Bitcoin retail merchants are snapping up Bitcoin as whales dump, a sample that would also stamp concern for the asset’s designate if historical past is any recordsdata, in accordance to sentiment platform Santiment.

Alternatively, diversified crypto analysts are divided on how the approaching weeks will unfold for Bitcoin (BTC).

“Historically, prices tend to note the direction of the whales, no longer retail,” Santiment acknowledged in a markets describe on Saturday.

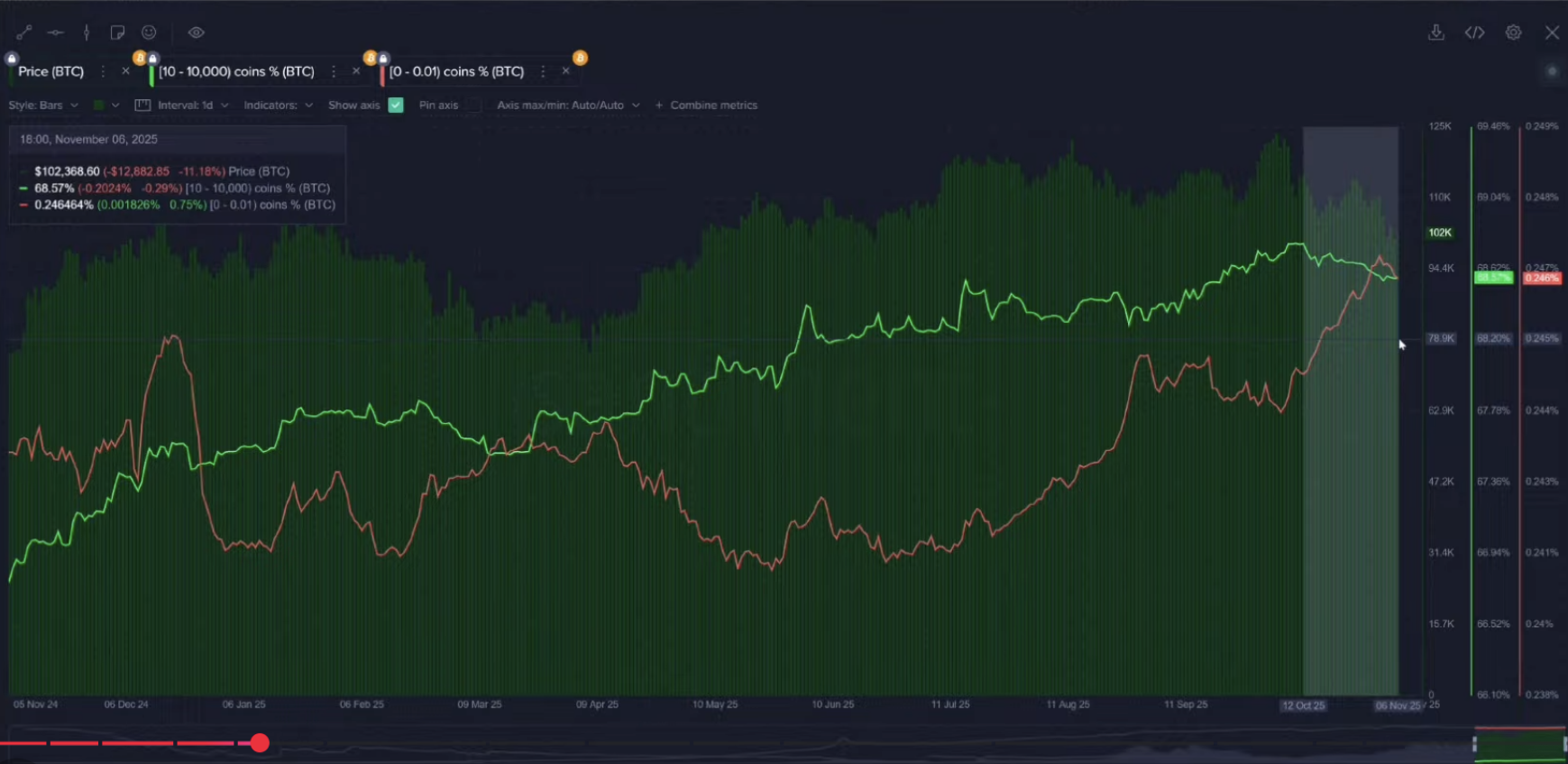

Santiment pointed out that since Oct. 12, Bitcoin whales — wallets holding between 10 and 10,000 BTC — like offered roughly 32,500 Bitcoin. Alternatively, Santiment added that “tiny retail wallets were aggressively attempting to gain the dip.”

Bitcoin’s nick up amongst the cohorts is a “cautionary stamp,” says Santiment

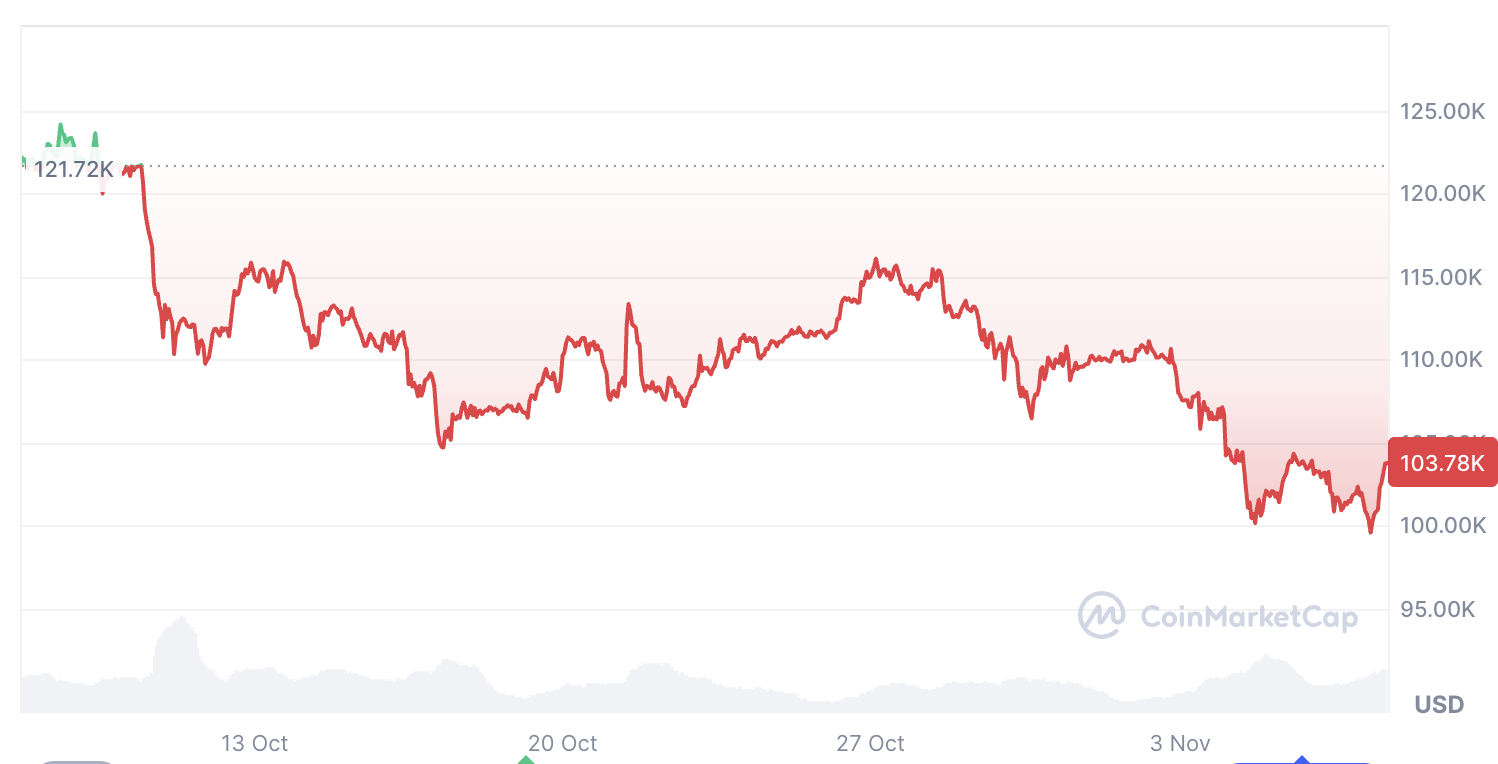

During that time, Bitcoin fell from $115,000 to $98,000 on Nov. 4, representing a decline of around 15%, in accordance to CoinMarketCap. BTC’s designate has since recovered to $103,780 on the time of e-newsletter.

Santiment described it as a “main divergence has regarded between neat and tiny merchants.” Santiment acknowledged:

“A divergence the attach whales are selling while retail is attempting to gain basically is a cautionary stamp.”

Diversified analysts are divided on how the approaching weeks will play out for Bitcoin.

Bitfinex analysts told Cointelegraph that they count on discontinuance to-time interval consolidation and a few volatility, rather then “a obvious trot to original highs.”

“We expect about ETF inflows earlier in October pushed the designate to around $125,000, sooner than mid-month macro shocks, a serious alternatives expiry, and profit-taking knocked it aid into the high $100,000s,” the analysts acknowledged.

On Friday, attach of living Bitcoin ETFs broke a six-day outflow breeze that noticed $2.04 billion in outflows, in accordance to Farside.

Bitcoin has a probability of hiking to $130,000 if situations give a enhance to: Analysts

They outlined that if attach of living Bitcoin ETF inflows return to delivering above $1 billion inflows per week and macro situations give a enhance to, Bitcoin might perhaps well perhaps in actual fact like a probability to climb toward $130,000.

Within the intervening time, Nansen senior overview analyst Jake Kennis told Cointelegraph that despite the truth that Bitcoin has historically posted year-over-year positive components, “the sizzling liquidation and breakdown in market construction kill it far much less possible within the discontinuance to time interval.”

“That acknowledged, there’s still room for meaningful upside into year-terminate,” Kennis acknowledged, explaining that a original all-time highs are still possible for Bitcoin this year if momentum does “shift decisively.”