Crypto markets posted gigantic declines on Tuesday, however indicators of relief from the Federal Reserve helped costs soar off their worst phases. A unhurried day Truth Social post from President Trump reminded bulls that he has the facility to reverse rising asset costs at any time.

Bitcoin BTC$112,920.16 traded as low as $109,800 right by the early U.S. session Tuesday after tumbling from practically the $116,000 stage in a single day. It is since bounced to $112,600, down 2.8% right by the final 24 hours.. Ether ETH$4,121.87 declined 4%, while BNB, XRP and Dogecoin dropped between 4% and 6% right by the same period. The necessary-market CoinDesk 20 Index fell 3.2%.

Prices found some footing after Fed Chair Jerome Powell acknowledged the central financial institution is nearing the end of its quantitative tightening (QT) cycle — the job of anxious its bond holdings. He furthermore necessary that the labor market is cooling and rising dangers to employment, coupled with some indicators of tightening in money markets. The feedback add as a lot as one other likely rate lower later this month.

U.S. equity indexes replied sharply, with the Nasdaq and S&P 500 reversing early losses to quickly turn green earlier than closing with 0.75% loss and zero.15% loss, respectively.

No longer lower than a fraction of the day’s soar in every crypto and shares used to be erased in a jiffy unhurried in the session after President Trump took to Truth Social to counsel blocking cooking oil imports from China except that country steps up its shopping of soybeans.

Miners proceed to be allege

Crypto mining shares over yet again led digital asset equities as merchants proceed to bet that booming computing strength quiz of from synthetic intelligence (AI) will profit these firms. Bitfarms (BITF), Cleanspark (CLSK), Iren (IREN), Marathon Digital (MARA) and TeraWulf (WULF) every surged over 10% on the day.

Wide leverage flush favors bitcoin accumulation

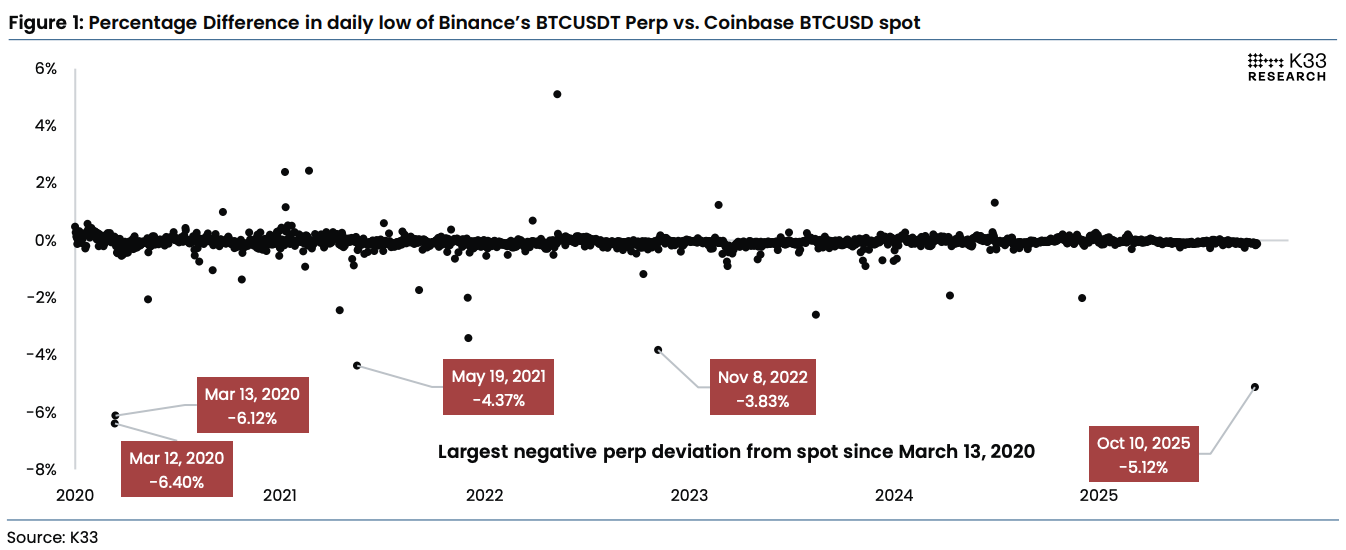

Whereas the rebound from ideally suited week’s flash smash lost momentum on Tuesday, Vetle Lunde, head of research at K33, sees the present dip as a optimistic setup with bitcoin stabilizing after a chief leverage reset.

“After the current leverage purge, we turn constructively bullish on BTC, although persistence stays key,” Lunde wrote in a Tuesday narrate. He necessary that liquidity is at probability of end thin in the immediate term as merchants secure better from compelled selling however argued that prior unwinds of this form on the complete marked market bottoms.

“We at ideally suited survey present phases as handsome for rising place of dwelling BTC publicity, as leverage has violently been cleared,” he acknowledged. “Blended with a supportive backdrop, alongside with expansionary policy expectations, excessive institutional quiz of, and pending ETF catalysts, the setup favors unhurried accumulation.