Bitcoin (BTC) has all over over again surpassed the $100,000 label reaching an intraday high of $102,514, its first leap forward above this psychological level since mid-December 2024.

$103K Resistance Looms as Bitcoin Climbs to $102,514 Amid Quantity Spike

This most up-to-date bitcoin surge reflects solid bullish momentum, with investors stepping in decisively to drive prices elevated. The 1-hour BTC/USD chart signifies a each day uptrend with sure indicators of accumulation around the $97,000–$98,000 fluctuate, as evidenced by the consolidation zone seen earlier in the week.

Following this consolidation, BTC broke out with a solid upswing accompanied by a large spike in volume at precisely 9:54 a.m. Japanese Time (ET), pushing the worth past $100,000 and peaking at $102,514 by roughly 11:25 a.m. Ethical now, the $ninety nine,000–$100,000 fluctuate represents a solid set a question to zone, supported by fresh label motion and the amount profile.

If BTC retraces to this zone, it would possibly maybe probably also provide a favorable procuring opportunity for day traders, notably if accompanied by a confident and bullish candlestick pattern or a continuation in elevated trading volumes. The $103,000 via $103,500 level represents the quick resistance where promoting stress is extra seen.

Brief traders can also take dangle of partial profits around this level. For longer-time duration holders, monitoring label habits at $103,500—one other doable resistance level—can also support settle exits. The pass above $100,000 on Monday follows Microstrategy’s most up-to-date BTC aquire. The publicly listed commerce intelligence (BI) firm now holds 447,470 BTC.

The quantity spike right via the breakout above $100,000 and $101,000 is barely a bullish indicator. Nonetheless, the four-hour and one-hour charts also reflect minor overextension, suggesting a that you will possible be capable to be capable to mediate brief-time duration pullback or consolidation sooner than extra upward movement. This took build after the intraday peak. Momentum-pushed traders can dangle to note carefully for confirmations above $103,000 to be certain that persisted bullish strength.

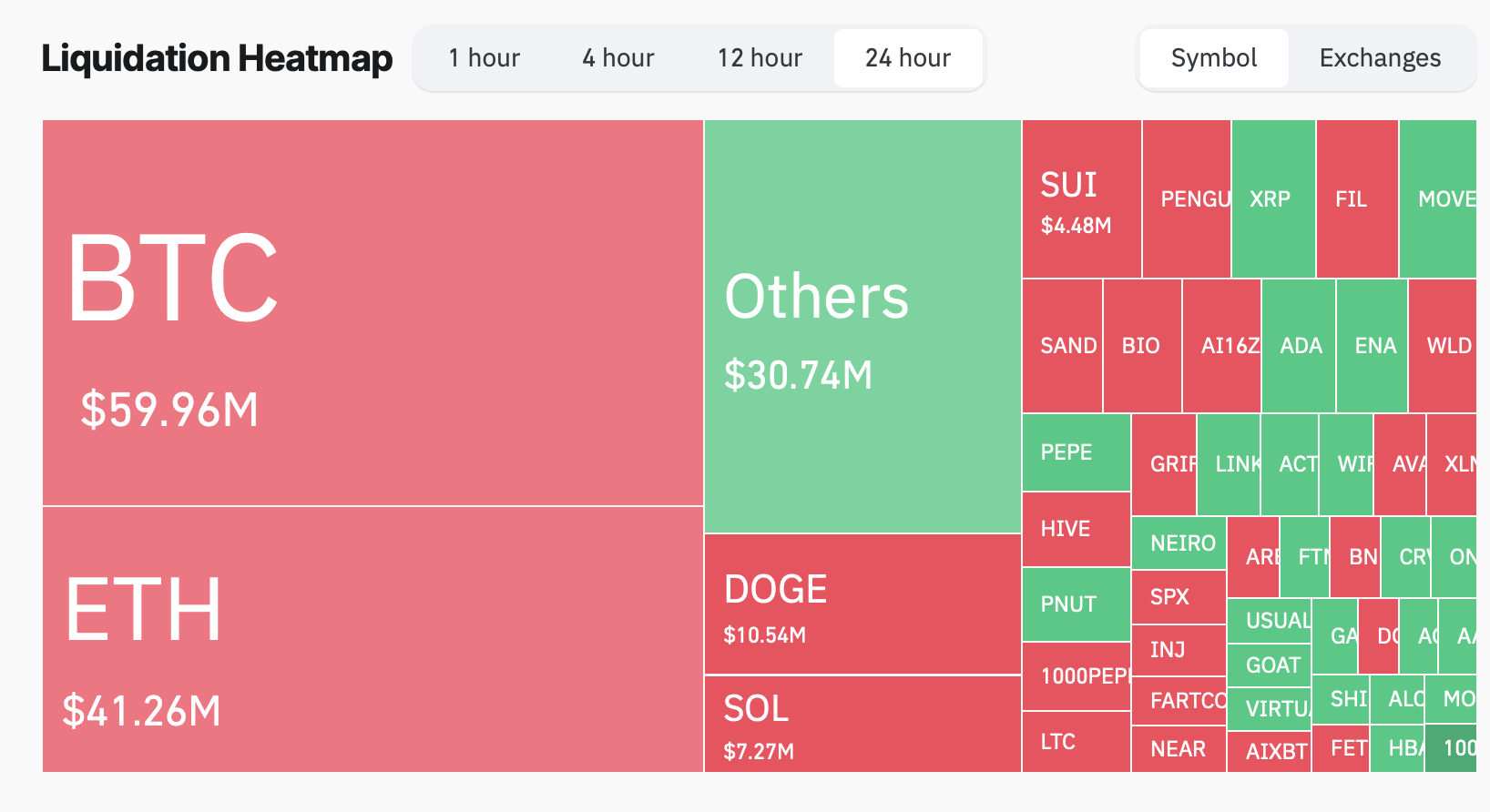

Bitcoin’s spoil above $100K this week reflects renewed market optimism and solid procuring hobby. Strategic entries diagram reinforce stages and vigilant monitoring of resistance zones will possible be necessary for navigating bitcoin’s dynamic label motion. Over the 24 hours, $48.13 million in bitcoin brief positions dangle been liquidated, because of the BTC’s swift label upward thrust starting at 10 a.m. As of 1:30 p.m. ET, around 74,997 traders dangle been liquidated right via the closing 24 hours right via the full crypto derivatives markets.