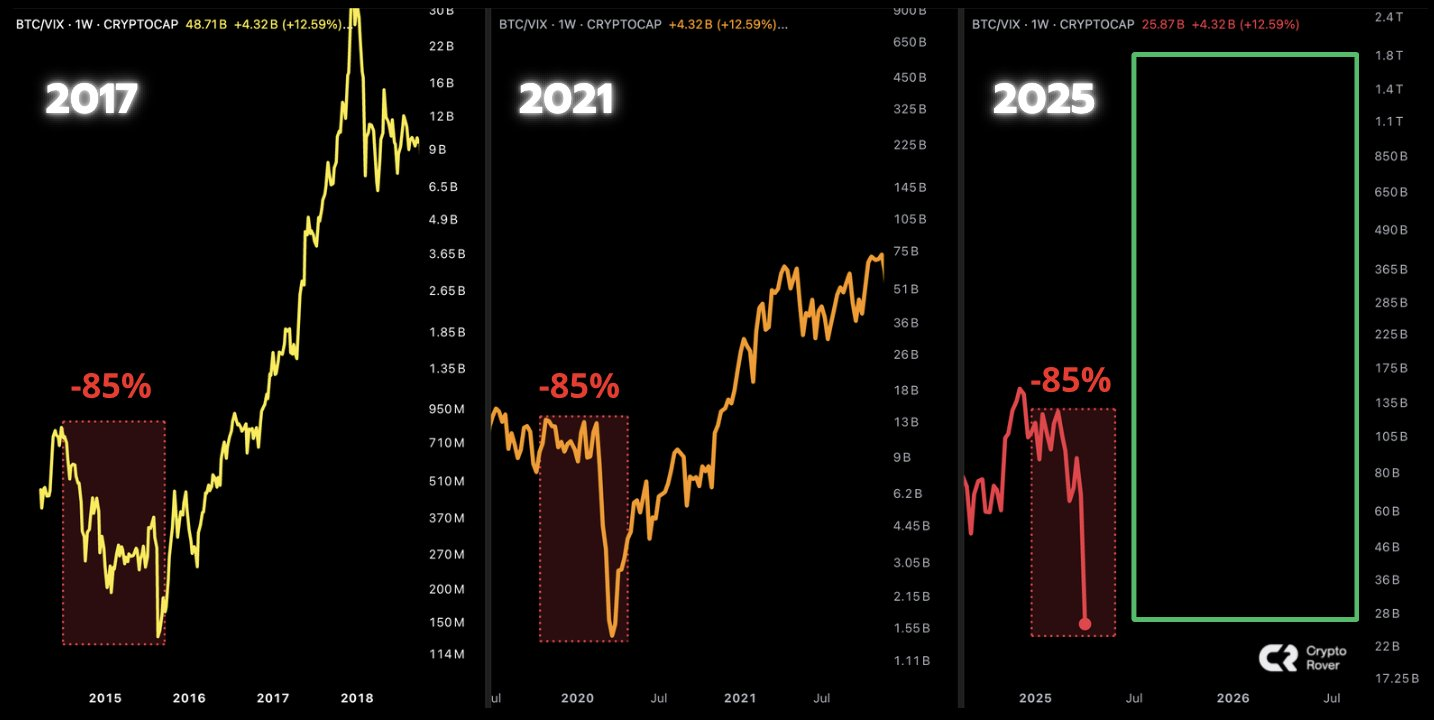

Bitcoin’s present cycle reveals sturdy similarities to the structural resets viewed in each 2017 and 2021.

Key market indicators, indulge in the connection between Bitcoin and market volatility (BTC/VIX ratio) and the total crypto market capitalization on weekly charts, are displaying alignments identical to those viewed contrivance previous crucial market shifts. These past predominant ticket adjustments acted as bigger than merely downturns; they effectively reset the market ahead of subsequent predominant upward trends began.

The Bitcoin Script: How Previous Crashes Historically Keep Up Novel Highs

Taking a investigate cross-take a look at at the larger image, Bitcoin’s ticket history finds a repeating multi-year construction. In overall, sturdy upward legs driven by frequent excitement at final discontinuance in steep ticket drops (traditionally generally over 80%-85% from the height).

Following these predominant drops, quieter intervals the keep devoted, prolonged-time duration merchants commence up step by step buying for yet all over again have traditionally began, laying the groundwork for the next primary climb. Examples consist of the lows reached spherical $200 after 2013, contrivance $3,000 after 2017, and spherical $16,000 following the 2021 peak.

The 2025 construction now reveals a well-diagnosed rhythm: after topping above $100,000, Bitcoin dropped sharply to under $80,000, driven by macroeconomic stress and heightened geopolitical dangers. Importantly, this pullback has introduced costs into zones the keep primary buying for emerged in past cycles, potentially making ready the bottom for the next upward style.

Bitcoin Tag Take a look at: Can BTC Destroy Key Resistance to Ascertain Sample?

Bitcoin is currently buying and selling contrivance $85,050, recuperating from present lows spherical $74,436. working its manner aid up from present lows spherical $74,436. On the 4-hour chart, the price has pushed above the descending trendline, now within the instantaneous overhead supply concentrated between $84,200 and $85,700.

The Relative Energy Index (RSI) sits spherical 59.58, suggesting moderate buying for energy is present with out the market being excessively overheated. Fibonacci retracement stages provide determined targets: $85,700 (0.786), $88,700 (1.0), and $97,600 (1.618), with doable upside to $111,900 (2.618) if style continuation is confirmed.

A day after day shut above $88,000 stays as the well-known threshold for bullish validation. On the blueprint back, key enhance stages sit at $82,000, adopted by $79,900 and $77,800.

If History Guides, May well Bitcoin Already Be Building Against $150k?

The market construction, coupled with on-chain indicators and historical cycle patterns, suggests Bitcoin might perchance well be entering a stress compose-up fragment sooner than one other expansion.

Nonetheless, affirmation will depend on quantity, breakout power above $88,000, and the sustained return of institutional buying for. If history repeats, Bitcoin’s course to $150,000 might perchance well already be underway.

Disclaimer: The move within the park supplied listed right here is for informational and academic capabilities most effective. The article does now not constitute financial advice or advice of any variety. Coin Model is never any longer to blame for any losses incurred since the utilization of protest, merchandise, or companies and products talked about. Readers are suggested to exercise caution ahead of taking any motion connected to the firm.