As of June 17, 2024, Bitcoin is buying and selling at $65,805, with a 24-hour intraday fluctuate between $65,518 and $66,992. The cryptocurrency market is exhibiting well-known volatility, as evidenced by main buying and selling quantity and fluctuating value levels.

Bitcoin

Bitcoin’s 1-hour chart shows a transparent downward pattern following a contemporary top, with key resistance and enhance levels at $66,914 and $65,521, respectively. Procuring and selling quantity spikes correlate with gargantuan downturns, indicating tall promoting strain. A seemingly entry point may perchance well perchance well be identified after confirmed enhance at $65,450 if the value reveals upward motion with increasing quantity.

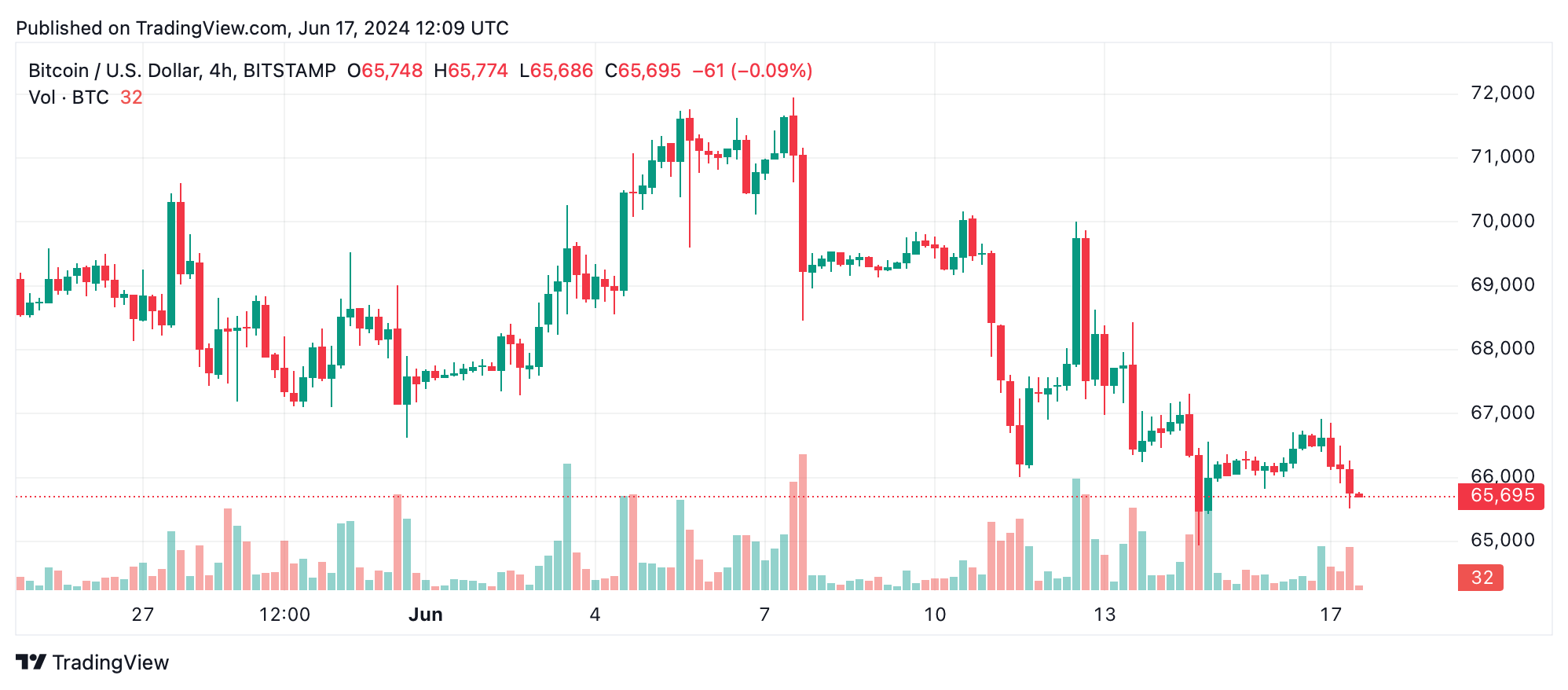

Mirroring bitcoin’s 1-hour chart, the 4-hour timeframe furthermore shows a downtrend put up-top, with resistance at $70,007 and enhance at $64,936. The amount prognosis signifies solid promoting momentum, with main spikes in the end of important drops. Entry considerations may perchance well perchance well be essentially based on consolidation in the end of the $64,936 enhance, coupled with bullish reversal indicators.

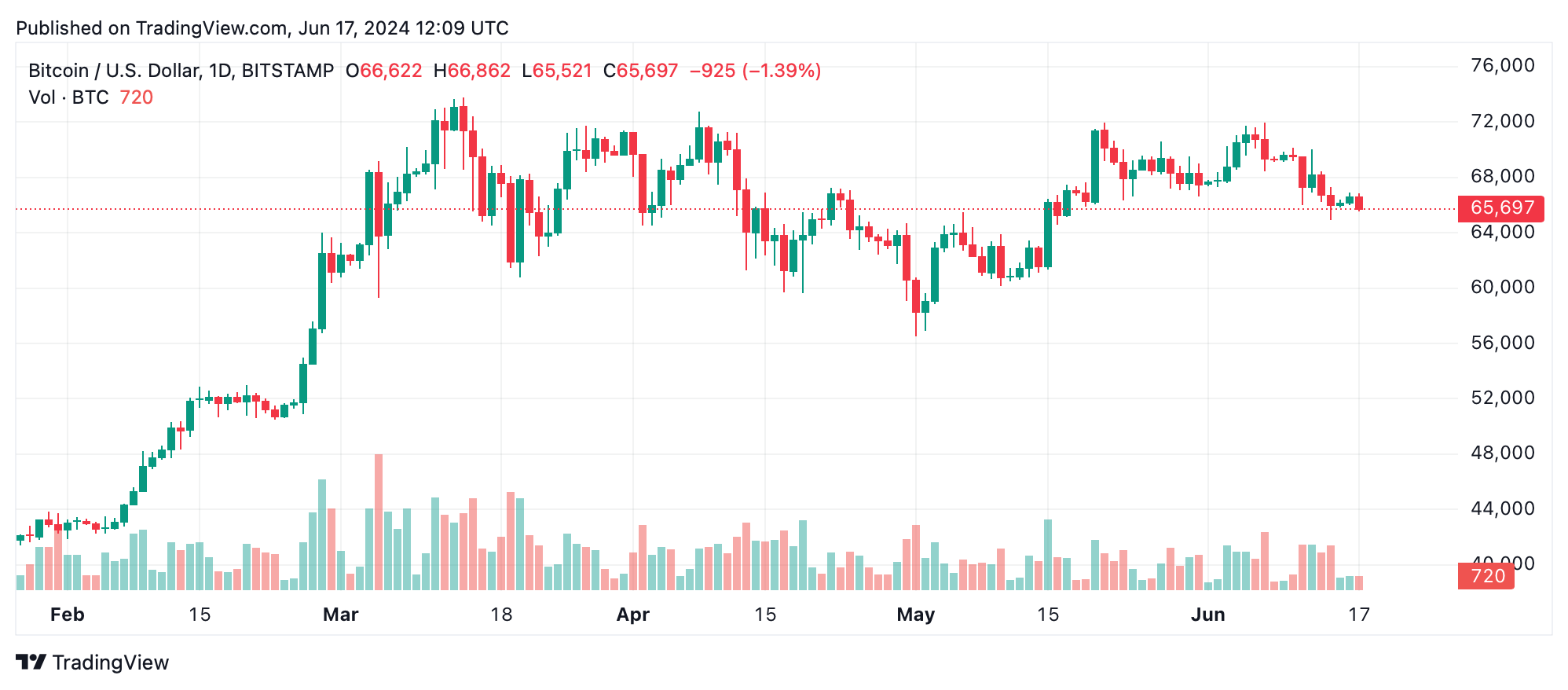

The daily chart provides a broader standpoint, illustrating a bearish correction following an uptrend. Resistance and enhance levels are identified at $71,958 and $61,322, respectively. High buying and selling volumes in the end of key actions counsel heightened market passion. A protracted-time duration entry may perchance well perchance well be viable on the $61,322 enhance, assuming it holds and reversal signs are evident.

Oscillators order a blended outlook, with the relative power index (RSI) at 42 (neutral) and the commodity channel index (CCI) at -120 (neutral). The momentum indicator suggests a aquire, whereas the transferring moderate convergence divergence (MACD) level signifies a sell, reflecting market uncertainty.

Transferring averages (MAs) predominantly value promoting strain: exponential transferring averages (EMA 10, 20, 30) and straightforward transferring averages (SMA 10, 20, 30) all suggest for bearishness. Longer-time duration indicators, such because the EMA (100) and SMA (200), counsel a aquire, hinting at seemingly recovery potentialities.

Bull Verdict:

Despite the prevailing bearish sentiment indicated by non eternal transferring averages and oscillators, bitcoin’s longer-time duration transferring averages counsel seemingly recovery. If enhance levels relish and bullish reversal indicators emerge, a rebound may perchance well perchance well be on the horizon. Merchants buying for long-time duration improve may perchance well perchance well also receive entry opportunities at unique lower levels, looking ahead to a future upward pattern.

Endure Verdict:

The final technical prognosis highlights main promoting strain, with downward traits evident in the end of a pair of timeframes. Key resistance levels remain unbreached, and quantity spikes correspond to solid promoting momentum. Merchants must exercise caution and rob into consideration exiting positions if bearish patterns persist, with the means for added value declines within the shut to time duration.