Bitcoiners had been noticeably more upbeat on social media on the present time as the percentages of a US Federal Reserve rate minimize in December with regards to doubled when compared to devoted a day earlier.

Some crypto market people are speculating that this might per chance well per chance presumably be the catalyst Bitcoin (BTC) needs to quit the asset’s downward pattern.

“Let’s assume if that’s sufficient to get a bottom here for now,” crypto analyst Moritz said in an X put up on Friday, as Bitcoin’s imprint trades at $85,071, down 10.11% at some stage in the last seven days, in accordance with CoinMarketCap.

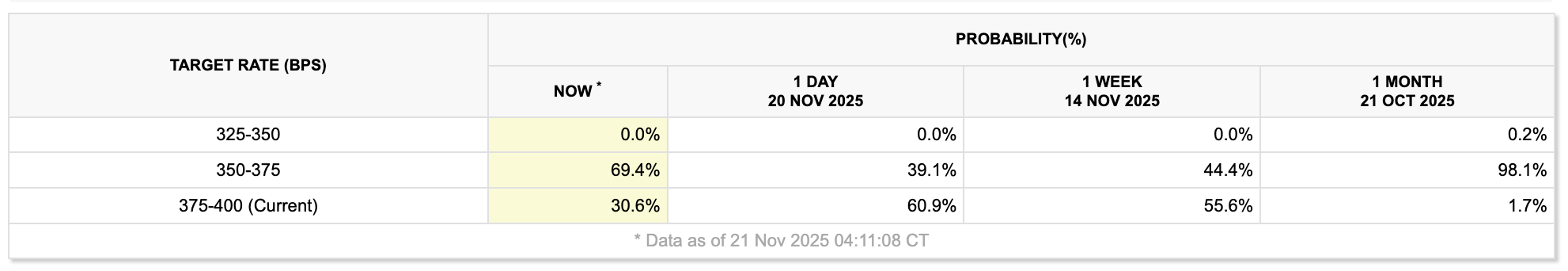

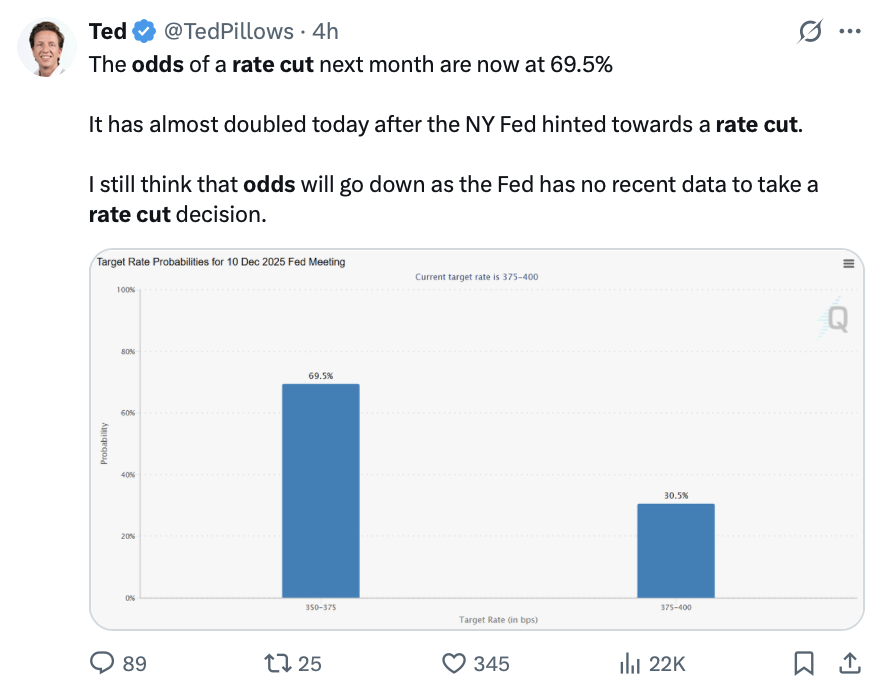

On Friday, the percentages of an ardour rate minimize on the December Federal Birth Market Committee (FOMC) assembly almost doubled to 69.40%, in accordance with the CME FedWatch Instrument. Valid the day before, on Thursday, it changed into once with regards to 30.30% decrease, at 39.10%.

Many in the wider market attributed the spike as a minimum partly to dovish remarks from New York Fed president John Williams, who said the Fed can minimize rates “in the shut to term” without endangering its inflation aim. Bloomberg analyst Joe Weisenthal said it changed into once the motive the percentages have “hugely increased.”

The setup is calling “unfathomably bullish,” says analyst

On the other hand, economist Mohamed El-Erian warned market people to no longer pick up “carried away” by the feedback. Within the meantime, the broader crypto community has reacted rather more bullishly. “In most cases this might per chance well per chance presumably be bullish,” Mister Crypto said in an X put up on Friday.

The Fed lowering rates is continuously bullish for riskier sources akin to Bitcoin and the broader crypto market, as aged sources akin to bonds and term deposits turn out to be less lucrative to investors.

Crypto analyst Jesse Eckel pointed to the surging rate minimize odds and said, “Whenever you zoom out, the setup is unfathomably bullish.”

“I don’t know why we protect going decrease,” Eckel said. “We’re going from a tightening cycle into an easing cycle,” he added.

Crypto analyst Curb said, “Crypto will explode in a large rally.”

The percentages of a rate minimize had been beforehand “mispriced”

Coinbase Institutional said in a X put up on Friday, “While markets are leaning in the direction of ‘no minimize’ this time, we predict in regards to the percentages for a rate minimize are indubitably mispriced. Contemporary tariff analysis, private market data, and valid-time inflation indicators counsel in any other case.”

Connected: BTC ETF outflows are ‘tactical rebalancing,’ no longer institutional flight: Analysts

“Since the October FOMC assembly, futures have shifted from looking out at for a 25bps minimize to favoring a protect, primarily on account of rising inflation considerations,” Coinbase Institutional said.

“On the other hand, reports interpret that tariff hikes can decrease inflation and expand unemployment in the short term, acting like detrimental ask shocks,” it added.

It comes as sentiment at some stage in the total crypto market has remained frail at some stage in the last seven days. The Crypto Effort & Greed Index, which measures overall crypto market sentiment, posted an “Impolite Effort” rating of 14 in its Friday update.

Journal: Bitcoin whale Metaplanet ‘underwater’ nonetheless eyeing more BTC: Asia State