Crypto markets are going thru appreciable volatility all over the past 24 hours as global occasions are if truth be told taking half of their share.

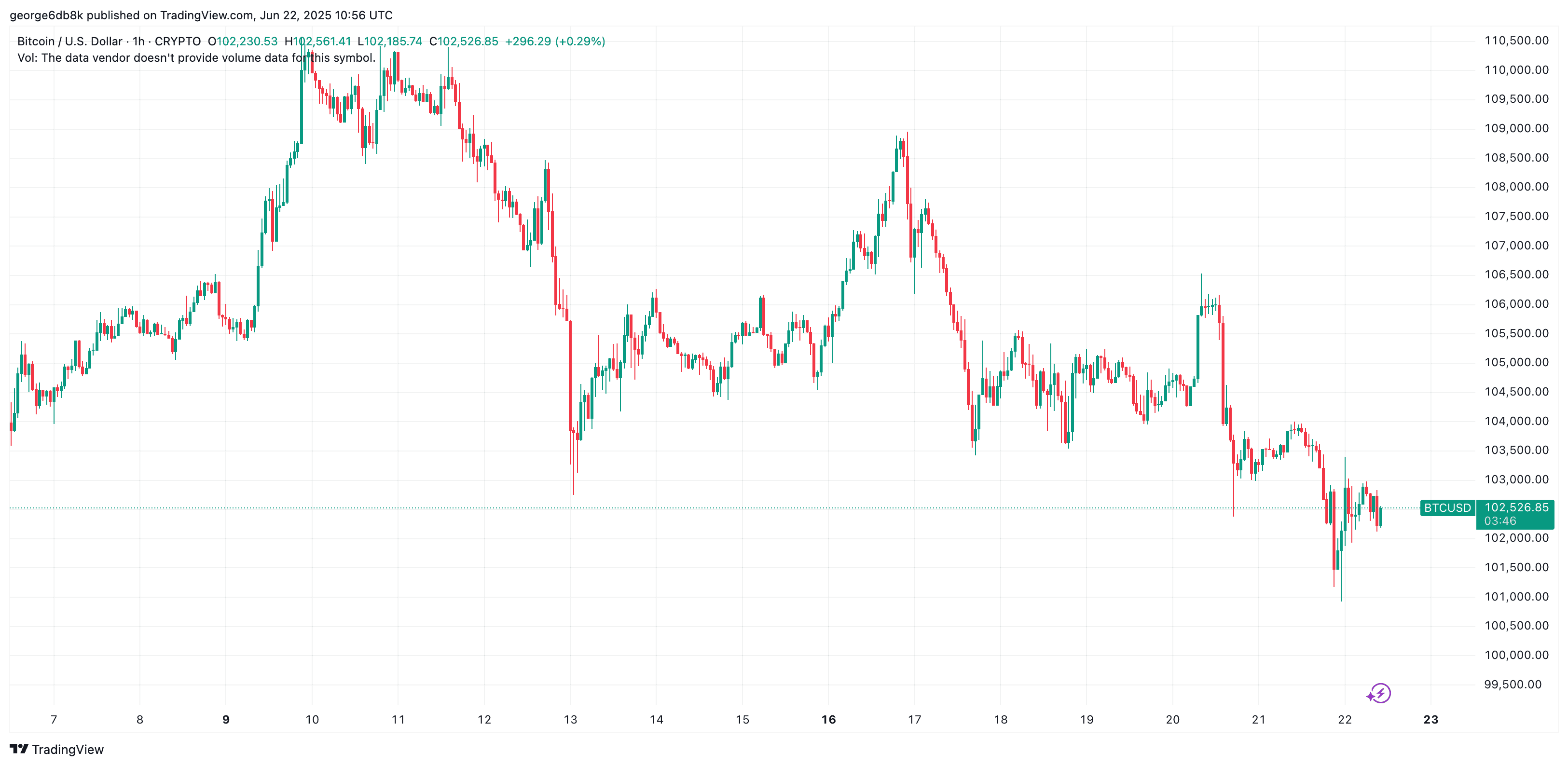

Bitcoin dropped to an intraday low of spherical $101,000, causing a appreciable uptick in liquidated positions.

Bitcoin Sign Dips to $101,000

As CryptoPotato reported earlier on the present time, Bitcoin’s mark dipped to an intraday low of $101,000. It has since recovered a chunk of bit and trades at $102,500 on the time of this writing.

That acknowledged, the volatiltity stays enhanced, which has resulted in a whopping $700 million price of liquidated positions across derivatives markets.

Records from CoinGlass shows that this represents an extend of higher than 55% when put next with yesterday’s ranges, testifying to the uncertainty of the ongoing pickle.

The turmoil is largely triggered by the US resolution to strike Iran earlier on the present time, no matter Donald Trump asserting that he’s going to take two weeks to assume on future moves, beautiful about a days ago.

Bahrain and Kuwait, home to US bases, also started making preparations for the chance the struggle could well well unfold to their territory in a transparent signal of escalation. The identical is gorgeous for Saudi Arabia.

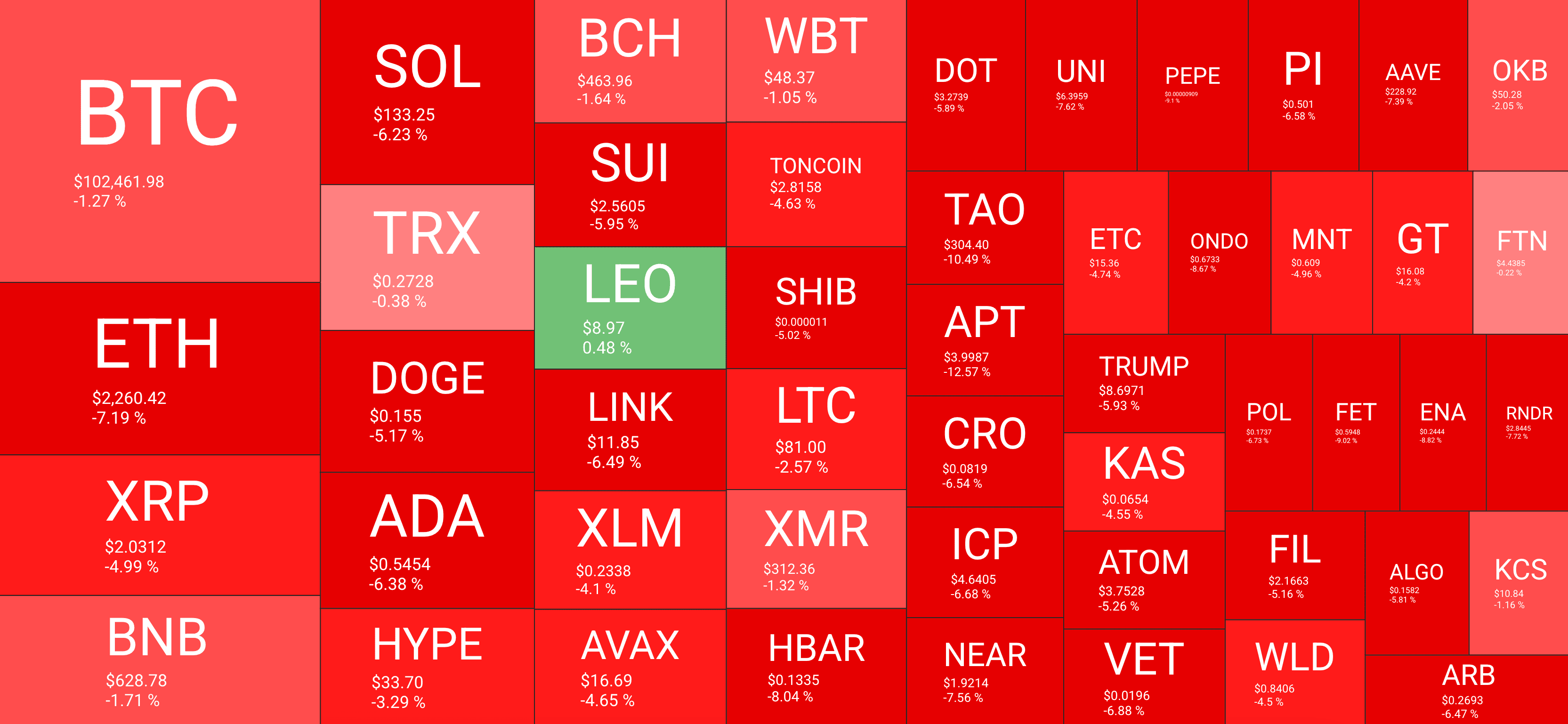

Altcoins Deep within the Crimson

The declines unfold across altcoin markets as nicely, which took even bigger of a beating. ETH plunged by higher than 7%, SOL is down by over 6%, DOGE, ADA, LINK, SUI, and plenty of more chart linked drops as merchants derisk.

The evident exception is LEO, which stays roughly damage even on the day, on the least from the pinnacle 50 cryptocurrencies by methodology of total market capitalization.

This day’s worst performer is Aptos (APT), adopted by Virtuals Protocol, and Injective (INJ), all of which are down within the vary between 10% and 13%.