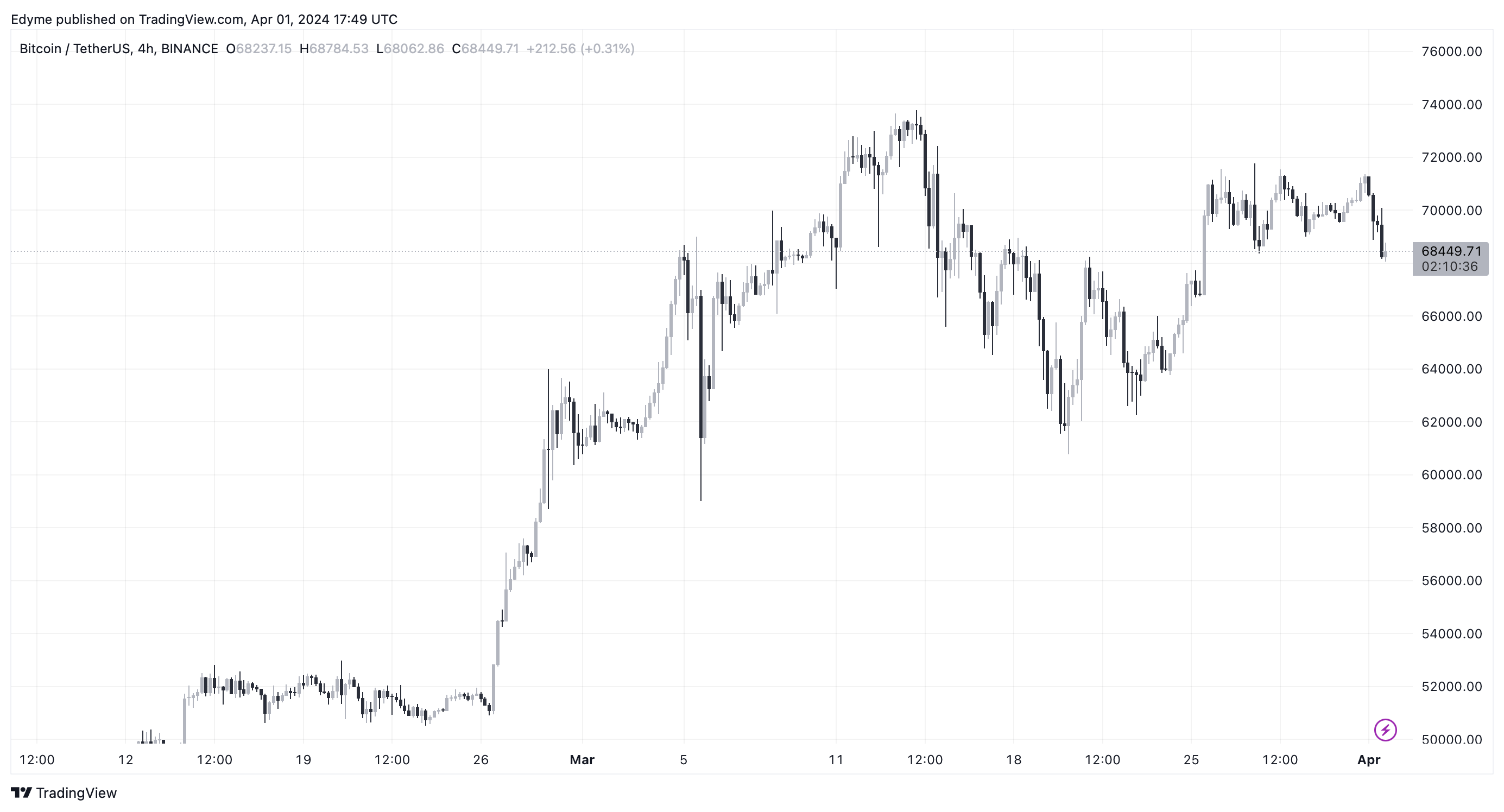

Bitcoin (BTC) has been making waves with its accurate climb in opposition to surroundings a new all-time high (ATH), currently finding a foothold at the $68,000 zone.

This stage of efficiency represents a fruits of investor self assurance, market dynamics, and underlying economic factors that paint a broader report of the digital forex’s “resilience and allure.”

Crypto analyst Ali has not too lengthy within the past make clear a significant juncture in Bitcoin’s ride, identifying a broad resistance stage that also can have an effect on its brief-term impress actions.

Key Resistance Awaits

Ali’s prognosis brings to the forefront a particular resistance barrier that Bitcoin faces on its path to reaching a new ATH. In response to Ali, a resistance stage at $70,320, characterized by a total quantity of 599,260 BTC held by 736,380 addresses, stands because the gatekeeper to further bullish momentum.

Surpassing this threshold also can potentially catalyze Bitcoin’s ascent, further solidifying its put because the top of the cryptocurrency market.

This resistance in particular represents the collective anticipation and strategic positioning of assorted of thousands of investors who maintain staked their claims in Bitcoin’s digital gold.

#Bitcoin finds accurate ground at $68,300, yet a atomize below also can lead to a downswing to the subsequent red meat up range at $65,250-$63,150, where 760,000 wallets believe 520,000 $BTC.

On the brighter aspect, securing $70,320 as red meat up is important for #BTC subsequent leg up! pic.twitter.com/EMPBRRADzT

— Ali (@ali_charts) April 1, 2024

Within the meantime, the crypto market’s sentiment has been a rollercoaster, with Bitcoin experiencing a runt retreat, marking a 1.4% decrease over the past week and a 2.4% dip within the closing 24 hours, touchdown at a market impress of $68,448, at the time of writing.

Caution Amid Bitcoin Represent Plod

Amidst this backdrop, author and outdated hedge fund supervisor Jim Cramer has voiced his observations, suggesting that the market is “essentially the most overbought” it has been in a whereas.

The observations approach appropriate as Bitcoin marks its seventh month of definite efficiency, a milestone closing performed in 2012. This duration of development is highlighted by a month-to-month candlestick chart closing larger than the peak of its closing cycle.

Including to this “overbought” sentiment by Jim Cramer is a transaction of the seventh wealthiest Bitcoin tackle withdrawing 8,889 BTC from Bitfinex, valued at roughly $627 million, recorded by Peckshield.

On the other hand, regardless of this, Cramer’s statements maintain sparked debates and skepticism among the many crypto neighborhood, with some questioning the timing of his feedback as an April Fool’s jest.

April Fools + Cramer Signal = Large rip incoming

— TB – JDUN (@Jduntrades) April 1, 2024

Featured report from Unsplash, Chart from TradingView