Data reveals that a Bitcoin indicator has no longer too lengthy previously fashioned a sample that has proved to be pretty bullish relating to the cryptocurrency’s tag.

Bitcoin Coinbase Top class Index Has Crossed Above Its 14-Day SMA

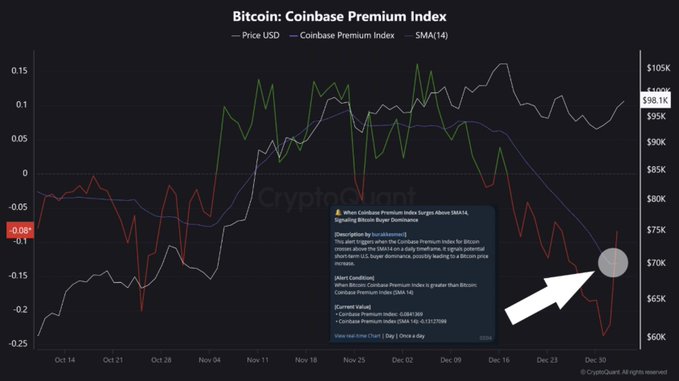

In a brand novel submit on X, the on-chain analytics agency CryptoQuant has discussed a sample that has no longer too lengthy previously fashioned in the Bitcoin Coinbase Top class Index. The “Coinbase Top class Index” is a trademark that retains computer screen of the proportion distinction between the Bitcoin tag listed on Coinbase (USD pair) and that on Binance (USDT pair).

This indicator is efficacious for determining how the purchasing for or selling behaviors vary between the userbases of the 2 cryptocurrency change titans. Obvious values indicate the customers on Coinbase are purchasing for at a elevated payment or selling at a lower payment than the ones on Binance. In the same diagram, negative values indicate that Binance customers possess pushed the BTC tag elevated than on Coinbase.

Now, here is the chart shared by the analytics agency that reveals the pattern in the Bitcoin Coinbase Top class Index, besides its 14-day straight forward transferring average (SMA), over the closing few months:

As displayed in the above graph, the Bitcoin Coinbase Top class Index plunged below its 14-day SMA and into the crimson territory closing month. The cryptocurrency’s tag plummeted alongside this challenge into the negative zone for the indicator, suggesting the shift in the metric took place no longer due to Binance customers purchasing for more, but pretty due to Coinbase traders taking to selling.

The exercise of Coinbase customers, who’re predominantly from the US, has in actual fact played a key role in BTC tag action this twelve months, with the asset’s tag on the entire finding itself closely mimicking the pattern in the Coinbase Top class Index. Thus, it’s no longer dazzling to occupy that these traders had been the drivers for the hot shatter as successfully.

From the chart, it’s considered that customers on the change continued to sell into the novel twelve months, but in the route of the closing few days, the metric has at closing confirmed a reversal. With this surge, its tag has crossed reduction above the 14-day SMA, potentially implying a return of momentum in the market.

CryptoQuant has pointed out that the closing time the cryptocurrency showed a identical pattern was once reduction in November. Following this outdated crossover, the indicator noticed a damage into the sure situation, alongside which Bitcoin loved a rally from the $69,000 stage to the novel all-time high of $108,000.

It now stays to be considered whether or no longer here is the starting up of a recent wave of buying for from American traders and if it’s miles also equally bullish for BTC this time as successfully. Signs had been taking a look sure to this level, as the asset has witnessed recovery above the $100,000 tag for the explanation that crossover looked.

BTC Model

On the time of writing, Bitcoin is buying and selling at spherical $100,900, up over 7% in the closing week.