This put up is prolonged overdue.

I declare about Bitcoin plenty. In any given week, I’ll have dozens of conversations about bitcoin with assorted of us across assorted sectors. And admire a pendulum oscillating every other year, the parable of bitcoin now not being a medium of change retains coming aid. I procure it. When influencers from the physique of workers are pushing this myth, of us listen. They’re influencers.

However on this put up, I desire to location the listing straight: Bitcoin IS a medium of change, now and sooner or later. What’s extra, its future as a store of ticket (SoV) depends on its acceptance as a medium of change (MoE). Doubtless the most of us pushing the (misleading) dichotomy between bitcoin as a SoV and a MoE are doing it for his or her possess self-passion. Some are fair appropriate hangers-on.

Luckily, these of us design now not regulate how bitcoin will continue to design and be developed. Bitcoin’s future depends on our collective swarm intelligence, and collectively we’re quite honest. Right here’s the conclusion we are going to have the flexibility to in the destroy, inevitably attain: the dichotomy of bitcoin isn’t very any dichotomy in any admire. Bitcoin’s durability and deflationary properties are what invent it a trusty SoV. Its divisibility, portability, relative fungibility — alongside with its decentralization and censorship-resistance — are what invent bitcoin a trusty MoE. However these qualities presuppose every other. Indeed, you can’t have a SoV with out a MoE.

There Is No Rate Without Change

Earlier than figuring out how the categories of SoV and MoE fit collectively, we ought to save what those terms indicate in the principle place aside. While there are conceptual differences between them, neither is admittedly thinkable without the other. There isn’t very one of these thing as a SoV with out a MoE and vice versa.

SoVs Change Across Time

Stores of ticket must be durable, and they have to defend their ticket. So a long way, so glaring. However what does it indicate to “defend ticket”? How might per chance you deliver?

There are several suggestions about how most productive to deem about ticket. Marx famously lowered ticket to labor, so the extra labor used to be invested in producing a thing, the extra it might per chance in all probability be price. However this fair appropriate begs the rely on: what’s a unit of labor price? And is a wild strawberry price much less than a cultivated one, even though it’s extra scrumptious?

Then there’s “intrinsic” or “purpose” ticket. In finance, intrinsic ticket attain something admire the “fair appropriate” or “purpose” ticket of an asset as eminent from its market ticket, which is supposedly distorted by the total market contributors and their (mis)perceptions. A company with plenty of quality machines and a sure bank balance would appear to have ticket even though its shares were worthless. In strict semantics, intrinsic ticket would indicate that the price is inherent, in the essence of the article.

However all ticket is contextual. Within the route of the barren region, a barrel of water is price higher than the total gold on this planet. The fastest mining rig ever devised is price nothing to a sadhu. Family heirlooms admire your slack grandma’s well-liked earrings are price incalculably extra to people of that family than to anyone else. You won’t get their ticket in their purpose characteristics.

That’s why many economists and mainstream bitcoiners subscribe to the subjective thought of ticket. The premise is that there might per chance be not any ticket in a transactional vacuum. Rate emerges from how of us contend with a thing, what they’re willing to change for it. One day, combination provide will meet combination question – the price – and that’s the place aside the trades will happen.

A ticket is good the price of one thing expressed in a quantity of something else. A Put Heuer Connected Calibre E4 trades for $1450 USD, which is same to about 0.02 btc, which is same to …

That’s the principle indispensable conceptual point about SoVs: except they are exchanged sometime, they have no true ticket. They would wish notional ticket, admire the price of an imaginary pet dragon, but their true ticket would by no attain have the probability to emerge.

The 2nd point is that every SoVs indicate a change by definition; it’s fair appropriate that the change is diachronic. In other phrases, the change with a SoV is in the same asset at two parts in time. Change a smaller ticket of thing A in essentially the most up-to-date for a greater ticket of thing A sooner or later. Same asset, two assorted times.

While we’re pondering time, clutch into consideration this: what does it indicate for a SoV to adore? Its ticket must be measured relative to something else. In other phrases, appreciation simply attain that its future true ticket will exceed its most up-to-date true ticket; I’ll be ready to change much less of it for added stuff sooner or later than I will this present day. Without a change — even fair appropriate an unrealized future change — there might per chance be not any ticket.

MoEs Change Across Assets

MoEs must be divisible, portable, and fungible. Right here the change is synchronic (on the same time) across assorted resources relatively across time (diachronic) with the same asset. However if MoEs are traded in essentially the most up-to-date by definition, how quick is basically the most up-to-date? What’s price extra: owning the total bitcoin that’s ever been mined, but fair appropriate for one femtosecond, or ten million durable sats?

Some amount of ticket retention and durability is serious for a MoE to work. To illustrate, cigarettes are primitive as currency in detention heart. However cigarettes fling primitive after about a weeks, so that they don’t defend ticket totally over time. Folks that have them are taking a scrutinize to use them rapidly. Ditto shitcoins whose ticket might per chance crumple next week. You’ve to clutch the change or reject it now.

Indeed, durability is one amongst the characteristics that invent gold a nearer MoE than, assert, sodium. Gold resists nearly any extra or much less corrosion, so our descendants will still have an an analogous quantity of gold to change generations from now, whereas sodium can’t even procure wet without exploding.

So even though conceptually MoEs are exchanged instantaneously in essentially the most up-to-date, nearly talking they exist in a temporal world of of us with finite lifespans, quick holidays, and prolonged hours in ready rooms. A MoE that retains its ticket is price higher than a perishable MoE, other things being equal. (Inviting wrinkle: when perishability will increase shortage, but let’s now not digress.)

And MoEs aid the subjective thought of ticket. If no one wants to aquire your artisanal pumpkin spice pasta for the price you’re asking, can you assert that all people is defective? That no-one acknowledges its intrinsic ticket or the price of the hours you’ve invested in making it? Of route now not. That monstrosity is price what of us are willing to change for it, nothing extra and nothing much less. Without a subjective, contextual thought of ticket, it’s exhausting to conceptualize a MoE in the principle place aside.

SoV-MoE Convergence

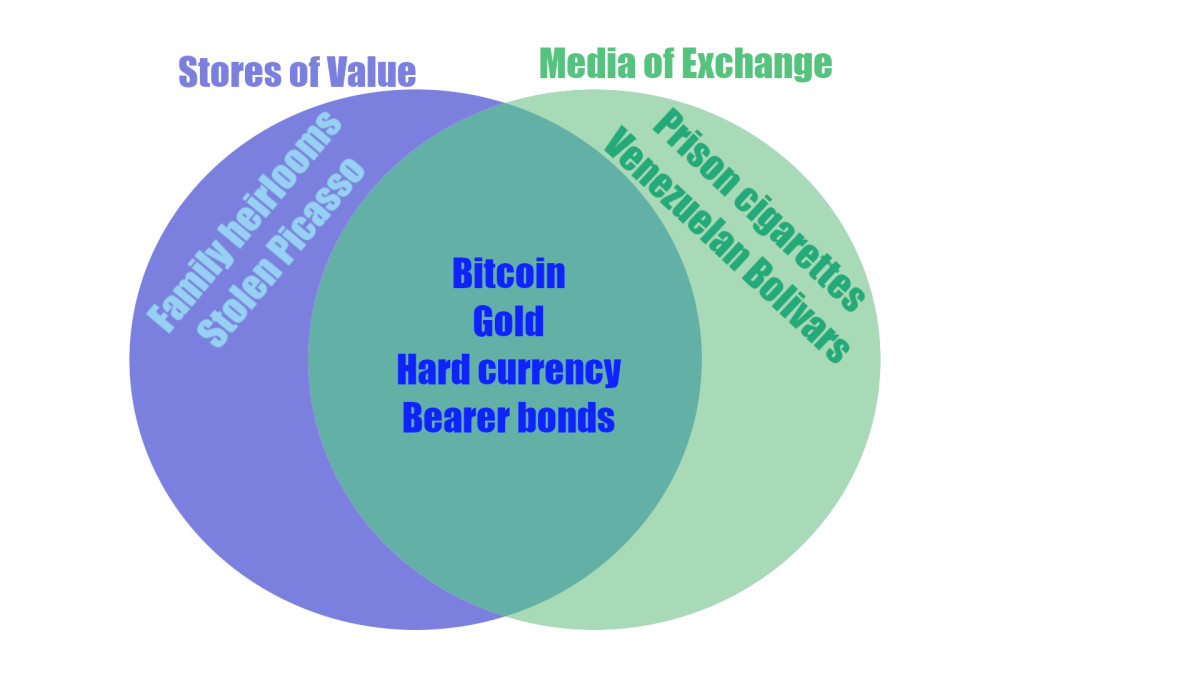

So there are about a edge cases on every aspect, the place aside the properties of the asset suggest it as either a SoV or a MoE. The more durable an asset is to change, the extra it might per chance in all probability seem admire a SoV. The faster an asset degrades, the extra it might per chance in all probability seem admire a MoE, as much as some degree. Without some tradability, a SoV is worthless and now now not a SoV. Without some durability, a MoE is worthless and now now not a MoE. However some resources drop extra on one aspect or the other.

The center, nonetheless, is much from empty. That’s the place aside you’ll get the in actual fact trusty stuff, admire gold, bearer bonds, exhausting currency, and bitcoin clearly. What makes them mountainous is that they part the attributes of every SoVs and MoEs. These resources are roughly fungible, portable, and divisible, fair appropriate admire trusty MoEs. And their ticket is durable, fair appropriate admire trusty SoVs.

If of us change them at high velocity, they scrutinize extra admire MoEs. If trades happen at longer intervals, then they scrutinize extra admire SoVs. The substance is an analogous; it’s the context and the recount that adjustments how we peruse them.

Difference this tickled twist of fate with the shriek of dichotomy. That is, what’s bitcoin as a SoV completely, i.e. without working as a MoE? Relatively than gape and note bitcoin’s in all probability, the SoV-simplest hypothesis absolves it from ever having to change. However since ticket emerges from transactions, by no attain in a vacuum, a SoV that by no attain functions as a MoE has no detectable ticket.

The premise that bitcoin is simplest a SoV is now not even defective. It’s incoherent. It’s striking ahead that bitcoin is a store of ticket whereas striking off it from essentially the most productive kinds of context that can allow us to discover its ticket. SoV and MoE are logically and nearly inseparable. A SoV is a MoE in transactional gradual motion, and a MoE is a SoV with the trading velocity cranked up.

However enough thought. Right here is the system things have continuously been, or at least as a long way aid as archaeology lets us peruse. We’ll return to bitcoin in a minute, but let’s scrutinize at its family tree first. The twist of fate of SoVs and MoEs is an empirical actuality that goes aid millennia.

Storing and Trading Assets Thru Historical past

Beyond thought, historical past offers evidence for the convergence of SoVs and MoEs. Historical past beneficial properties a host of resources that characteristic as every MoEs and SoVs attributable to in the occasion that they’re in question, you can change them, and whereas you happen to maybe can change them, then it’s trusty to have a stockpile in storage. SoV and MoE are – and continuously were — two aspects of the same, er, coin.

Bronze Ingots

The overlap between SoVs and MoEs is illustrated beautifully by Bronze Age oxhide ingots. These ingots were fashioned admire oxhides, came in roughly standardized weights (most frequently round 30 kg / 66 lbs.), contained relatively pure copper or tin, and were passed round all across the Mediterranean and beyond from the 2nd millennium BCE — the Bronze Age.

Since all people used to be the exhaust of bronze, copper and tin – the two substances of bronze – held their ticket totally. All people might per chance exhaust them. Inquire of used to be high and stable. They were also relatively easy to store.

However they were also relatively easy to hurry. A load of ingots chanced on in a shipwreck from 1327 BCE contained metal that originated in Uzbekistan, Turkey, Sardinia and Cornwall. Chariots were still relatively new tech, but these hunks of metal were traversing the acknowledged world, farther than almost about any human would have traveled, attributable to they were “connected to programs of world distribution, change and change.”

Now let’s assert that you’re a Bronze-Age fisherman who comes across a sunken cargo of ingots. Are they a SoV or a MoE? Neatly, whereas you happen to’ve had a trusty season, you is likely to be feeling flush, so you place them for a rainy day, by which case they’re a SoV. If, nonetheless, the fish haven’t been biting and that you should some liquidity, then you’d presumably change them rapidly, by which case they’re a MoE. However how would you know they were price saving in the occasion that they weren’t being traded someplace to express their ticket? And who might per chance you change with if there weren’t counterparties available tickled that owning some ingots round would be monetary resolution?

The oxhide ingots’ durable, high-question offers made them trusty SoVs, and their standardized sizes and portability made them trusty MoEs. The ingots were every concurrently attributable to every exhaust implies the other.

Gold

Folks started gathering gold about a millennia before they were into bronze. However in the beginning, gold used to be basically primitive for decorative and sacred purposes, admire statues and ceremonial jewelry. Since such objects aren’t fungible, they were unhappy MoEs, and trades were very uncommon. The low trading velocity used to be as a result of the impossibility of discovering a ticket: ceremonial objects’ owners would continuously ticket them extra highly than any counterparty.

Standardized gold cash simplest started showing up across the seventh century BCE, about 1000 years after the ingots. Curiously, they looked in China and Anatolia across the same time. As cash, gold had in the destroy change into fungible, which increased the trading velocity and introduced the SoV and MoE uses nearer collectively. Coins also supplied some advantages over oxhide ingots: a coin doesn’t weigh 30 kg, gold doesn’t corrode, and it didn’t have a host of other uses, so the provision didn’t have to compete with question for indispensable stuff admire ploughs and swords fabricated from bronze.

Gold cash were so efficient as every a SoV and a MoE that in overall all people started the exhaust of them, admire the Roman aureus, the Almoravid dinar, the Spanish doubloon, the Tokugawa Koban, and so forth. Even now, 2600 years later, worldwide locations from Armenia to Tuvalu are minting and circulating gold cash for folks to place and change, to store and change.

Again, the exhaust of gold cash as a MoE made gold a extra glaring and accepted SoV, and their accepted recognition as a SoV made them a extra liquid MoE.

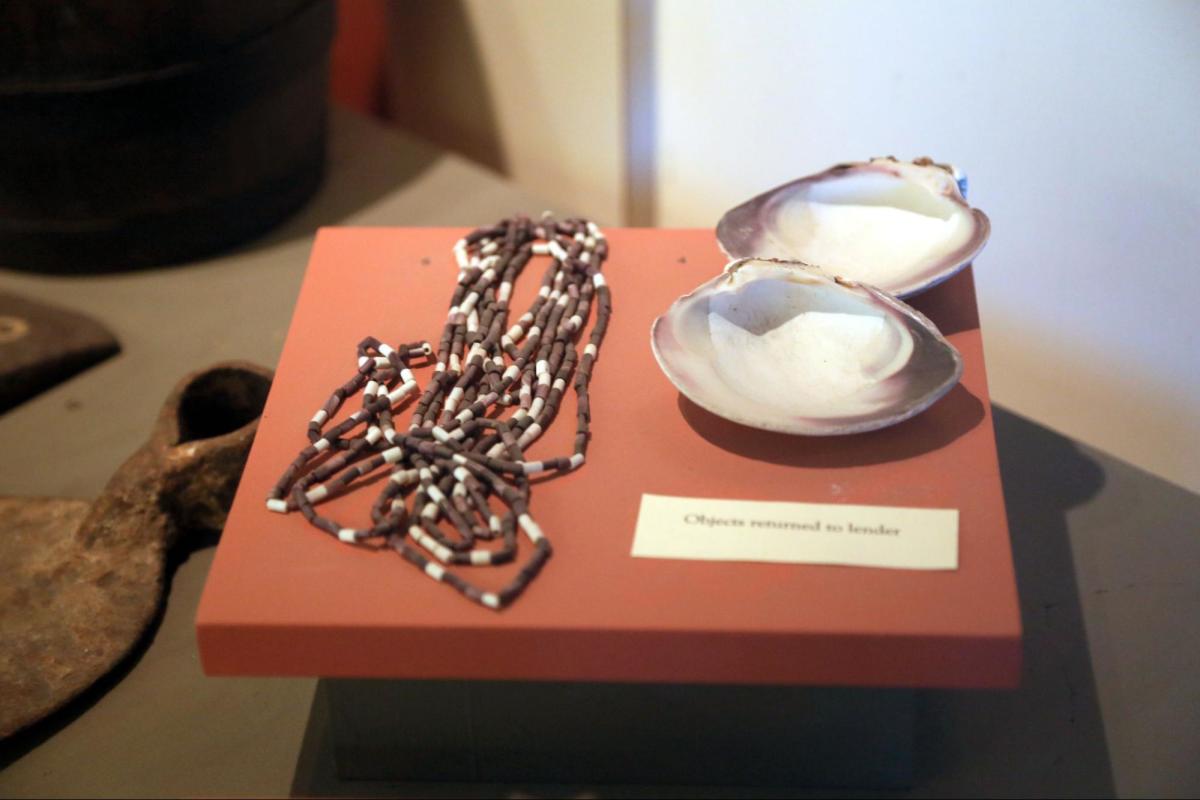

Wampum

Within the 17th century, early European settlers on the Atlantic cruise of North The United States and the indigenous peoples of the continent were getting to know every other. The worlds they knew were radically assorted. No overall language, no overall faith, no overall historical past, radically assorted technology, radically assorted cosmologies. However as folks design, they began to change quite rapidly. Without repeatedly acknowledged SoV-MoEs, though, trading is exhausting.

On the beginning, fur pelts had a sure ticket, but they’re full, their ticket used to be now not standardized, they’ll degrade, and so forth. They were greater than nothing as a SoV and MoE, but now not glorious as either. Venetian glass beads also worked, but getting beads from Venice to the European colonies in the “Contemporary World” might per chance clutch months, per chance years.

Then in 1622 a Dutch supplier named Jacques Elekens took a Pequot sachem (admire a chieftain) hostage and demanded ransom. The sachem’s of us introduced Elekens 280 yards (~256 m) of white and pink beads product of clam shells – wampum. It appears to be, they hadn’t in actual fact primitive wampum as cash before, and even on this instance the ransom had essentially symbolic ticket, admire ransoming a prince by sending a fancy ceremonial scepter.

However Elekens used to be a supplier, and though he omitted the transcendent symbolic ticket of wampum, he saw its profane cash ticket right away. When you happen to maybe can aquire a prime’s freedom with wampum, what couldn’t you aquire? Quickly the Europeans were forcing about a tribes to develop wampum, and it used to be traded in items of size, admire so-and-so many pelts for so-and-so many fathoms (1 fathom ~ 1.8 m / 6 feet.) of wampum beads.

Wampum rapidly grew to change into an official MoE. A entire lot of colonies adopted wampum beads in standardized values as trustworthy tender, a be aware that persevered for approximately a century. And wampum used to be naturally handsome as a SoV: “the European colonists rapidly started attempting to amass mountainous portions of this currency, and transferring regulate of this currency sure which energy would have regulate of the European-Indigenous change.” They weren’t fair appropriate trading with it; they were building currency reserves. They were storing the MoE for its future ticket, and its future ticket made it an efficient asset to change this present day.

The phrases “gold” and “wampum” still indicate cash in sure contexts. Speaking of cash…

The USD

The energy to develop cash is enshrined in the US Structure, and the Coinage Act of 1792 pegged the price of the brand new greenback to the Spanish silver greenback and a mounted quantity of 416 grains of silver. “Eagles” were effectively $10 cash that were to accept 270 grains of gold.

The architects of the greenback were leveraging the historical context that all people already understood: precious metals work as every MoEs and SoVs. After three and a half millennia, note had bought round.

As tends to happen with specie, the cash were debased over time, that attain that the minters kept step by step lowering the amount of precious metals contained in the cash. That’s how inflation works with a MoE that’s pegged to place its ticket as a SoV. That you simply can still mint an an analogous quantity at much less ticket by manipulating the peg.

The Gold Usual Act of 1900 hardened the peg by making every greenback redeemable for a mounted amount of 25.8 grains of 90% pure gold. So if greenback notes were redeemable for gold, would that invent them a MoE or a SoV? The notes circulated, however the US authorities used to be dedicated to storing an same amount of gold to place their ticket. The gold might per chance scrutinize admire a SoV, and the notes might per chance scrutinize admire a MoE, but they were same, so it’s simplest the exhaust that differs, now not any deeper nature.

When the Immense Despair struck, there used to be a bustle on the Federal Reserve. Folks were angry by the greenback’s persevered viability as a MoE, so that they began to redeem their dollars for gold. When the Federal Reserve grew to change into angry by its possess skill to continue converting dollars for gold, President Roosevelt suspended the gold standard.

However, clearly, bank deposits didn’t drop to zero, so the greenback persevered to operate as a SoV and MoE. And of us were hoarding gold so that they might per chance per chance per chance simply change it fair appropriate in case the greenback did lose its utility as a SoV and MoE. However every dollars and gold retained every functions.

The gold standard returned with the Bretton Woods system after the 2d World Battle, but this time the USD used to be pegged at $35 per ounce of gold, and central banks across the realm might per chance change their dollars for gold at that rate. This effectively made the USD the hardest currency, and by mounted change rates it used to be presupposed to bolster other currencies too. As before, the equivalence by redemption almost about erases any good distinction between the SoV and the MoE.

For a unfold of troublesome reasons that might per chance be reductively simplified down to “inflationary stress” (i.e. fiat’s possess perverse version of “numbers fling up”), the united states needed to abandon the realm gold standard of Bretton Woods in 1971.

While this used to be a wanted turning point for economic historians, the USD remains every a SoV and a MoE. According to the IMF, about 60% of world foreign change reserves are held in USD, about 3x as much as the closest competitor. Assorted worldwide locations store USD fair appropriate in case they have to change it for his or her possess currency to prop up their very possess currency’s ticket or to aquire necessities in a pinch.

Even without gold backing, question for USD is unbelievable. International worldwide locations place $8.8 trillion of American debt — IOUs to be paid in dollars in some unspecified time in the future sooner or later, which appears to be admire a classic SoV. And most world change is billed and settled in USD. Even in Europe, a continent with its possess overall currency, over 20% of change is settled in dollars.

The remarkably resilient question for dollars offers the united states as their minter a privileged station. The phenomenon of “petrodollars” illustrates fair appropriate how the USD has remained dominant since the crumple of the gold standard. Petroleum exporters promote oil for USD, and they rapidly procure mountainous reserves of dollars. They have to use these dollars, and it fair appropriate so happens that the US is continuously inviting to promote T-Bills (American I.O.U.s) for dollars to finance its $35 trillion in debt.

As prolonged as other worldwide locations place that debt, they have an passion in preserving the price of the greenback. As prolonged as the greenback can defend its ticket, it remains indispensable for change. As prolonged as it remains indispensable for change, other worldwide locations will procure dollars and greenback-denominated debt. Sound admire a Ponzi blueprint? Neatly, it’s now not now not a Ponzi blueprint.

Briefly, other worldwide locations’ foreign reserves of USD let the US change on a loads of. Preserve that thought.

Sure, Bitcoin Is a SoV Is a MoE

Bitcoin is basically the most up-to-date descendant on this lineage of readily tradable SoVs, i.e. of MoEs that folks desire to hoard attributable to they place their ticket. Alternatively, there is a accepted, most frequently repeated shriek that bitcoin is good a SoV. Indeed, that’s why I’m writing this, and that’s why I in actual fact feel the burden of proof is on me to display bitcoin’s viability as a MoE. So a long way I’ve laid out some theoretical suggestions about how SoVs and MoEs are conceptually inseparable and lined several historical examples to display that this mutual presupposition is how things have worked as a long way aid as historical past can fling. So now let’s turn to bitcoin, which is good new tech following established patterns: MoE and SoV fling collectively attributable to they must.

Transactions in the Trillions

Each person is aware of bitcoin works as a MoE attributable to of us hurry bitcoin – A LOT. Adjusting for change addresses, River estimates that $14.9T of funds were settled with bitcoin in 2022. So even though 74% of bitcoins don’t hurry within six months, bitcoin same to the mixed GDPs of Germany, Japan, India, and Canada can change palms in only appropriate a year.

Trading Bitcoin

There are about 2.35 million btc in change accounts (about $150B). This ought to be puzzling attributable to autonomy and self-custody are two of bitcoin’s valuable promoting parts. If bitcoin is good a SoV, why would anyone entrust it to at least one other procure collectively relatively than preserving it in cool storage themselves? If it’s a store of ticket, why wouldn’t you store it as safely as that you can deem of, severely brooding about that decently safe storage can ticket as diminutive as a share of paper?

The aim higher than one in ten of all bitcoins in existence are held in change accounts is to facilitate trading. Exchanges are fair appropriate that: the place aside of us fling to change one asset for one other. Bitcoin works beautifully as a MoE for such trades attributable to no other cryptocurrency even comes shut to the question for bitcoin. Whether you fling by market cap or unit ticket, bitcoin is in a league of its possess. The excellent other coin that can compete on any intelligent metric is USDT, whose trading volume is roughly double bitcoin’s spectacular $26 billion/day. And that’s per chance attributable to Tether earnings from the waning dominance of the legacy world MoE – the USD.

If bitcoin were simplest a SoV, no one would depart their hoard on an change, and the trading velocity would be miniscule. However they design. And it isn’t.

Retailers Settle for Bitcoin

Some might per chance object that, whereas bitcoin is likely to be a MoE among the tech boys of the monetary cognoscenti, it hasn’t penetrated the “true economic system” the system a “true” MoE ought to. However examples of bitcoin circulating in the categorical economic system would be enough to refute this shriek. We’re in success.

Retailers are the exhaust of bitcoin as a MoE attributable to it already offers concrete advantages. Lift one gleaming instance from essentially the most up-to-date River document: Atoms, a Brooklyn shoe company. In 2021, Atoms started accepting bitcoin as price and launched a bitcoin-themed sneaker. Atoms accepts bitcoin as a MoE (shoppers pay for sneakers with bitcoins), after which Atoms place it as a SoV till the need arises. And when it does, their SoV bitcoin is mechanically tradable MoE bitcoin attributable to it’s the same bitcoin.

Atoms proves that the dichotomy is exactly conceptual and misguided. True bitcoin is every a SoV and a MoE; it fair appropriate depends on how its owner happens to be the exhaust of it for the time being.

And Atoms is now not alone, now not by a prolonged shot. Balenciaga accepts bitcoin. Put Heuer accepts bitcoin. AMC Theatres, PayPal, twitch, Ferrari, and Proton all obtain bitcoin. Is anyone going to shriek that AMC or PayPal are niche vendors acknowledged simplest to nerds with obscure monetary spare time activities?

Are these notorious, world brands hodling bitcoin as a SoV or trading it as a MoE? There’s that dichotomous thinking again. Bitcoin is a divisible, fungible, durable asset, so that they’ll place it as prolonged as they desire and change it at any time. They’re going to obtain it, use it, lend it, no matter. Bitcoin has no vital essence. It is not any matter they/we exhaust it for.

All MoEs and SoVs Are Honest appropriate Betas

But some other valuable lesson from the examples above is that SoVs and MoEs by no attain discontinue evolving. Bronze Age fintech used to be about standardizing ingots and purifying the metals they contained (or, for the ruling class, per chance debasing them). How SoV-MoEs are designed affects how we exhaust them, which influences their originate, which affects how we exhaust them, and so forth. However evolution is continuously about local optimization, by no attain perfection, so there will continuously be room for extra improvement.

Shining cash has continuously served as every a SoV and a MoE, and bitcoin still has room to develop. Let’s clutch into consideration the areas the place aside bitcoin might per chance exhaust extra optimization.

Fiat’s First-Mover Profit

If asked, almost about every buddy of bitcoin would desire to accept their earnings in btc whereas paying their funds in fiat. However this doesn’t indicate that bitcoin is sinful as a MoE; it attain that fiat is sinful as a SoV. Folks desire to place bitcoin attributable to bitcoin holds its ticket greater than fiat, so it makes sense to place the bitcoin for the next day when this will likely be price extra and use the fiat this present day before it’s price much less.

So fiat’s edge is good that it has constructed up 13 centuries of network results to atone for its glaring defects. Folks know fiat. The realm’s payroll programs, tax codes, and banking programs are constructed round fiat. The realm has substantial sunk funds in the fiat challenge. That’s why it’s so indispensable for bitcoin to exceed fiat in any metric: ticket retention, autonomy, censorship resistance, and clearly…

The UX. Always the UX.

Bitcoin’s UX is bettering. Many improvements are unequivocally ameliorations. The Lightning Network, as an instance, will increase bitcoin’s most trading velocity by loads of orders of magnitude.

Assorted aspects of the exhaust of bitcoin, nonetheless, might per chance be parts and bugs concurrently. Primarily the most glaring is self-custody. Keeping your possess bitcoin is admittedly essentially the most productive system to absolutely revel in the autonomy and freedom bitcoin affords, whether or now not as a SoV or a MoE or every. However with mountainous energy comes mountainous accountability, and assessing and enforcing assorted ways to store and exhaust bitcoin in overall is a diminutive much for many no-coiners.

And even for all its advantages, Lightning has barriers that we’re still attempting to conquer. Lightning provides complexity to liquidity management, though LSPs are helping to rework liquidity from a difficult technical disaster into a largely automatic monetary consideration. However friction is friction.

Equally, Lightning can simplest clutch on new customers so instant attributable to every new user requires at least one on-chain transaction and extra liquidity. Contemporary technology, admire Breez’s nodeless SDK implementation, can pork up Lightning’s throughput and mitigate its liquidity constraints fair appropriate admire Lightning surpasses on-chain bitcoin for some exhaust cases.

And if this style of innovation → UX tweaking → innovation continues as it has for fiat, we’re in trusty shape. Comprise in suggestions the bank card. No person primitive credit playing cards for diminutive purchases for the principle three decades or so of their existence. It used to be a mountainous tale when Burger King started accepting credit playing cards in 1993. Folks even bought all judgmental about it. “I deem it’s quite injurious if it be indispensable to make exhaust of a bank card whereas you fling to a instant meals restaurant.” Credit ranking playing cards were for mountainous purchases, admire airfare, jewelry, resort stays, and car repairs. In 2024, about a Third of funds are made by bank card, and no one – now not a single living soul — cares whereas you happen to pay for an picture of fries or bus fare with a bank card.

Folks in 1993 react to #creditcards being popular at a #burgerking

As credit playing cards grew to change into more easy to make exhaust of (it primitive to be exhausting work), of us primitive them extra and for smaller purchases. The lesson right here is that folks will exhaust an asset as a MoE selectively if the UX is rocky, the exhaust of it extra assuredly and for smaller purchases as the UX improves.

Suitable/Regulatory Therapy

We’ve all heard the out of date FUD that bitcoin is admittedly fair appropriate for criminals. Proton is a mountainous company that accepts bitcoin and is recommended by Sir Tim Berners Lee — now not exactly your fashioned moustache-twirling supervillain. However of us disaster what they don’t note, and legislators and regulators like pandering to traditional fears.

Some jurisdictions are open and revolutionary. Within the EU, as an instance, bitcoin is believed of a currency and is handled accordingly in most felony guidelines. Exchanging bitcoin for one other currency incurs no VAT, but procuring a products and services or products with bitcoin does incur VAT, fair appropriate as it might per chance in all probability with any other currency.

Within the US, whereas some regulators and courts have acknowledged that bitcoin is “a medium of change and a attain of price,” the IRS treats it as a property self-discipline to capital good points tax, which makes trading it extra costly and, as a outcome, slows its trading velocity. So it’s natural that bitcoin might per chance scrutinize extra admire a SoV than a MoE to American citizens self-discipline to that tax regime.

Some worldwide locations admire Morocco and China have banned bitcoin outright. Whatever. King Canute tried to discontinue the tides till his toes bought wet, at which point he declared that no king might per chance gainsay eternal felony guidelines. That’s a trusty lesson for the SoV crowd and the staunch bitcoin opponents alike. Folks desire to be free, and they desire their cash to be free. When you happen to don’t give it to them, they’ll clutch it in the destroy.

Volatility

Many of us is likely to be averse to the exhaust of bitcoin as a MoE thanks to its characteristics as a SoV. First, its ticket is comparatively volatile. Within the final few years, we’ve viewed the price of bitcoin relative to the USD swing up and down by a component of 4x. This makes it exhausting for shoppers to use and exhausting for retailers to acquire since the change rate of bitcoin relative to a given trusty — i.e. its ticket — might per chance be too unsure.

The extra disposable earnings and wealth any individual has, the much less sensitive they are to volatility. When you happen to continue to have plenty of earnings left over every month after taxes, groceries, and mortgage funds alongside with healthy financial savings, it won’t matter much if one tranche of your portfolio drops a diminutive for about a months. You exhaust your resources on a assorted timescale than ticket volatility. Long-term good points higher than outweigh short drops, so let it swing.

Many others are now not so privileged. Their earnings is their wealth; they design now not have any financial savings or surplus to buffer ticket swings. For them, a sudden drop in the price of their earnings might per chance indicate hungry days on the discontinue of the month. If they produce bitcoin (and plenty design), they’re likely to change it for a extra stable asset as rapidly as they’ll.

Bitcoin’s volatility is a boon to some, a curse to others, and beside the point to many. We can, nonetheless, peruse a natural route ahead for it to allure to all user groups. One system to deem about bitcoin’s volatility is as a woefully incomplete index. The price of fiat is frequently measured by change rates to other currencies, by official “baskets” of goods to discover its official procuring energy parity/user ticket index, and by hundreds and hundreds of of us fair appropriate transacting in their day after day lives. Every source of recordsdata offers a review on the others, triangulating something admire a “fair appropriate market ticket.” The extra of us transact and the extra goods are priced in bitcoin, the extra true the triangulation, and the much less need for ticket swings.

In other phrases, the extra of us exhaust bitcoin as a MoE, the extra its ticket curve will stabilize relative to other resources. Even as a speculative asset, it might per chance in all probability scrutinize extra admire T-Bills than, assert, oil. And shiny exhaust as a MoE will place expectations of its future question, which, alongside with its deflationary originate, preserves bitcoin’s station as an unparalleled SoV. Bigger usage fair appropriate smoothes the upward curve.

Preaching Advantages the Preacher

There’s a strange, schoolmarmy undertone in the rants of the SoV proponents. Enjoy, what design they care what all of us design with our bitcoin? If SoVs and MoEs necessarily overlap, why lecture all people that bitcoin is ackchyually a SoV completely? No person’s hindering their most standard exhaust, so what offers?

Take into accout the US greenback? The US tickled the realm to head prolonged on the USD. When you happen to persuade the realm to hoard what you’ve already started hoarding, then you’re in a extremely trusty station. You’re stoking question for what you can provide.

However you don’t even have to present it. Convincing others to covet your hoard lets you borrow in opposition to it, providing you with procure admission to to leverage. If your hoard grants you these advantages, it’ll change at a loads of. When you happen to have n bitcoins on your hoard, you is likely to be ready to promote shares of your hoard at a 3n valuation. You’ve fair appropriate discovered the style to push the inflation rate of a deflationary asset as much as 300%. Dastardly, but artful.

The wonder of freedom cash, though, is that no one can deliver you the style to make exhaust of it. Particular, I’m telling you it’s underestimated as a MoE, and I’ve a vested passion in its exhaust as a MoE, but I’m now not telling anyone what to design. I’m describing what I peruse and debunking some injurious, maybe disingenuous claims.

Retailer your bitcoin the place aside and the system you admire to have, use it the place aside and the system you admire to have, and its ticket depends on what all of us design collectively, no what some suits design in their exclusionary conclave. Nor does it rely on what some talking head on twitter said is most productive. Of route, when the huge majority of the realm’s freedom cash is held by a pick out few, then it won’t be very free.

Bitcoin is versatile enough for all our diverse wants, and all of us have a assert in what it’s and what this would per chance simply yet change into. Let our selection be our strength.

Right here is a visitor put up by Roy Sheinfeld. Opinions expressed are fully their very possess and design now not necessarily mediate those of BTC Inc or Bitcoin Magazine.