A well-known crypto investor has very a lot expanded quick positions in Bitcoin and Ethereum, deepening bearish sentiment amid a broader market struggling to catch momentum.

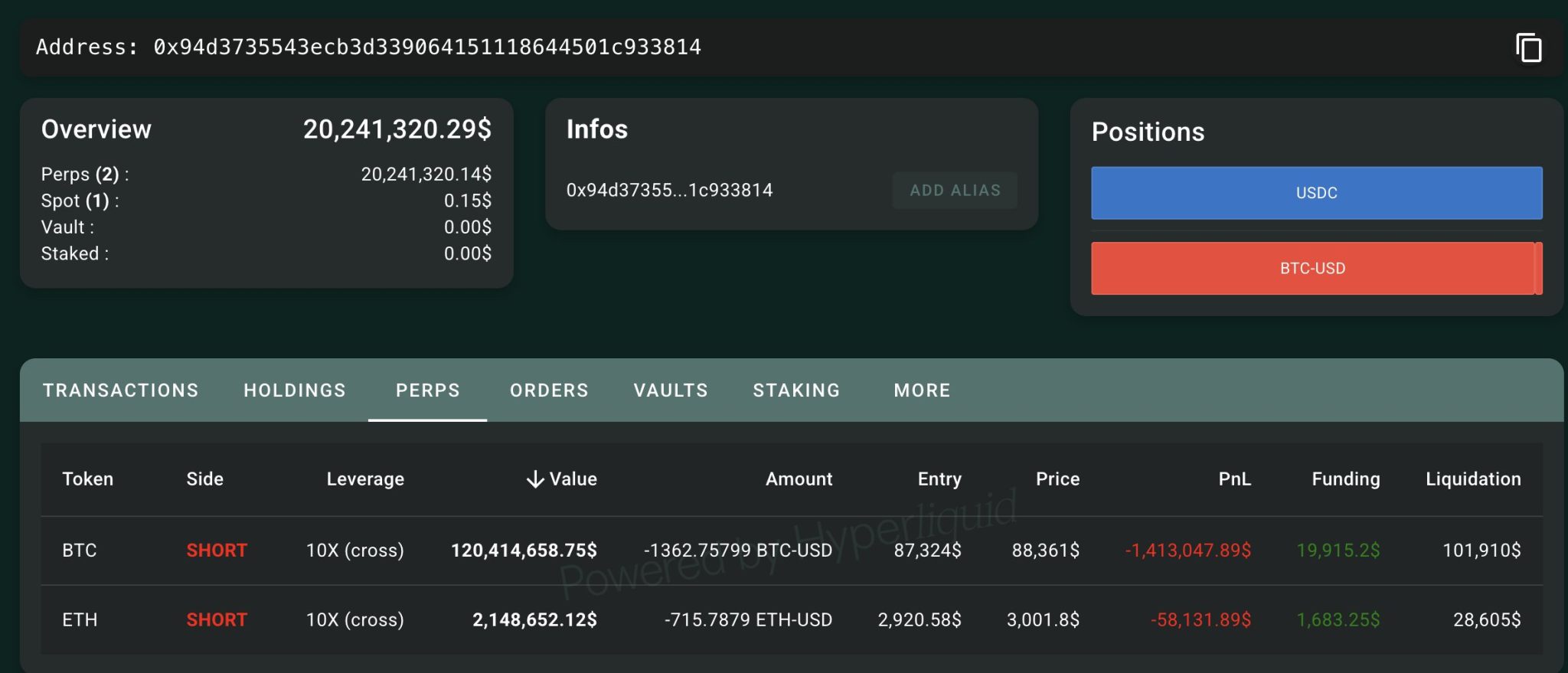

On-chain data presentations that a whale pockets identified as 0x94d3 has persisted to produce downside exposure after sharply reducing its Bitcoin holdings earlier in the week. The exercise underscores a growing conviction that primarily the most trendy market rebound might perhaps perhaps well also be fragile.

In step with blockchain analytics firm Lookonchain, the pockets sold 255 BTC last Friday at $21.77 million at an reasonable impress of $85,378 per Bitcoin. Rapidly after exiting section of its pickle exposure, the pockets pivoted aggressively in opposition to leveraged quick positions.

Leveraged Shorts Magnify All over Bitcoin and Ethereum

Lookonchain data indicates that the whale opened 10× leveraged shorts in both Bitcoin and Ethereum on Friday. Particularly, the preliminary Bitcoin quick totaled 876.27 BTC, with a notional impress of roughly $76.3 million. On the same time, the pockets shorted 372.78 ETH, worth roughly $1.1 million.

Reasonably than reducing possibility, the trader added to these positions on Monday. An additional 486.49 BTC and 343.01 ETH were positioned on the quick aspect.

As a end result, total Bitcoin quick exposure has increased to 1,362.76 BTC, valued at $120.41 million, while the Ethereum quick announce now stands at 715.79 ETH, with a blended impress of spherical $2.15 million.

Location Metrics Advise Early Drawdowns

On-chain metrics provide additional insight into the danger profile of the trades. For occasion, the Bitcoin quick carries an reasonable entry impress of $87,324, with liquidation estimated shut to $101,910.

With Bitcoin currently buying and selling spherical $88,361, the announce is exhibiting an unrealized loss of roughly $1.41 million.

Ethereum data paints a equal portray. The ETH quick changed into once entered shut to $2,920, with a liquidation stage a long way above at $28,605. At a market impress shut to $3,001, the unrealized loss is estimated at $58,131.

-

On-chain Metrics for Bitcoin and Ethereum Brief Positions

These aggressive bearish bets come moral because the broader crypto market attempts to stabilize following a chronic downturn in October. Despite the indisputable truth that prices bear staged a cautious recovery, analysts continue to warn that underlying weak point stays.

Plenty of technical indicators imply the rebound might perhaps perhaps well also face renewed stress.

Technical Diagnosis Indicators Arrangement back Threat

Crypto analyst CryptoOnchain highlighted these concerns in a most trendy post on X, noting that selling stress continues to dominate Bitcoin’s impress structure.

Bitcoin is currently buying and selling shut to its Level of Take care of watch over (POC), a key stage where most most trendy buying and selling came about and usually acts as increase or resistance.

The analyst warned that failing to reclaim prior highs will increase the danger of a tumble in opposition to $70,000–$73,000.

A bearish divergence in the RSI provides additional concern for a deeper pullback.

Merchants might perhaps perhaps well also light stare the $72,000 stage for signs of a seemingly jump, nonetheless staying above $70,000–$73,000 can be quite vital. Falling below might perhaps perhaps well space off a increased correction.

Citi Outlook Echoes Caution

This technical outlook aligns with most trendy projections from Citigroup. In a study impart, the bank outlined a large amount of that you just might perhaps perhaps mediate of outcomes for Bitcoin over the next year.

Below its bearish concern, Citi estimates Bitcoin might perhaps perhaps well tumble to $78,000. Conversely, a bullish case might perhaps perhaps well explore prices climb as excessive as $189,000, thereby highlighting the surprisingly excessive stage of uncertainty going thru the market.