Saifedean Ammous, creator of The Bitcoin Customary, told his 319,200 followers on X (formerly Twitter) that a family member brought up the level that Bitcoin outperforms the investments the financial handbook suggests, prompting the handbook to confess that he merely sells programs.

Then again, the financial handbook confessed that he in my belief prefers investing in Bitcoin.

Bitcoin Customary Creator Questions Monetary Advisor Bitcoin Reluctance

In a up to date X submit, Ammous recounted the response the financial handbook gave to his cousin when puzzled about venerable financial funding programs, declaring that Bitcoin surpasses them all and “doesn’t necessitate any costs or vigorous management.”

“Monetary handbook: Apt level. To be correct, that’s what I discontinue with my absorb money, then again it’s my job to sell these programs.”

Extra than one replies flooded the submit, including one X one who confessed to being expelled from several financial advisory Facebook teams merely for declaring Bitcoin.

Any other X person published that this was as soon as the principle keep off of their departure from the financial advising occupation. They expressed their reluctance to imply products they knew were not as high-performing as Bitcoin, citing a resolve on to preserve ethical integrity.

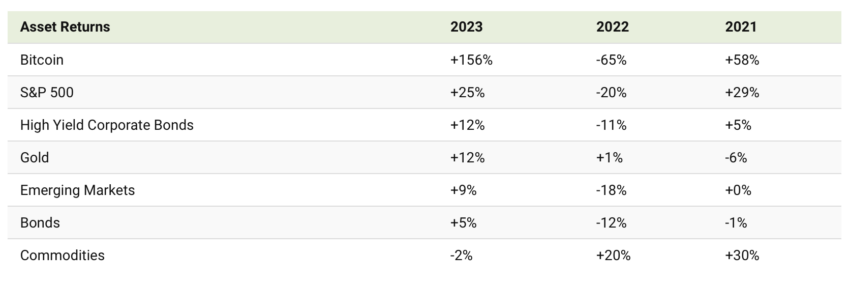

BeInCrypto recently reported Bitcoin’s outperforming outcomes in contrast to other world sources. On an annual foundation, in bullish years, BTC generated earnings ranging from 37% (2015) to as powerful as 5516% (2013).

Despite experiencing a fundamental downturn in 2022, even handed one of many worst undergo markets for the crypto industry, Bitcoin continues to outperform with its moderate annual returns.

Consultants Forecast Persevered Increase in Bitcoin Returns

Crypto analysts foresee no indicators of Bitcoin slowing down by methodology of its returns anytime quickly.

On February 22, BeInCrypto reported that Bitcoin expert Max Keiser predicts a surge in Bitcoin cost beyond $500,000.

This comes as he foresees a US stock market shatter of remarkable scale such as the unhurried Eighties.

In step with Keiser, the market is overripe for a correction. He cited records from The Kobeissi Letter, exhibiting a being concerned concentration in top stocks not viewed for the reason that Substantial Unhappy. This indicators a market teetering on the threshold.

Disclaimer

In adherence to the Have confidence Mission pointers, BeInCrypto is committed to unbiased, clear reporting. This records article aims to offer appropriate, well timed files. Then again, readers are educated to evaluate facts independently and focus on to a talented sooner than making any choices consistent with this voice. Please demonstrate that our Terms and Conditions, Privateness Policy, and Disclaimers were up so a ways.