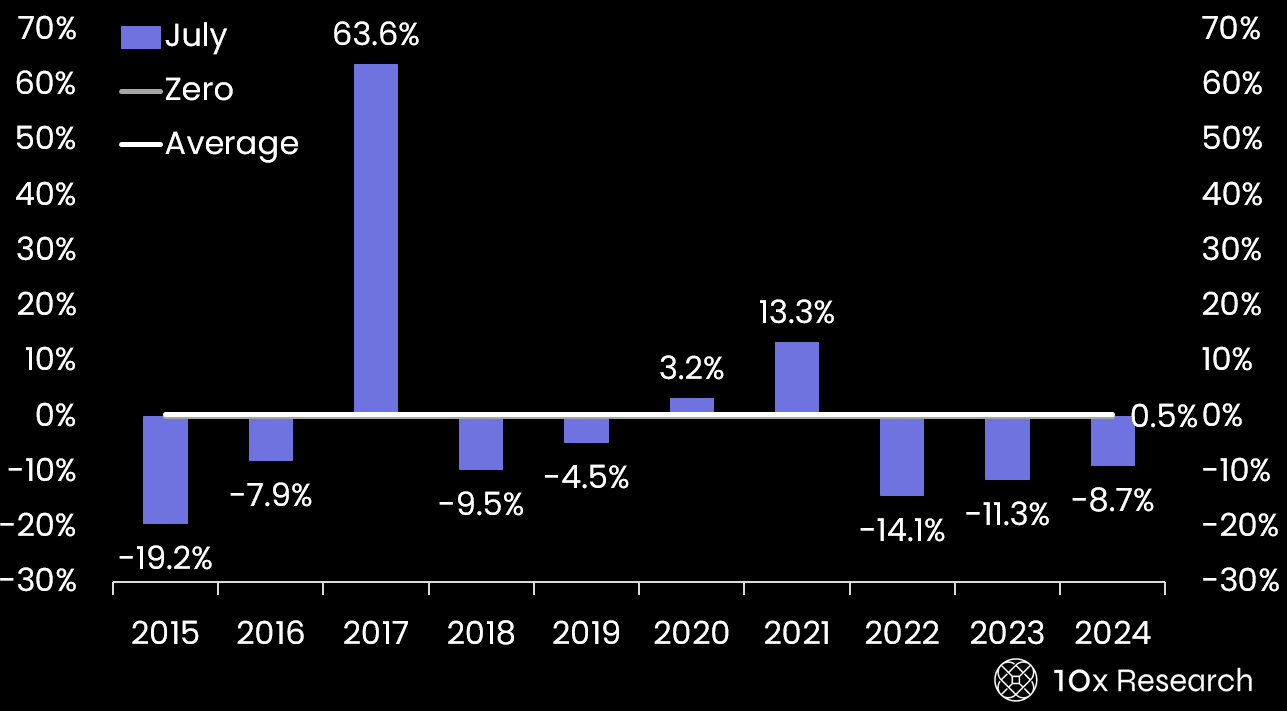

August has been bitcoin’s weakest month over the final decade, with entirely three certain years and others handing over 5–20% losses, the enlighten well-known.

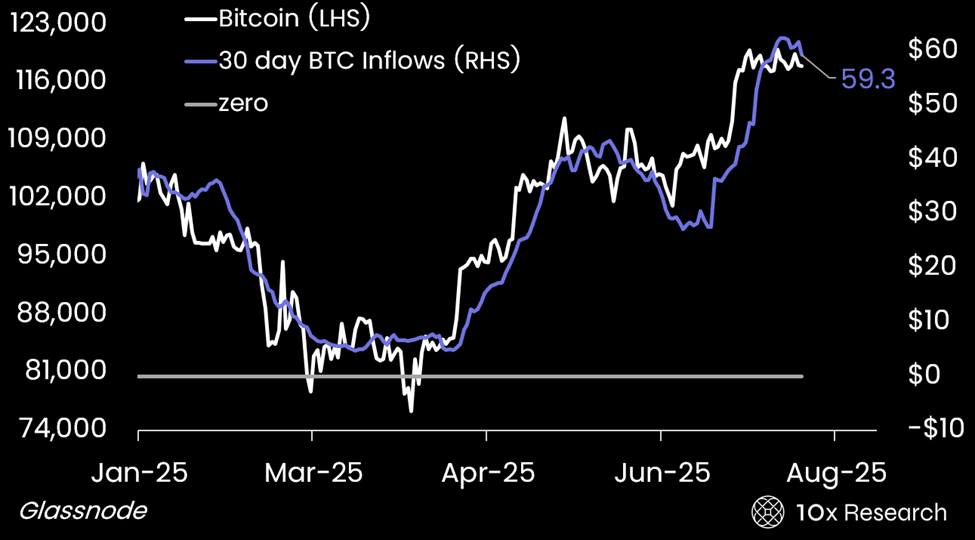

The enlighten moreover flagged a slowdown in capital flows into the Bitcoin network, a key driver of designate action this year. Total cumulative inflows into the network now exceed $1 trillion, with $206 billion arriving in 2025.

But the 30‑day rolling moderate slipped from $62.4 billion to $59.3 billion, that also can designate the initiating of a consolidation phase, the enlighten said, mirroring past peaks on this metric fancy in Q1 and Q4 2024.

“Time is working short, and despite billions in capital inflows from company treasuries, the valid designate affect has been surprisingly muted,” wrote Markus Thielen, co-founder and lead analyst at 10x. “This raises the possibility that even with continued increase, the market also can plunge short of handing over the more or less upside many are hoping for.”

The enlighten forecasts a probable wreck below $117,000, with increase at $112,000 and a deeper ground around the $106,000–$110,000 threshold.

Serene, BTC bulls also can grasp to the hope that the outlier August beneficial properties occurred in 2013, 2017 and 2021, in the course of Bitcoin’s put up-halving years coinciding with roaring bull markets.

And 2025 would be a year real fancy those.

Study more: BTC Faces Golden Fibonacci Hurdle at $122K, XRP Holds Enhance at $3