Market forces are at play as Bitcoin consolidates at the $70,000 mark, signaling an approaching breakout. At press time, Bitcoin used to be 3% disquieted of registering a fresh all-time excessive. The excessive file used to be made following market hype, which resulted in Bitcoin halving. Bitcoin halvings secure historically been bullish.

Also Read: Bitcoin Volatility: Is accumulation and low volatility the last phases earlier than a enormous market circulate?

This text analyzes Bitcoin’s actions on the charts and examines fundamentals that can inspire the next breakout. Will Bitcoin attain $100k?

Bitcoin Day-to-day Chart: Bitcoin breaks the Could honest imprint vary

Bitcoin closed Could honest’s vary liquidity as it crossed above $71,000. The circulate used to be a repeat of strength as bulls dominated the market.

Also be taught: Semler Scientific buys $17M Bitcoin, plans $150M fundraise for additional BTC acquisition

Earlier to closing Could honest’s vary, Bitcoin broke above two diversified serious ranges—the low and the mid-vary—within the span of 1 week. The tips mean that Bitcoin is now lend a hand to its annual excessive. It registered its all-time excessive on Mar 14, 2024 at $73,750.

Bitcoin Weekly Chart: Bitcoin repeats historic pattern

The weekly chart highlights the formation of bullish flags in old weeks. The phenomenon is better outlined by the market, which moves in two phases: enlargement and contraction. Expansion occurs when the market breaks out from consolidation, which shall be in either course. Contraction refers to the notify of consolidation. Longer classes of contraction secure historically resulted in extended breakouts. It’s miles cherish a balloon: the longer you squeeze it, the increased the chance of it bursting.

Taking a peep at the chart, Bitcoin is breaking out from the contraction piece.

Above, which you can perchance perceive diversified historic scenarios of enlargement and contraction. When it bursts, it explodes. The pattern carefully resembles the bullish flag pattern; the breakout begins after the formation of the flag. The pattern held via in old same scenarios.

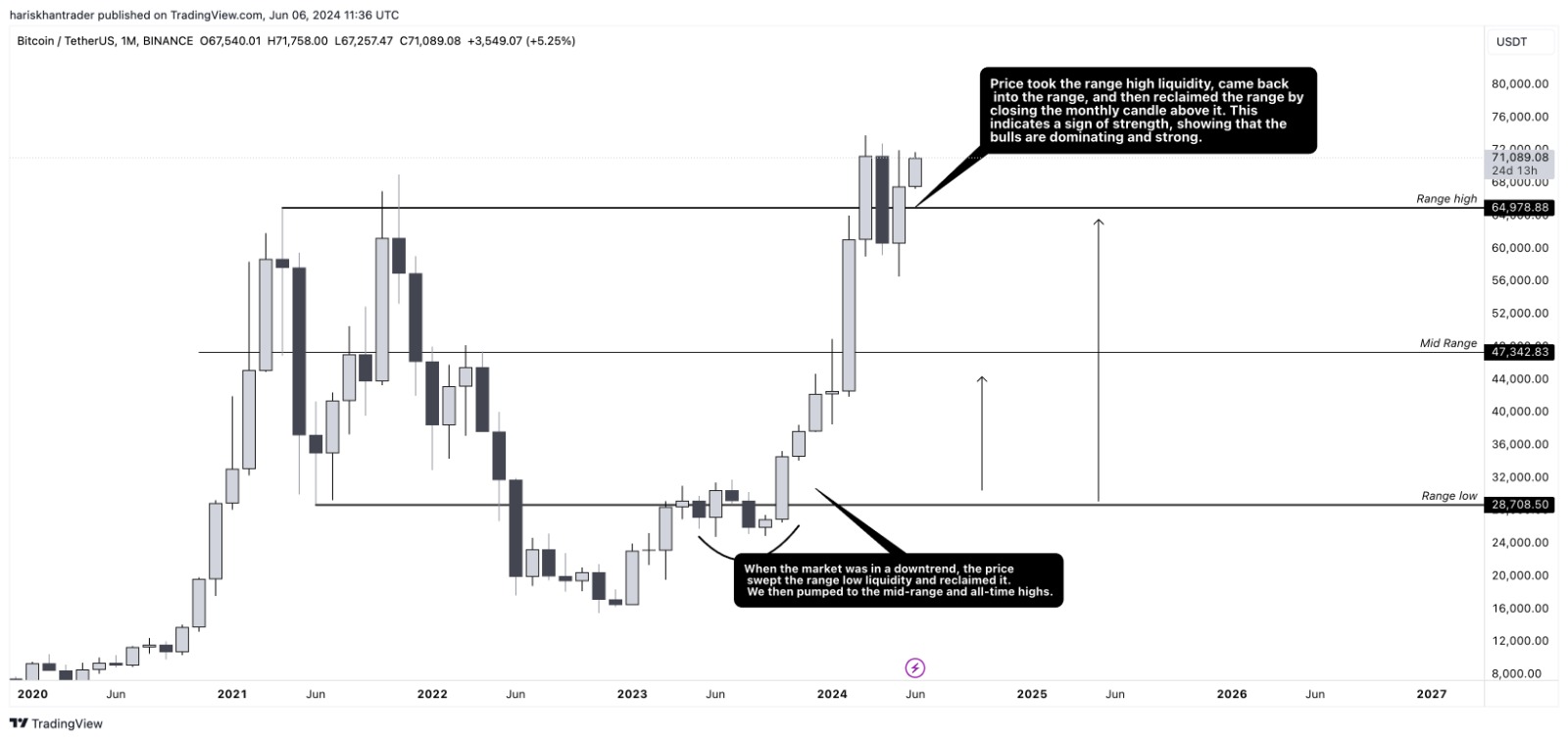

Bitcoin Month-to-month Chart: Bitcoin reclaims vary excessive liquidity

Lastly, on the month-to-month chart, Bitcoin swept the liquidity at the vary low within the 2nd half of 2023, indicating a shift in market structure. This month, the payment took the vary-excessive liquidity, returned to the vary, and reclaimed it by closing above the month-to-month candle. This particular circulation is a repeat of strength, seriously for the bulls. Nonetheless, it’s additionally believable that Bitcoin will retrace to the $63k level and dwell bullish.

Pronounce that if the day-to-day candle closes below $56.5k, this can invalidate the fresh formation, which is serious for an entire pattern shift. Diving into shorter timeframes can fetch technical and, resulting from this truth, appropriate for traders.

Constant with the fresh formations, we are in a position to manufacture that a $90 to $100k is extremely that which you can perchance accept as true with must accumulated the fresh pattern protect. Nonetheless, endure in thoughts, the crypto market is extremely volatile. The imprint can tumble in a 2nd’s peep, driven by altering market fundamentals.