On-chain knowledge reveals a chunk of the Bitcoin provide has its value foundation above the fresh place trace, which would possibly perhaps presumably potentially form volatility if BTC rebounds.

Bitcoin Offer Overhang May perchance perchance perhaps perhaps Dictate Volatility & Selling Strain

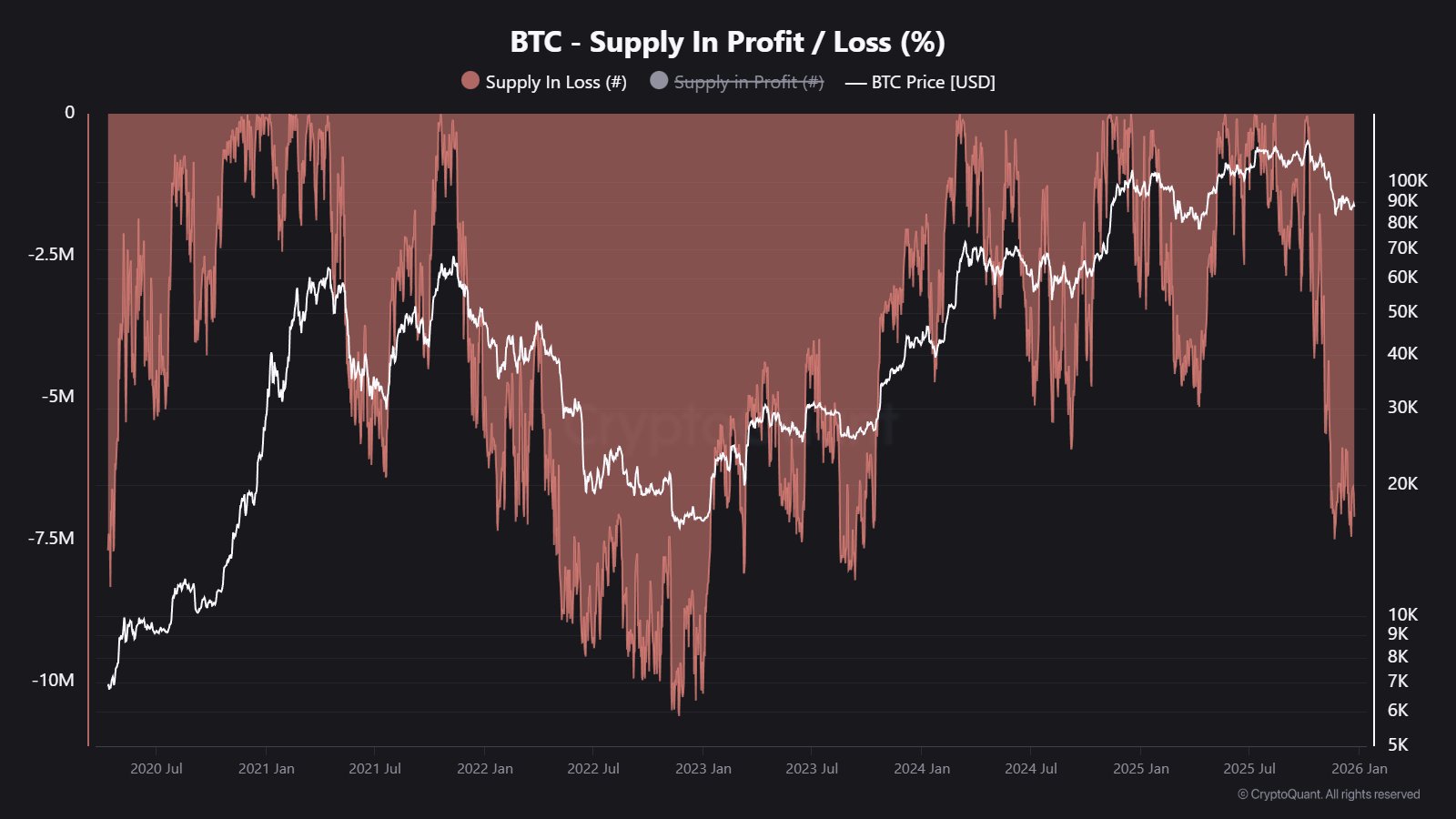

As identified by CryptoQuant community analyst Maartunn in a brand modern post on X, over 6.6 million BTC is being held above the latest place trace of the cryptocurrency. The on-chain indicator of relevance here is the “Offer In Loss,” which measures, as its name suggests, the overall quantity of Bitcoin that’s for the time being carrying some catch unrealized loss.

The metric works by going by the transaction historic past of every and each token in circulation to receive out the value at which it became final transacted on the blockchain. If this outdated transfer trace became more than the fresh place trace for any coin, then that individual token is truly apt to be in a verbalize of loss.

The Offer In Loss adds up all coins dazzling this situation to receive the overall dispute on the community. A counterpart indicator known as the Offer In Profit accounts for the provision of the opposite kind.

Now, here is the chart shared by Maartunn that reveals the pattern within the Bitcoin Offer In Loss over the final few years:

As displayed within the above graph, the Bitcoin Offer In Loss lowered in size to a value of zero because the asset’s trace self-discipline its all-time high (ATH) above $126,000 abet in October, nevertheless with the market downturn that has followed since then, the indicator’s value has shot up.

This day, around 6.6 million tokens of the cryptocurrency sit below value foundation, connected to a Third of the BTC provide in circulation. The fresh highs within the Offer In Loss signify the very supreme degree of difficulty on the market since 2023.

In one other X post, the analyst has shared the chart for one other Bitcoin indicator, this one known as the UTXO Realized Label Distribution (URPD). The URPD contains details about how noteworthy BTC became purchased final at each and each of the stages that the asset has visited in its historic past.

Looks love a foremost piece of the provision sits above the place trace | Offer: @JA_Maartun on X

From the chart of the URPD, it’s considered how the Bitcoin provide that’s in loss is allotted across the many stages correct now. A pair of stages are in particular prominent within the degree of provide that they invent, while some others are notably skinny with coins.

On the entire, investors who’re in loss ogle forward to a retest of their value foundation so that they’ll gain their money “abet.” Once this happens, some of those arms mediate to exit, fearing that BTC will lunge down again within the advance future. This promoting can influence dapper provide clusters above the place trace, skill aspects of volatility.

Brooding about that a dapper piece of the provision is underwater correct now, a venture abet to bigger stages would possibly be met with promoting stress for Bitcoin.

BTC Label

Bitcoin has made some restoration throughout the past day as its trace has returned to $88,600.