As Bitcoin (BTC) establishes its designate above the $67,000 designate, an analyst has observed that the crypto is destined for every other all-time high essentially based on foremost technical indicators.

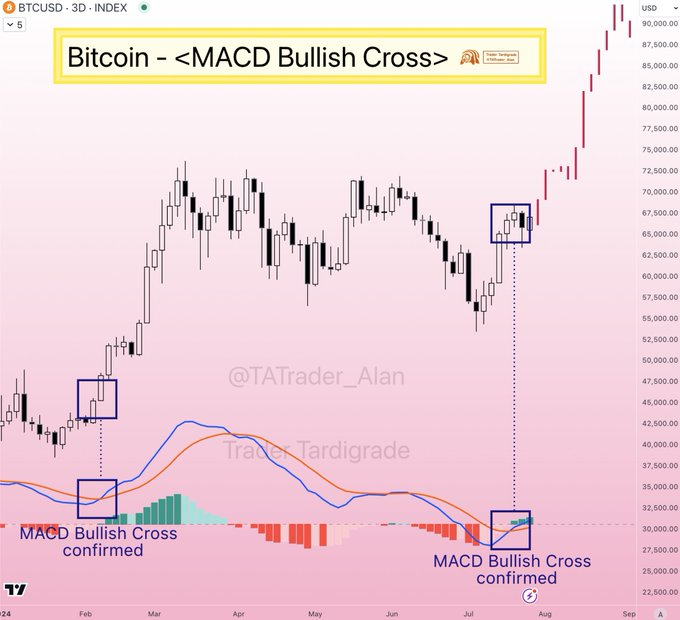

In an diagnosis shared on X on July 26, Dealer Tardigrade predicted that Bitcoin is destined for $90,000 after confirming a key bullish crossover on the shifting sensible convergence divergence (MACD) indicator.

Based mostly on the analyst, the Bitcoin chart outlines significant insights aligning with the bullish sentiment. The MACD indicator, a usual instrument merchants use to identify doable market traits, has signaled a conceivable shift in momentum from bearish to bullish.

“Bitcoin MACD Bullish Crossover confirmed. BTC 3-day chart presentations a Bullish Crossover on MACD indicator. This represents an Uptrend Momentum has been developed and would possibly well well bring to a brand unusual Surge soon,” the expert mentioned.

The well-known crossover came about in early February, ensuing in a significant surge in Bitcoin’s designate. The contemporary crossover, confirmed in unhurried July, suggests that Bitcoin would possibly well well smartly be on the cusp of every other well-known rally, with $90,000 last a doable target. Traditionally, such crossovers possess been unswerving indicators of upward designate hump, giving merchants and consumers a motive on the good thing about optimism.

As of the final MACD bullish heinous, Bitcoin’s designate become once round $32,000. If the historical sample holds true, this crossover would possibly well well propel Bitcoin against the projected target, representing a close to threefold prolong in designate.

Critically, a upward thrust to $90,000 would reaffirm Bitcoin’s region and bolster investor self belief across the whole digital asset market.

Bitcoin going through minor pullback

Indeed, the market is staring at Bitcoin’s ability to push against the $70,000 designate, as this region would seemingly validate any conceivable pass against a brand unusual all-time high. In the short timeframe, every other crypto analyst, Ali Martinez, has instructed that Bitcoin can also face a minor pullback earlier than rallying.

In an X put up on July 26, Martinez renowned that the TD Sequential indicator had presented a promote signal on the Bitcoin hourly chart. This technical signal, identified for its ability to foretell market reversals, suggests that a instant correction in Bitcoin’s designate is forthcoming earlier than it doubtlessly reaches elevated highs.

Critically, the TD Sequential identifies style exhaustion and conceivable designate reversals. The contemporary signal implies that Bitcoin would possibly well well trip a non everlasting dip, offering a doable procuring for opportunity for those having a witness to capitalize on lower entry parts.

Additionally, Bitcoin’s designate command doable is deemed to be modern in the coming months. In explicit, in step with a Finbold document, the Market Worth to Realized Worth (MVRV) and Community Worth-to-Transaction (NVT) diagnosis presentations favorable designate command for Bitcoin.

Bitcoin designate diagnosis

At the time of reporting, Bitcoin become once trading at $67,190, with each day beneficial properties of over 4%. All over the last seven days, it has been up 2%.

Overall, Bitcoin has established bullish momentum in the short timeframe, and reclaiming $70,000 is mostly key in concentrating on a brand unusual high.

Disclaimer: The command material on this space mustn’t ever be notion about investment advice. Investing is speculative. When investing, your capital is in distress.