US particular person label data came out on Monday, Can even simply 15. The core particular person label index (CPI), which measures underlying US inflation, elevated lower than anticipated in April. It climbed 0.3% from March, marking the first time in six months.

This resolve suggests a doubtless downtrend in inflation, raising hopes for a future Federal Reserve hobby fee slit.

Crypto Market Rebounds as US Inflation Slows, nonetheless Will It Glorious?

Yet, Fed officials want more data forward of indignant about fee cuts. On Tuesday, Fed Chair Jerome Powell acknowledged the central financial institution will “ought to wait and see and let restrictive policy elevate out its work.” Moreover, some policymakers elevate out no longer behold fee cuts taking place this yr.

Despite this, the inflation files boosted optimism in financial markets, in conjunction with crypto. Bitcoin’s (BTC) label jumped from $62,000 to $66,000, a roughly 7% amplify in 24 hours.

Essential altcoins furthermore experienced important gains, with Ethereum (ETH) and Solana (SOL) rising by 4.4% and 12.3%, respectively. As a result, the total cryptocurrency market capitalization expanded by 6.7%, reaching $2.5 trillion, in response to CoinGecko data.

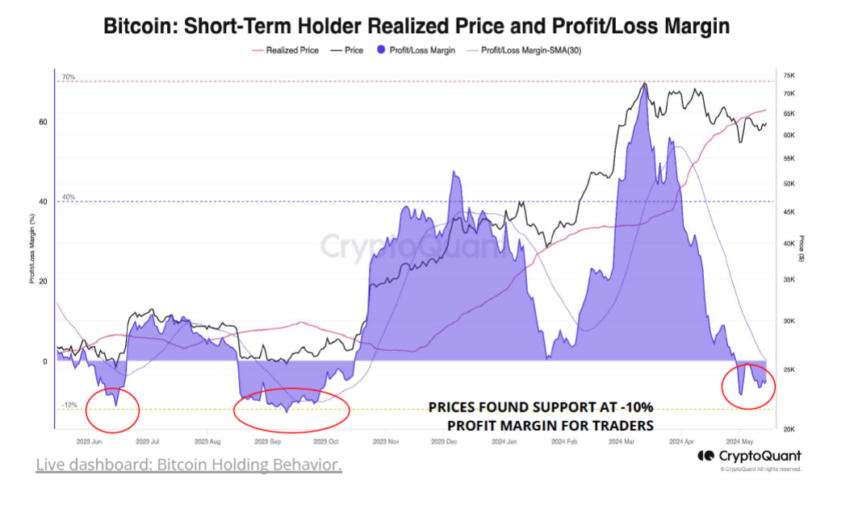

Analysts imagine factors along with easing US inflation furthermore influenced Bitcoin’s contemporary rally. CryptoQuant analysts behold that “lower selling stress” contributed to the topic.

“Lower selling stress [is] evident in transient Bitcoin holders selling at in overall zero income and traders depleting their unrealized earnings in the previous couple of months. [Furthermore], Bitcoin balances at [over-the-counter] OTC desks stabilizing, which capacity there may perhaps be much less Bitcoin provide coming into the market to sell by capacity of these entities,” they informed BeInCrypto.

Then again, put a query to development needs to speed for the rally to be sustainable. While there are indicators of elevated put a query to from long-period of time holders and monumental traders, it needs to secure sprint. Moreover, CryptoQuant analysts illustrious that quandary Bitcoin alternate-traded fund (ETF) purchases remained minimal, and stablecoin liquidity development had but to make stronger.

Moreover, Bitcoin’s label remains undervalued from a miner’s profitability perspective. Following the Bitcoin halving tournament in leisurely April 2024, miners’ rewards were halved, striking financial stress on them. Historically, extremely low miner profitability is frequently related to label bottoms, suggesting doable for future development.

Overall, analysts and business consultants stay bullish on Bitcoin’s long-period of time trajectory. Because the crypto market continues to evolve, macroeconomic stipulations, regulatory traits, and political factors will play crucial roles in shaping its future.