- Bitcoin hits $109K amid five weeks of rating alternate outflows totaling $920 million.

- Bitcoin ETFs contain $138B AUM with high trading volumes and low expense ratios.

- Designate upward push from $50K to $110K aligns with sustained outflows and holder accumulation.

Bitcoin’s value has surged previous $109,000, supported by fixed outflows from exchanges and titillating trading all during the Bitcoin ETF market. Recordsdata from early July 2025 exhibits a fifth consecutive week the effect Bitcoin experienced rating withdrawals from exchanges, signaling a shift in asset custody. This pattern aligns with rising transaction charges and proper ETF market capitalization, exhibiting elevated investor engagement at some level of multiple fronts.

BTC recorded its fifth consecutive week of rating outflows from exchanges, basically pushed by flows into effect of dwelling ETFs pic.twitter.com/k7oSvXBwwt

— Sentora (previously IntoTheBlock) (@SentoraHQ) July 4, 2025

Most contemporary figures reveal that Bitcoin exchanges contain considered rating outflows totaling $920 million. This signals a sustained sample the effect holders are transferring BTC off exchanges into deepest wallets. Such behavior could maybe perhaps well counsel a necessity for long-time length storage as a replacement of fast promoting, as sell pressure on exchanges seems to be to be reducing. The upward push in community charges, which contain risen by 13.8% to $3.86 million, additionally indicates heightened transaction quantity and exercise on the Bitcoin blockchain.

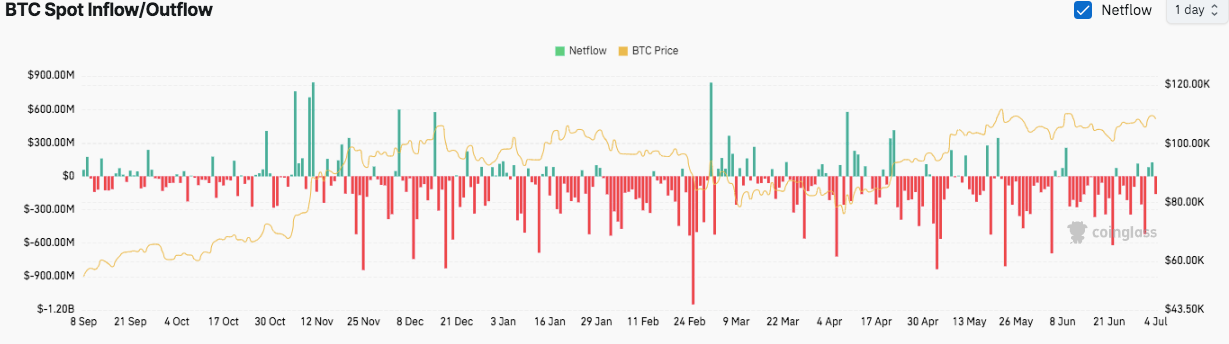

Historical whisk with the spin info suits this sample, with wise outflows coinciding with Bitcoin value surges. Necessary peaks in outflows passed off in slack November, mid-February, and April, sessions that additionally marked BTC value rallies. In disagreement, inflows onto exchanges occur less commonly and are inclined to spike at some level of value corrections or consolidations, maybe reflecting temporary trading or earnings-taking exercise.

Bitcoin ETF Market Stays Sturdy

The Bitcoin ETF market continues to narrate wise scale and liquidity. The whole market capitalization for all listed Bitcoin ETFs is reported at $138.35 billion, matched by sources below administration (AUM) of $138.09 billion. Trading volumes remain high, with $2.63 billion recorded at some level of the market.

Leading the sphere, the iShares Bitcoin Have faith (IBIT) maintains an AUM of $76.31 billion and holds the very top trading quantity of $2.04 billion despite a runt value decrease of 0.37% to $62.19. The Constancy Practical Origin Bitcoin Fund (FBTC) holds $21.35 billion in sources and trades with a quantity exceeding $150 million. The Grayscale Bitcoin Have faith ETF (GBTC) retains a market cap of $20.15 billion, with a up to date value of $86.07, albeit with a minor decline of 0.42%.

The absolute top turnover rate of 5.34% implies that ProShares Bitcoin ETF (BITO) has a rather titillating spirit to alternate out of the full ETFs. Among the many ETFs, the moderate expense ratios are 0.20-0.25% with GBTG having a rate of 1.50%.

The value of Bitcoin has been increasing since September 2024 when it became once priced at about $50,000 at one moment to over $110,000 in early July 2025. Such expansion is linked to continued outflows on exchanges, that could maybe perhaps well decrease liquidity that could maybe perhaps well additionally be inclined in trading and abet assemble upward value pressure. Each day inflow and outflow numbers ascertain that spikes in inflows will on an everyday basis occur but the rating get will serene have a tendency toward rating outflows, in favor of holders’ accumulation.