Bitcoin and gold dominate discussions as alternative investments, representing the conflict of favorite and former stores of price. But both derive very exiguous in fashioned. Gold has been revered as a retailer of price since former cases, whereas Bitcoin was once born decrease than two a protracted time ago.

Bitcoin honest now not too prolonged ago surpassed silver in market price, highlighting its rising adoption as a decentralized, scarce, and inflation-resistant digital asset, positioning it as a favorite alternative to former life like metals.

With its mounted offer, transparent ledger, and rising institutional acceptance, Bitcoin is being increasingly extra viewed by merchants as the “subsequent gold. ” It offers same advantages of wealth preservation and diversification whereas embracing the advantages of the realm digital economic system.

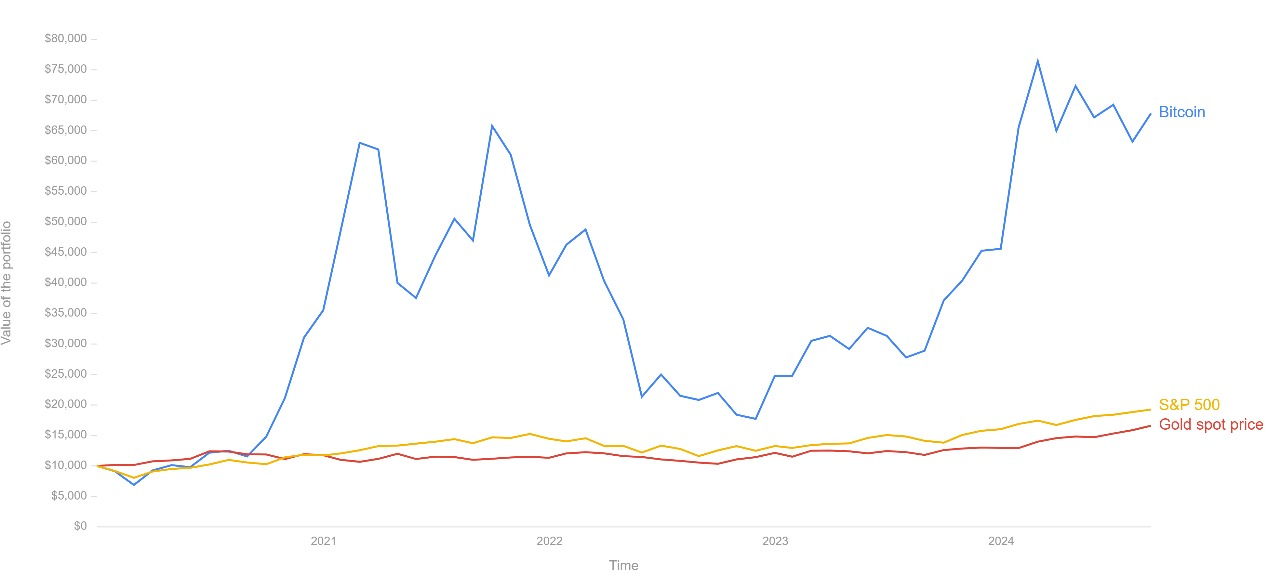

The numbers abet this up, with Bitcoin seeing a staggering 10,000% return over the final decade in comparison to gold’s extra modest 117% and a 2,500% return over the final five years versus gold’s 102%.

Then all any other time, gold stays the time-examined king of wealth preservation, revered for its prolonged historical previous as a haven someday of enterprise uncertainty. For hundreds of years, it has been a respectable hedge in opposition to inflation, forex devaluation, and economic crises.

Universally identified and valued, gold’s intrinsic properties—a lot like shortage and sturdiness—make a contribution to its balance as an asset. It is moreover a key machine for diversifying funding portfolios, offering balance when diverse markets are volatile, making it an vital asset for heaps of merchants. Gold’s proven video display file in both price retention and diversification solidifies its characteristic as a cornerstone of wealth preservation.

A extra thorough comparability is well-known to search out out which of these heavyweights gives the absolute best prolonged-timeframe funding alternative. Let’s dive in:

Bitcoin’s Performance Over the Years

Offer | The height of peaks is lowering, indicating that BTC is stabilizing as an asset.

Launched in 2009, Bitcoin (BTC) is a decentralized digital forex free from authorities control. In 2010, it was once rate most appealing half of a cent ($0.003), and currently, it has crossed $97,000! Consultants predict it could perhaps well perchance contact $100k by the cease of 2024.

Despite its outdated volatility, Bitcoin is stabilizing as an asset. This style is largely due to rising institutional involvement, regulatory clarity in key markets esteem the U.S. and Europe, and rising acceptance as a digital retailer of price. Technological upgrades, including the Taproot enhancement, derive moreover improved Bitcoin’s scalability and privateness, reinforcing its prolonged-timeframe potentialities.

Additionally, the introduction of Bitcoin Assign ETFs, a lot like these filed by firms esteem BlackRock, has made it more straightforward for institutional merchants to impress publicity to Bitcoin with out correct now conserving the asset.

With President-elect Donald Trump’s skilled-crypto stance, Bitcoin’s situation as a mainstream asset seems solidified.

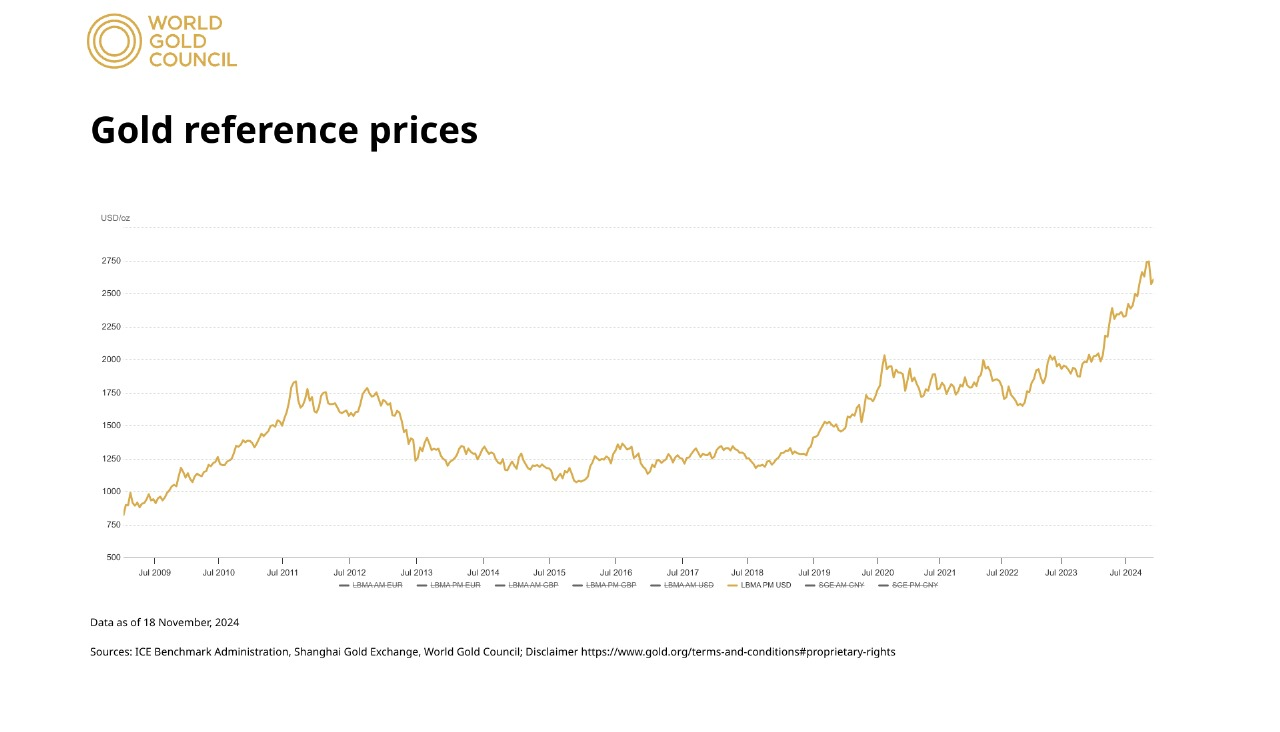

Gold’s Performance Over the Years

Offer | Gold demonstrates trusty, slack development with exiguous volatility.

Gold has been valued for millennia, now not most appealing as a safe-haven asset but moreover for its bodily properties, a lot like resistance to corrosion and shapely conductivity, which impress it considerable in electronics and technology.

It is broadly former in jewellery, contributing to merely about 50% of its world query, and is a vital ingredient of central bank reserves as a machine for economic balance.

Furthermore, gold’s universal recognition and restricted offer enhance its recognition as a respectable retailer of price.

Gold has prolonged been identified as a safe-haven asset someday of cases of enterprise turmoil, geopolitical instability, and market uncertainty. To illustrate, someday of the Eurozone Debt Disaster

Equally, in the 2008 World Financial Disaster, gold prices soared as stock markets plummeted, underscoring its skill to preserve wealth in cases of monetary stress. Right through the COVID-19 pandemic, gold reached file highs above $2,000 per ounce in 2020 as central banks worldwide adopted aggressive monetary policies. Gold’s plan as a refuge someday of world conflicts is extra exemplified by historical events a lot like World Warfare II. Its low correlation with stock markets is largely due to gold being influenced by macroeconomic factors—a lot like inflation, forex balance, and central bank query—rather then company earnings or investor sentiment.

Notably, Warren Buffett’s tender funding in Barrick Gold in 2020 highlighted how even prolonged-time skeptics of gold acknowledge its price someday of enterprise uncertainty.

Whether or now not someday of crises or as a portfolio diversifier, gold’s resilience makes it a cornerstone of monetary balance. Gold is identified for its low correlation with former sources, making it a life like hedge someday of market corrections or geopolitical events, a lot like the Eurozone Debt Disaster from 2010 to 2012. Its skill to preserve or amplify price in such scenarios has solidified its characteristic as a machine for wealth preservation someday of world monetary downturns.

Bitcoin vs Gold: Key Differences

Let’s examine the returns of BTC and gold:

|

Time body |

Gold |

Bitcoin |

||||

|

ROI |

Annualized Return |

ROI |

Annualized Return |

|||

|

|

33.0% |

33.0% |

124% |

124% |

||

|

|

55.51% |

15.67% |

154% |

34.22% |

||

|

|

87.03% |

13.26% |

1343% |

144.61% |

||

|

|

147.0% |

9.46% |

39929.51% |

57.43% |

||

Over the quick timeframe (1 to 3 years), Bitcoin outperforms gold with spectacular development, particularly in 2023. In inequity, gold shows extra constant, trusty development.

Over the very prolonged timeframe (5 to 10 years), Bitcoin’s returns far exceed these of gold, but its dramatic fluctuations impress it a better-possibility funding.

Gold, on the diverse hand, stays a stable, low-possibility asset with a trusty, predictable return, which appeals to extra conservative merchants. But in most popular years, BTC has stabilized as an asset.

Now, let’s examine gold and BTC on diverse parameters:

Retailer of Price

-

Gold has a

5,000-year historical previous as a retailer of price, continuously conserving its rate through diverse economic crises. As an illustration, someday of the 2008 monetary crisis, the price of gold surged as merchants sought refuge from stock market crashes. -

Bitcoin, most ceaselessly known as “digital gold,” shares this retailer-of-price allure but has key variations. Its restricted offer—capped at 21 million coins—makes it inherently scarce, in inequity to gold, which does now not derive a finite offer. This shortage is bolstered by Bitcoin’s deflationary have faith, with the final block projected to be mined around 2140. These attributes attract institutional merchants esteem MicroStrategy, which holds billions in Bitcoin to counter inflation dangers. Then all any other time, Bitcoin’s volatility—driven by speculative purchasing and selling, regulatory adjustments, and market sentiment—design it lacks the same constant balance as gold.

Scarcity and Offer Dynamics

-

Gold is scarce but continuously mined, with discoveries quiet being made. Then all any other time, regardless of these new mining operations, the realm’s gold offer increases most appealing incrementally every year, which supplies a natural steadiness between query and offer.

-

Bitcoin is strange due to its mounted offer cap of 21 million coins, which has change into a key driver for its prolonged-timeframe price proposition.

Portability and Divisibility

-

Gold is much less portable and divisible than Bitcoin. Transporting smooth amounts of gold is dear, and dividing gold can derive an impact on its purity and price.

-

Bitcoin is very portable and divisible. It is probably going you’ll well perchance presumably ship Bitcoin globally in minutes, and it goes to be divided into little fractions (Satoshis), making it accessible to miniature merchants.

Correlation with Outmoded Markets

Offer | Bitcoin’s declare correlation with the S&P 500, whereas gold’s impress actions live largely unaffected by broader market dispositions.

-

Gold in total has a low correlation with stock markets, most ceaselessly rising when equities decline. Right through the 2008 world monetary crisis, gold surged whereas stock markets crashed.

-

Bitcoin has shown a correlation with tech stocks and the broader market. Right through the COVID-19-brought on market sell-off in March 2020, Bitcoin fell in sync with equities. Extra honest now not too prolonged ago, Bitcoin’s impress actions derive mirrored these of the NASDAQ someday of cases of market optimism and possibility-taking.

Inclusivity and Accessibility

-

Gold is now not as with out plight accessible for miniature-scale merchants. Whereas central banks and smooth institutions preserve gold, folks in total must possess gold bars, coins, or ETFs, which advance with storage and security charges.

-

Bitcoin is very accessible and could well perchance even be sold by any individual with an web connection. Many platforms impress Bitcoin purchasing as easy as attempting to search out stocks, opening up entry to a world viewers, particularly in rising countries.

Law

-

Gold is well-regulated. Central banks control smooth reserves, and gold is traded on established exchanges. It has a prolonged historical previous of being integrated into the realm monetary system.

-

Bitcoin is field to evolving regulatory frameworks. In 2022, the U.S. authorities began to introduce extra clarity on crypto law, whereas countries esteem China derive banned it. Bitcoin’s decentralized nature makes it tougher to control, but governments are increasingly extra fascinated with control it.

Risks of Bitcoin

Despite all its promise, investing in Bitcoin too has its share of pitfalls, namely:

-

Regulatory uncertainty stays a field, as governments are quiet rising tips around its expend, taxation, and purchasing and selling, which could well perchance impact its impress and adoption.

-

Despite Bitcoin’s tough blockchain, security dangers, a lot like hacking, phishing, and theft from exchanges or wallets, moreover pose a menace.

Conclusion

Gold stays a respectable retailer of price, prized for its balance and resilience someday of enterprise downturns. With a proven historical previous of conserving price someday of recessions and geopolitical crises, gold is quiet a staple in diversified portfolios, providing merchants with security someday of unsure cases. Whereas its price rises with inflation and market volatility, gold is progressively much less vulnerable to snappy fluctuations than extra speculative sources.

Bitcoin, on the diverse hand, has change into a extra stabilized asset as institutional involvement increases. With rising enhance from key gamers esteem BlackRock, the rise of Bitcoin ETFs, and President Trump’s skilled-crypto stance, the market outlook seems bullish.

And regardless of its dangers, Bitcoin continues to evolve. With its mounted offer and decentralized nature, Bitcoin is increasingly extra viewed as an spectacular retailer of price and a hedge in opposition to inflation.

By idea the hazards and rewards of both Bitcoin and gold, merchants can tailor their portfolios to align with their possibility tolerance and prolonged-timeframe monetary objectives.

Nikhil Sethi

Director, Zuvomo

Twitter | LinkedIn