Bitcoin

hovered reach $118,348 on Sunday, up 0.39% in 24 hours, as two analysts outlined paths that may perhaps well check merchants’ nerves: a dip in direction of $108K–$112K or a drawn-out vary with room for altcoins.

Lark Davis argues that if bitcoin continues to glide, the in all likelihood touchdown zone is $108,000–$112,000. That vary served as a ceiling earlier this 365 days when bitcoin’s rally stalled, and in market psychology, levels that after blocked place in most cases flip into crimson meat up when revisited.

He emphasizes that this home furthermore aligns with two classic pullback checkpoints identified as the 50% and 61.8% Fibonacci retracements. These measures, drawn from the scale of bitcoin’s very finest rally, are extensively watched because they in most cases place where profit-taking slows and unusual buying emerges. While Fibonacci ratios sound mathematical, in apply they work as self-satisfying markers since many merchants belief entries there.

Davis furthermore ingredients to the 20-week exponential transferring common, a vogue line that updates swiftly with most recent place action. When this line is rising into the identical $108K–$112K home, it strengthens the case for crimson meat up, because technical merchants explore every history and momentum assembly in a single zone.

When a total lot of signals cluster fancy this — resistance became crimson meat up, Fibonacci checkpoints and a rising common —merchants call it “confluence,” and confluence zones in most cases act fancy magnets for place exams.

In other words, Davis isn’t predicting collapse however a wholesome reset. His framework means that if bitcoin dips, merchants may perhaps well step in around that band and gas the next leg higher.

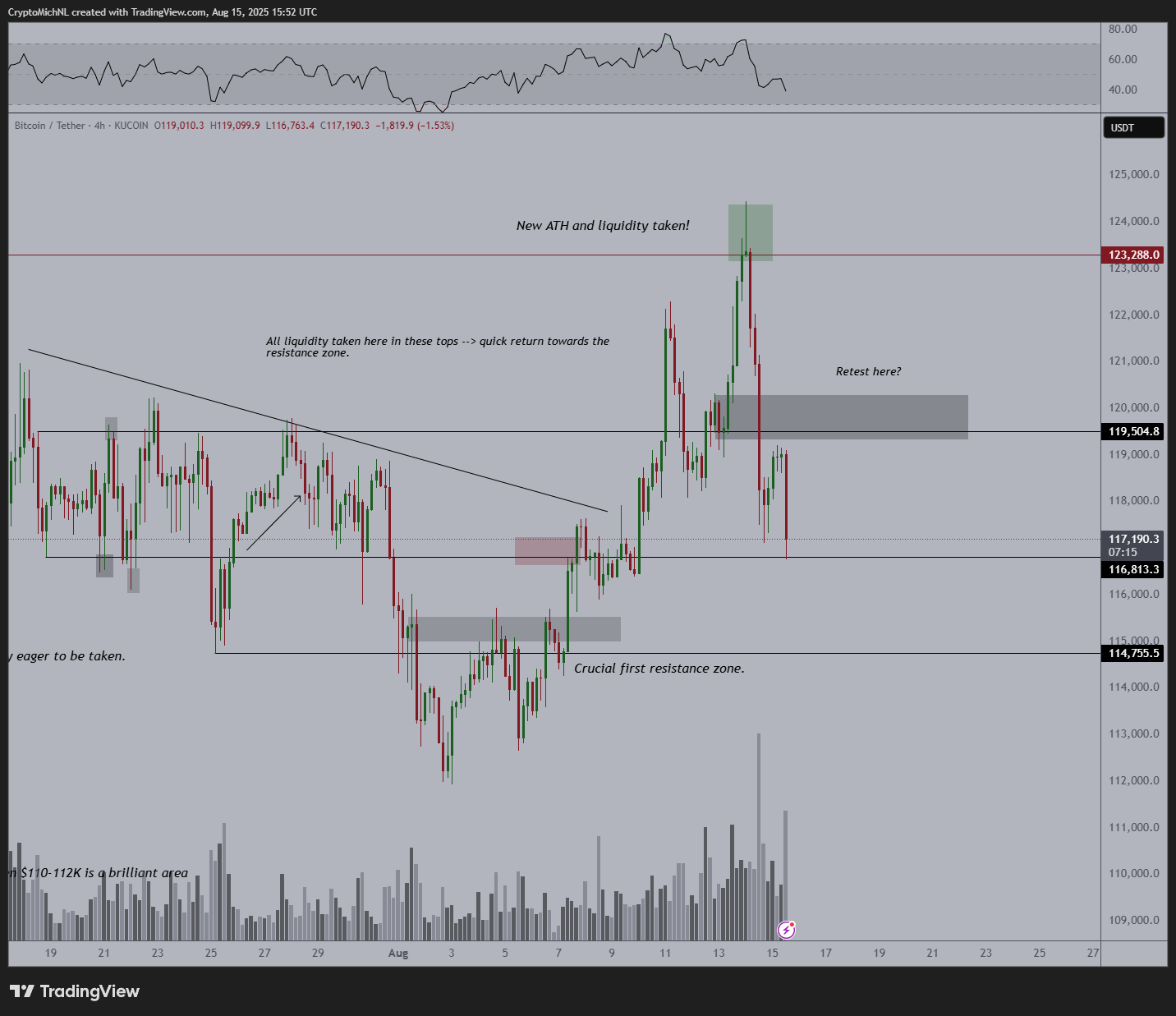

Michaël van de Poppe takes a clear angle, noting that bitcoin became upright rejected at a key resistance level reach its most recent highs. A rejection capacity sellers absorbed request as the price tried to spoil out, a general signal that momentum wants to chill off earlier than the next push. He expects the market to consolidate as opposed to vogue, with bitcoin transferring sideways between a ground and a ceiling while leverage resets.

The TradingView chart he shared underscores this. It confirmed bitcoin making repeated attempts at the pause of its vary however failing to preserve above resistance. The candles shaped wicks —place spikes that swiftly weak — suggesting promoting stress became filled with life reach the highs. Underneath, the chart marked a zone of capacity crimson meat up, where Van de Poppe believes bitcoin may perhaps well rating a depraved earlier than one other breakout strive.

For van de Poppe, the message is now no longer about deep retracement however time. A sideways vary would give the market respiratory room, definite out overextended positions, and method the stage for the next pass up. It would furthermore delivery the door to rotation into altcoins, which in most cases outperform when bitcoin stops trending.

That rotation, he suggests, may perhaps well already be brewing. Once bitcoin stabilizes, merchants in most cases glance higher returns in natty altcoins fancy ether earlier than spreading to smaller tokens. Altcoin rallies hardly ever ever delivery up while bitcoin is in freefall, however they in most cases safe momentum when BTC ranges and volatility cools.

In ugly terms, the two analysts are describing varied however appropriate playbooks. Davis favors a deeper pullback into a crimson meat up cluster that may perhaps well refresh the uptrend, while van de Poppe sees a vary-trail pause with capacity for altcoins to shine.

For every day readers, the pointers is straightforward: eye whether bitcoin trades sideways or dips to the $108K–$112K zone. In both case, analysts agree the broader bull market framework stays intact, however the glide forward may perhaps well behold very varied reckoning on how crimson meat up and resistance play out within the weeks forward.

Technical prognosis highlights

- Per CoinDesk Analysis’s technical prognosis data model, Bitcoin confirmed bullish energy within the 24-hour window from Aug. 16, 15:00 UTC to Aug. 17, 14:00 UTC, rising from $117,847.02 to $118,485.32, a 1% safe.

- Pork up shaped reach $117,261.72 early on Aug. 17, followed by a spoil above $118,000 with higher-than-common volume of 2,848.15 BTC within the route of rallies at 04:00, 08:00, 09:00, and 13:00 UTC.

- In the final hour from Aug. 17, 13:17–14:16 UTC, bitcoin climbed from $118,165.31 to $118,397.67, in conjunction with a nice looking pass at 13:51–13:52 UTC when place spiked from $118,417.23 to $118,604.10 on 679.81 BTC of volume.

- The pass method non eternal resistance around $118,600 earlier than consolidating reach $118,400, leaving capacity for additonal upside after cooling.

Disclaimer: Parts of this text had been generated with the the abet of AI instruments and reviewed by our editorial crew to safe decided accuracy and adherence to our standards. For extra data, explore CoinDesk’s fat AI Coverage.