Fleet Preserve shut

Bitcoin’s 20% decline from its all-time excessive has raised concerns about the functionality impact on the ongoing bull hump.

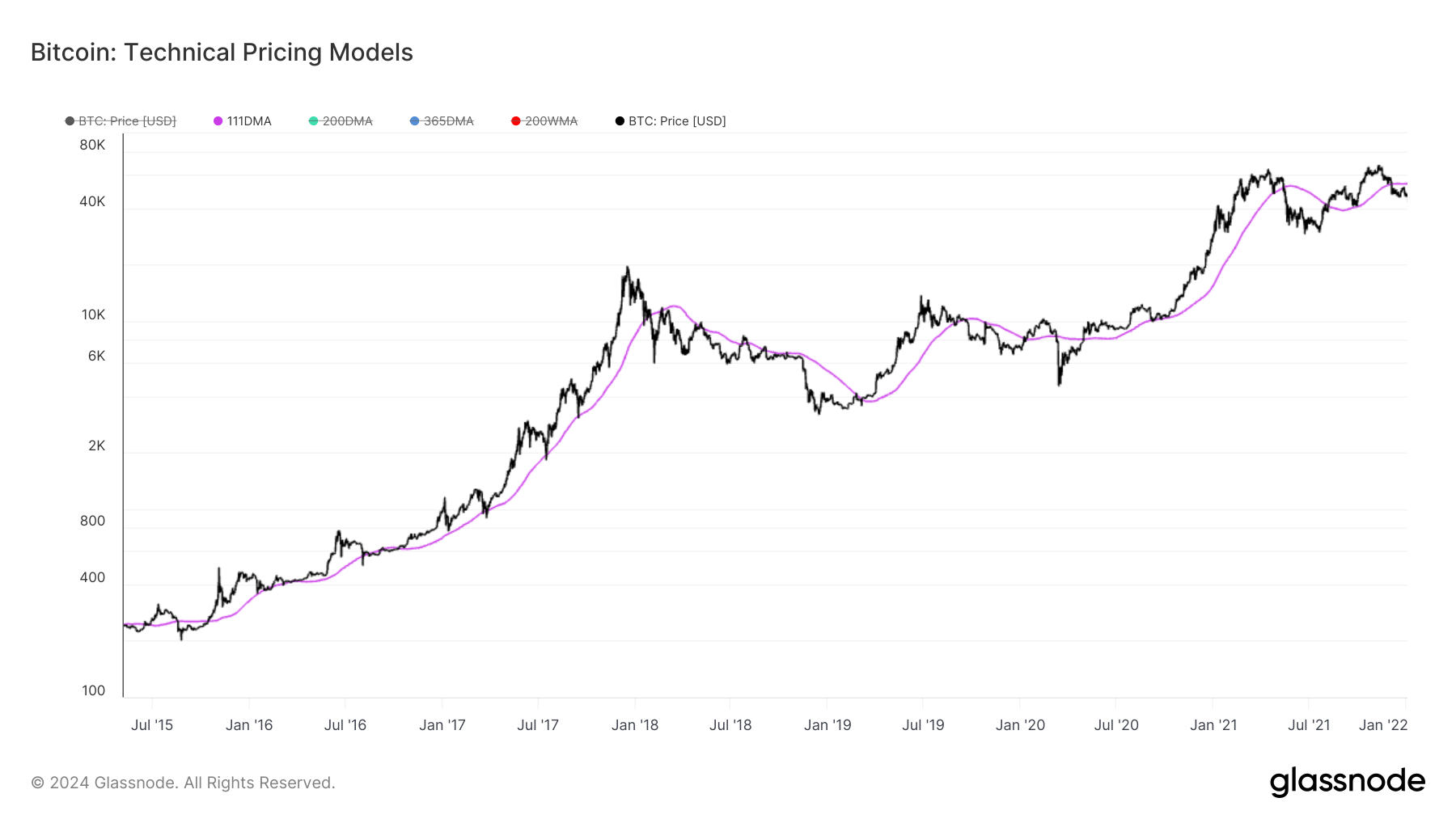

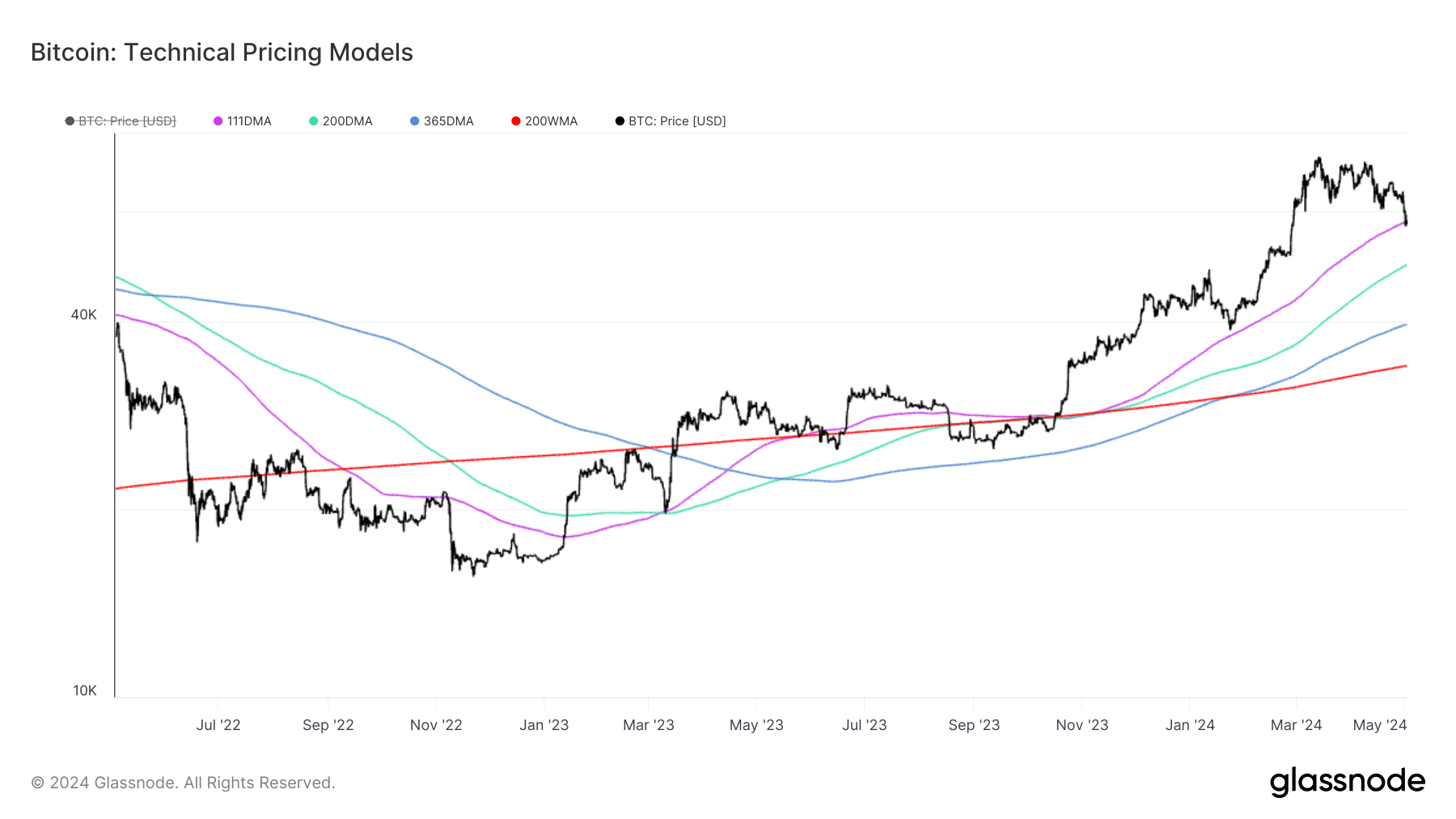

To better realize the unique market stipulations, we can analyze Bitcoin’s designate against key transferring averages, broadly ancient technical indicators within the digital asset space. Really one of primarily the most a truly powerful transferring averages is the 111-day transferring reasonable (111dma), for the time being at $57,779. Bitcoin in rapid dipped below this level, a scenario that has took place in outdated bull runs, particularly in 2017. This transferring reasonable has historically been a extreme toughen level for the length of bullish sessions.

Reasonably just a few key transferring averages to gaze embody the 200-day transferring reasonable (200dma) at $49,278, the 365-day straight forward transferring reasonable (365dma) at $39,593, and the 200-week transferring reasonable (200wma) at $33,963. Bitcoin have to shield its predicament above these ranges to shield the functionality bull hump alive.

Per Glassnode knowledge, these transferring averages wait on diversified purposes. The Pi Cycle Indicator (111D-SMA) captures short-to-mid-length of time market momentum, whereas the Mayer Just a few (200D-SMA) is often linked with the transition point between bull and endure markets. The Yearly Shifting Average (365D-SMA) provides a long-standing baseline for excessive time-physique market momentum, and the 200 Week Shifting Average (200W-SMA) captures the baseline momentum of a traditional four-three hundred and sixty five days Bitcoin cycle.

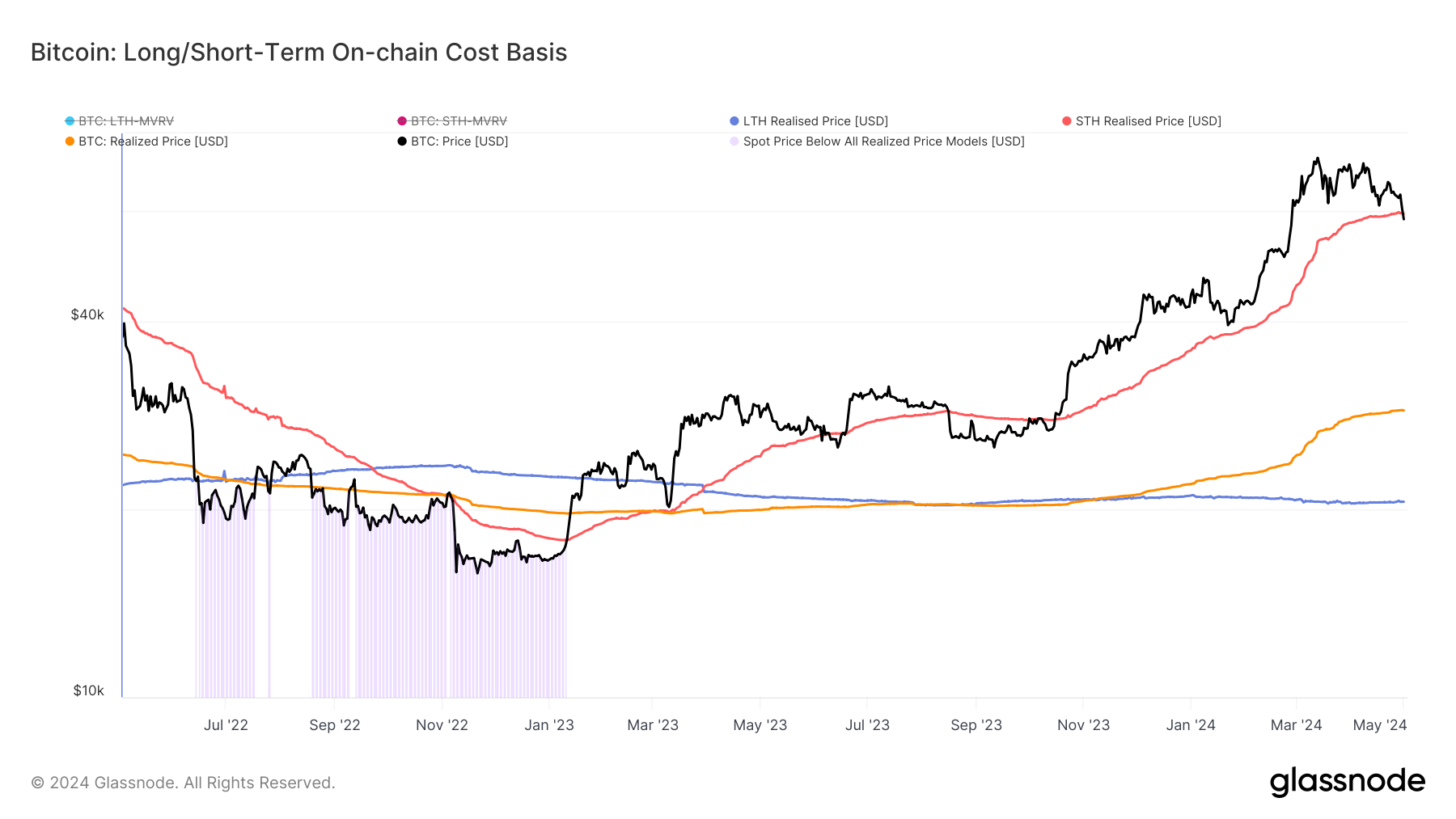

Furthermore, Bitcoin has fallen below the rapid holder realized designate, for the time being at $59,468. Reclaiming this level is regarded as a crucial indicator of the digital asset’s doable recovery.