At the same time as more companies board the bitcoin treasury bandwagon, their collective appetite for scooping up BTC has weakened.

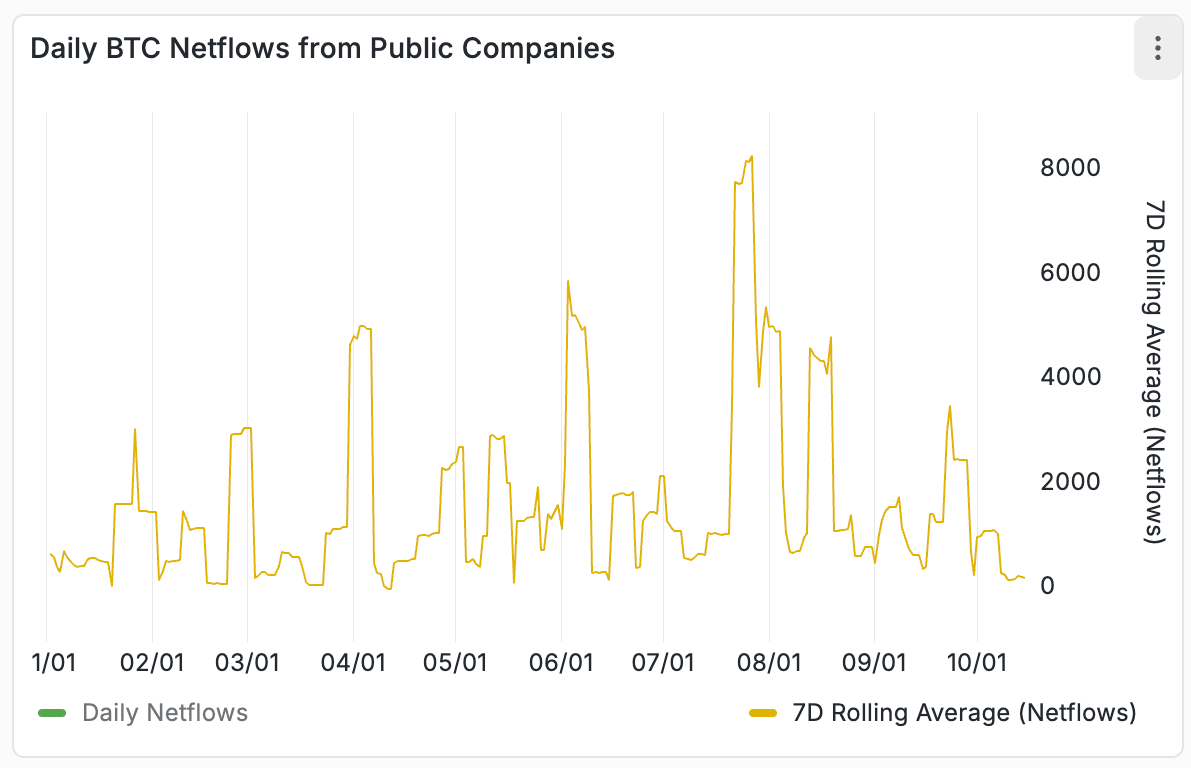

That decline is nothing in need of drastic must you glimpse on the numbers. The seven-day transferring real looking of catch daily inflows into bitcoin digital asset treasuries (DATs) recently dropped to 140 BTC, marking the lowest stage since mid-June and a pointy decline from a July high of 8,249 BTC, in accordance to BitcoinTreasuries.catch.

Issues glimpse even bleaker must you zoom in on daily exercise this month: 12 out of 15 days saw below 500 BTC flowing in, including more than one days with no inflows in any map.

It tells us that institutional appetite for publicity to BTC by process of pale market vehicles has weakened after a length of aggressive shopping for early this year that helped prop up BTC costs.

Interestingly, bitcoin’s imprint rally has cooled off sharply, losing to practically $110,000 after hitting a file high of over $126,000 on October 6. Zooming out, the market has been consolidating inside a gargantuan vary above $110,000 since June, reflecting a tug-of-battle between bullish optimism and profit-taking.

The DAT vogue, pioneered by the likes of Approach, follows a centuries-veteran playbook of borrowing fiat to compose scarce, arduous sources.

Bitcoin, with its fastened present capped at 21 million money and the supreme performance among predominant sources over the closing decade, has drawn ask from a increasing replacement of digital asset treasuries searching for to hedge inflation and diversify reserves. Thus some distance, the tip 100 public DATs by market imprint delight in cumulative received over 1 million BTC.

Unsustainable vogue?

However, be pleased gold, BTC would now not provide an inherent yield, which manner that money received with borrowed money sit down indolent on the balance sheet with none offsetting money circulate. The DAT vogue, attributable to this truth, is a gamble that costs will continue to upward push, producing capital positive aspects. It be related to running a ompany centered on shopping gold, which would possibly perhaps well perhaps even be a zero-yielding asset.

The most in fashion strategy has been to scenario stock at a top fee to the catch asset imprint (NAV), adopted by issuing debt to finance purchases. The highest fee is the end result of the story, “a memetic top fee in accordance to the figurehead on the company – you realize them by name,” NYDIG acknowledged.

These companies, attributable to this truth, stand uncovered to a utter where they either fail to generate enough memetic top fee to magnify their crypto per part or investors liquidate their part holdings, inflicting the head fee to NAV to collapse.

That is already going on. Roughly one in four publicly traded DATs now trade below their catch asset imprint (NAV), which manner their market valuations are now not as much as the associated fee of the cryptocurrencies they keep on their balance sheets.

In response to NYDIG, these premiums are positively correlated to costs, which manner a downtrend in BTC’s imprint would possibly perhaps well perhaps explore these premiums evaporate.