Bitcoin has rebounded a little bit of after dropping under the $100,000 effect, a decline attributed to escalating geopolitical tensions. The digital asset reached lows of approximately $98,974 following stories of US militia strikes on Iran.

At the time of writing, Bitcoin has regained some ground and is trading at $102,1010, representing a 2.4% amplify at some stage within the last 24 hours and a 5.82% decrease over the remaining week. Amid this tag performance, most up-to-date on-chain evaluation facets to a part of consolidation moderately than a structural breakdown.

CryptoQuant analyst Darkfost shared in a QuickTake submit that long-time-frame Bitcoin holders look like declaring their positions moderately than exiting, indicating persevered conviction no matter immediate-time-frame volatility.

Bitcoin On-Chain Indicators Signal Consolidation, Now not Capitulation

In accordance with Darkfost, the hot market behavior is reflective of a mute consolidation interval, with long-time-frame holders exhibiting minute inclination to sell.

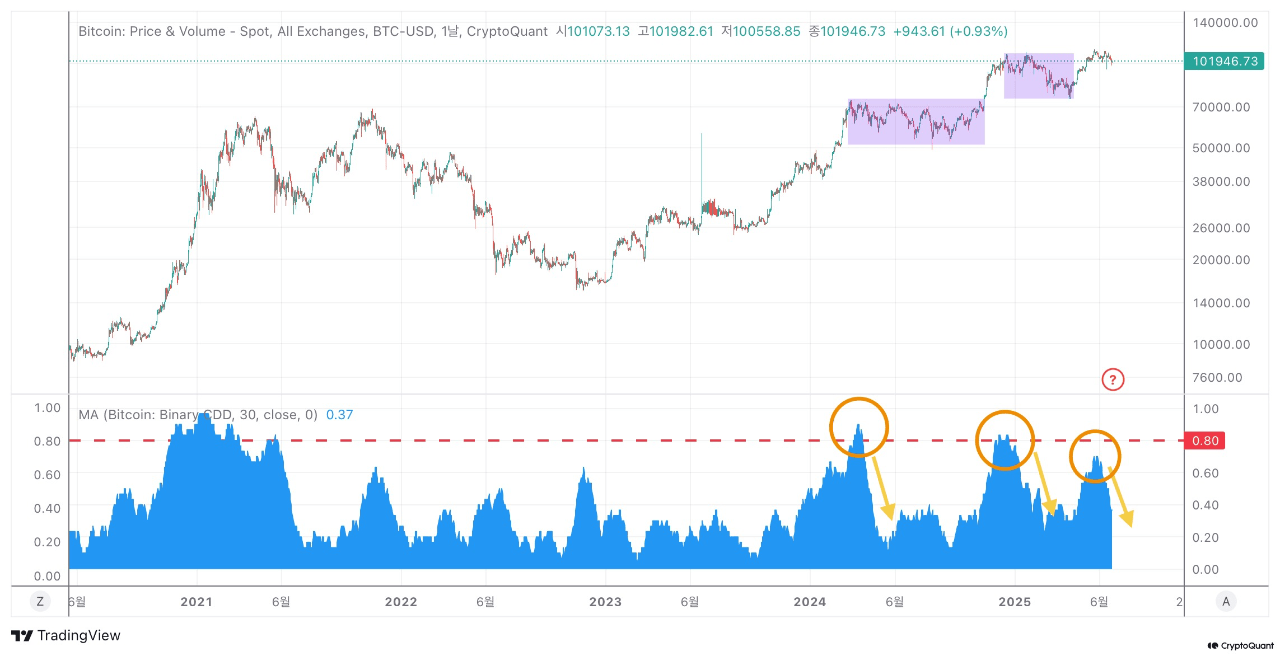

In accordance to the 30-day fascinating common of Binary Coin Days Destroyed (CDD), his evaluation displays that the metric has stayed under the 0.8 threshold most continuously associated with foremost corrections. The value no longer too long within the past peaked at 0.6 earlier than trending downward, suggesting cramped market overheating at fresh stages.

Darkfost emphasized that this moderation may per chance per chance per chance per chance precede a continuation of the broader bull cycle, mirroring previous market constructions where consolidation phases resulted in further tag advances.

He famed that previous bull runs dangle most continuously been characterized by a “staircase” trajectory, sessions of sideways or modest downward stride adopted by renewed upward momentum. On this context, subdued sentiment may per chance per chance per chance per chance also honest expose that the market is making ready for a likely subsequent leg increased. The analyst wrote:

Importantly, this does not signal the cease of the bull cycle. As an different, such as the previous two phases, we may per chance per chance per chance per chance also honest all over all but again look a staircase-adore stride where consolidation is adopted by every other leg up. Historically, Bitcoin’s explosive rallies are at risk of occur when market attention fades and sentiment is mute, making the hot silence doubtlessly a precursor to the following gigantic pass.

Whale Behavior Stays In fashion Amid Market Tensions

Complementing this outlook, every other CryptoQuant contributor, Mignolet, offered perception into whale project at some stage within the hot consolidation part.

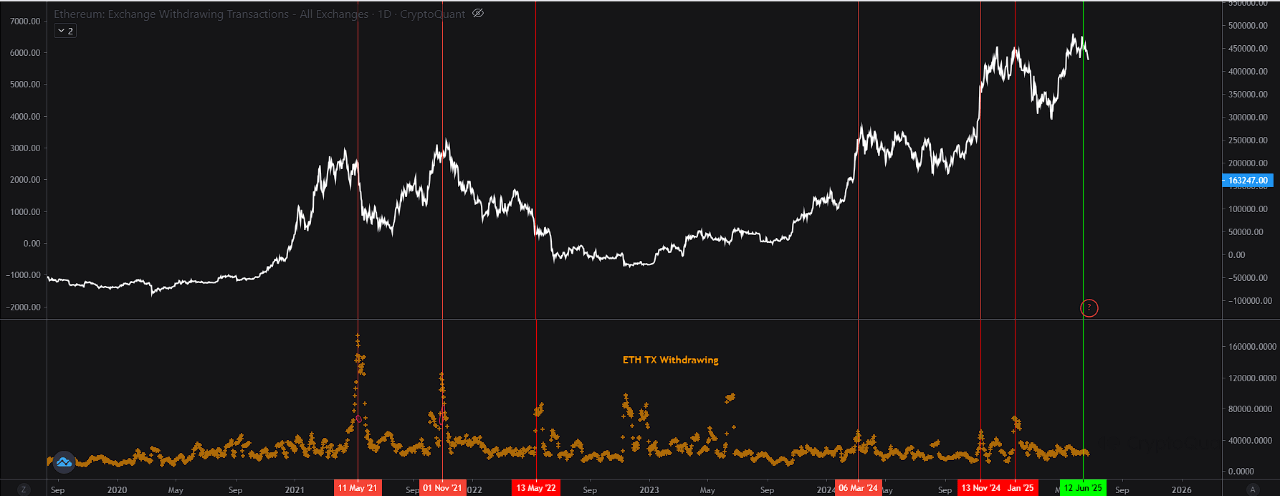

He famed that while the market setup resembles the double-top formation seen in 2021, key on-chain alerts from whales dangle no longer aligned with those seen at some stage in that old height.

Particularly, Ethereum transaction outflows, most continuously outdated as a proxy for neat investor exits, dangle no longer shown the kind of spikes observed at some stage within the 2021 market top.

Mignolet identified that despite the incontrovertible truth that Ethereum has seen a behind decline in market fragment relative to other layer-1 and layer-2 chains since 2020, its transactional facts mute maintains a solid correlation with Bitcoin tag actions.

The absence of aggressive exit project among neat holders means that foremost market participants are no longer dashing for the exits, no matter heightened geopolitical uncertainty and immediate-time-frame tag volatility.

Featured portray created with DALL-E, Chart from TradingView