After capitulating on March 19, Bitcoin recovered on March 20. Nonetheless, while the crypto community expects extra rapidly beneficial properties, even above the all-time highs of spherical $73,800, Willy Woo, an on-chain analyst, thinks the coin will likely consolidate within the times forward.

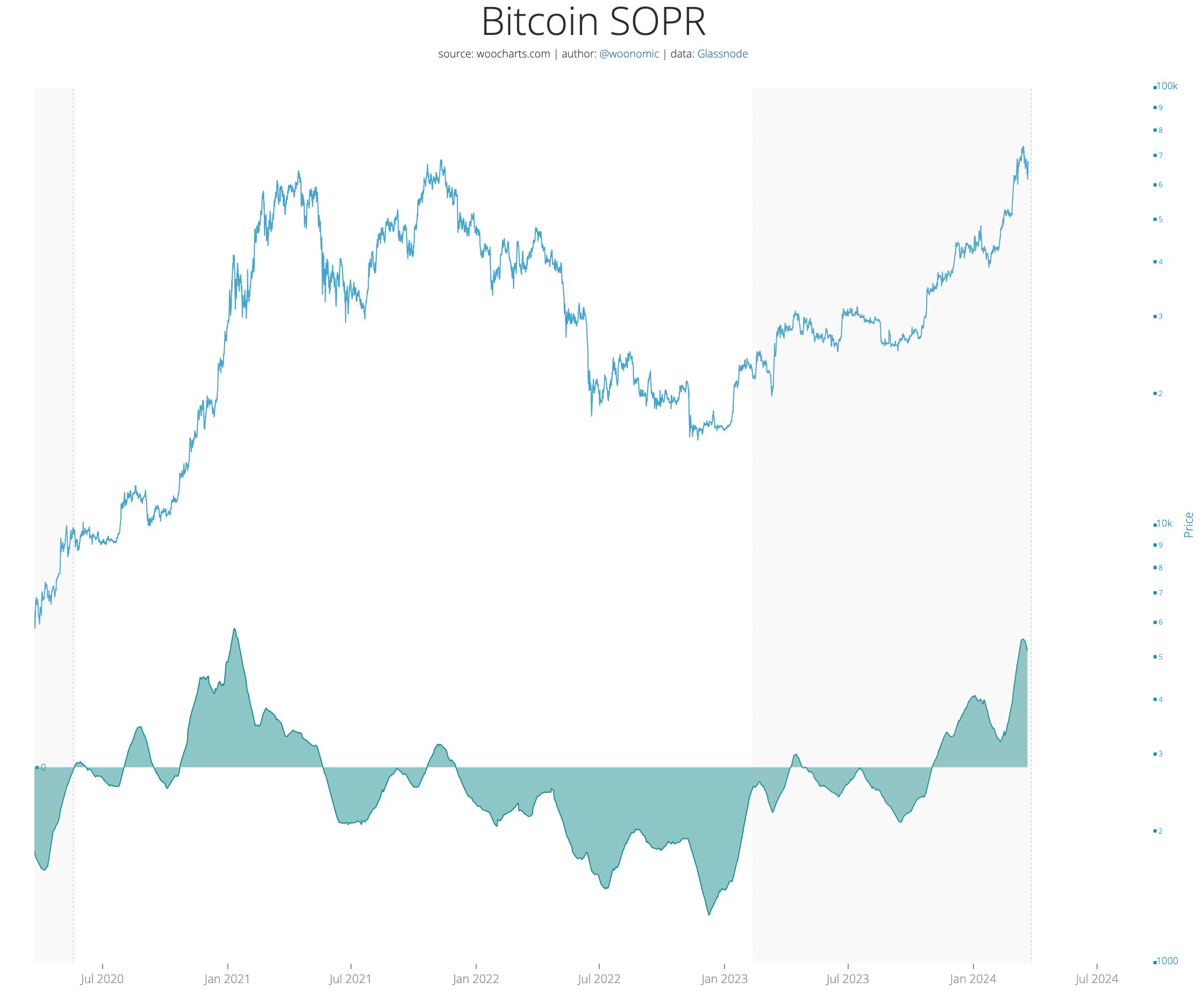

SOPR Peaked At An Unusually High Stage: Earnings-Taking?

Taking to X, Woo listed quite a lot of on-chain metrics, some of which, while supporting prices, are countered by others that will perhaps presumably unhurried down the uptrend. On the tip of the listing, the analyst notes how the Spent Output Earnings Ratio (SOPR) discovering out is printed out.

The SOPR is extinct to measure the profitability of Bitcoin transactions. When it is, it means that extra BTc being moved spherical are in green. Whereas this discovering out has risen within the past few trading weeks, the plot it peaked is a explain.

In Woo’s overview, there is probably going profit-taking since the SOPR peaked at an unusually “high stage.” Accordingly, profit-taking interprets to holders exiting, which plot promoting on the plight, presumably ensuing in a sideways consolidation.

Nonetheless, the analyst finds reasons for optimism. Namely, primarily the most up-to-date fall from the swing high, at spherical $73,800, changed into spherical 20%. This dip tends to be extra severe when put next to historical cycles and, extra importantly, earlier than halving.

The analyst acknowledged it fell by over 30% within the final cycle earlier than halving in 2020.

Additionally, the analyst views the present upward push in “Macro risk keep,” a metric that compares inflows to volatile asset prices love Bitcoin and crypto, as a sure keep. Even supposing it is rising and bullish, it can perhaps presumably also “freak out” customers, shaking out some earlier than prices rally to contemporary ranges.

Bitcoin To Consolidate, Altcoins To Pump?

What’s happening to Bitcoin could perhaps presumably also moreover affect altcoins and leverage merchants. Namely, the analyst thinks that altcoins will likely pump as Bitcoin consolidates in a technically bullish construction.

Even so, by Woo’s overview, the truth that leverage ratios on perpetual swap bets haven’t been reset plot merchants desires to be careful because of the expected volatility tagging keep modifications.

Whereas Woo is bullish, predicting seemingly uneven tag go in April, merchants are bullish. Brooding about primarily the most up-to-date wave of institutional search records from, Halving could perhaps presumably drive prices elevated within the upcoming sessions.

At the moment, BTC bulls bag reversed losses of March 19. The coin is trading above the 20-day transferring moderate. Optimistic merchants explore at $73,800 because the quick- to medium-length of time diagram.