Bitcoin

volatility bulls could additionally quickly discover their prefer because seasonal patterns in Cboe’s Volatility Index (VIX) counsel Wall Avenue is poised for increased turbulence.

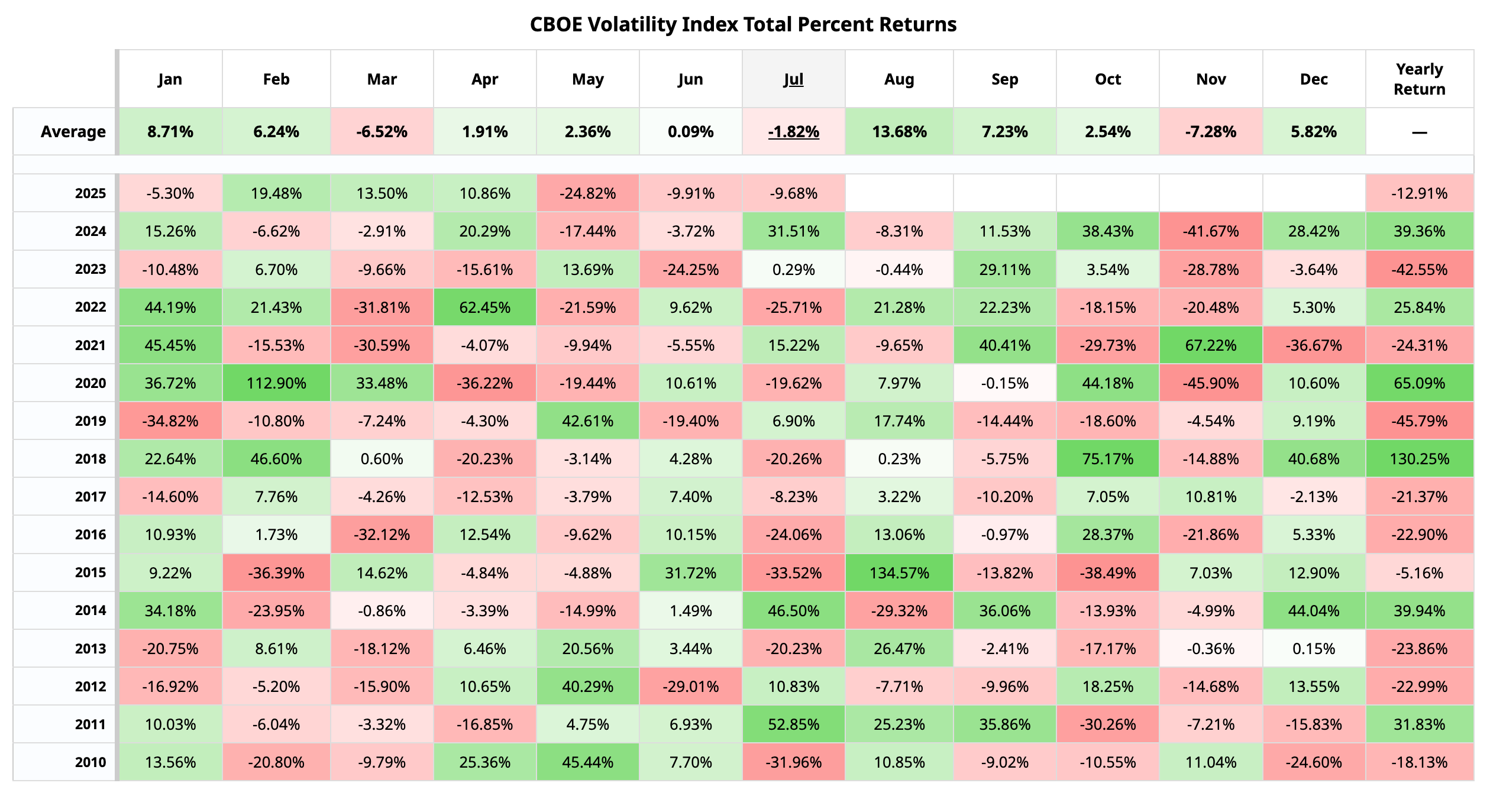

The VIX measures the predicted 30-day swings of the S&P 500 benchmark. Its ancient pattern, per Barchart.com, reveals a frequent August surge, repeatedly preceded by a decline in July.

August stands out as having the absolute most realistic common month-to-month invent, 13.68%, over the past 15 years, rising in 10 of these years, including a huge 135% spike in 2015.

History repeating itself?

The VIX fell for a Third straight month in July, extending the accelerate from April highs. It hit a 5-month low of 14.92 on Friday, per files source TradingView.

If ancient past is a files, this decline is most likely surroundings the stage for the August tell in volatility and possibility aversion on Wall Avenue. The VIX, which has been nicknamed the Awe Gauge, spikes increased when stock prices decline and falls after they upward push.

In hundreds of words, the anticipated volatility tell on Wall Avenue could additionally be marked by a stock market swoon, which could additionally spill over into the bitcoin market.

Bitcoin tends to trace the sentiment on Wall Avenue, especially within the expertise stocks, barely carefully. BTC’s implied volatility indices possess developed a real stagger correlation with the VIX, signaling a each day evolution into VIX-love dread gauges. Since November, BTC’s 30-day implied volatility indices possess declined sharply, ending the stagger correlation with the plight label.

Read: Bitcoin’s ‘Low Volatility’ Rally From $70K to $118K: A Chronicle of Transition From Wild West to Wall Avenue-Fancy Dynamics