- Bitcoin’s $86.8K designate basis has change precise into a severe stage for market strikes and investor self belief.

- Immediate-duration of time holders preserve earnings with the MVRV ratio at 1.08, indicating resilience amid designate volatility.

- Analysts agree with breaking above or below $86.8K will strongly influence Bitcoin’s next designate direction.

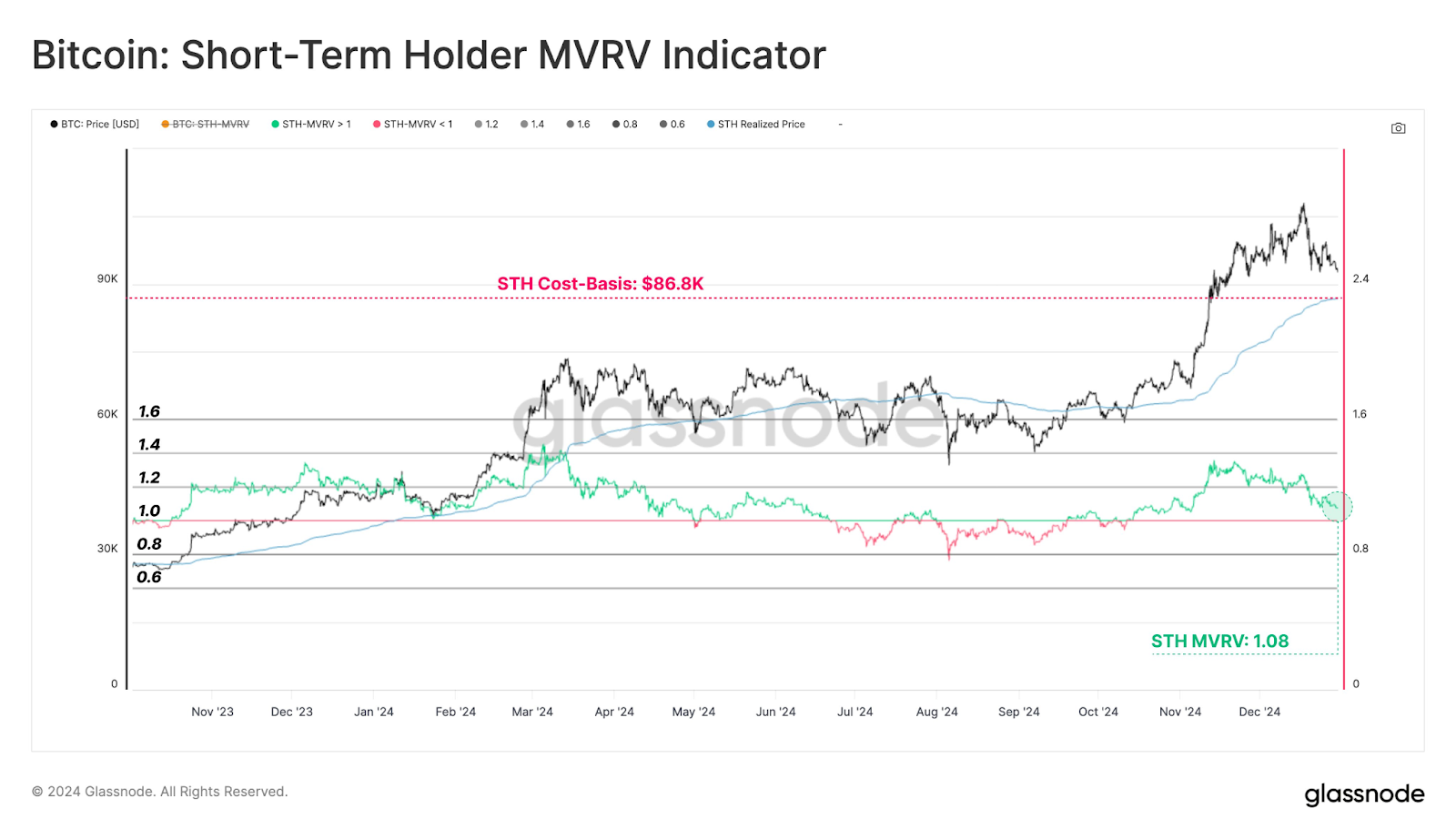

Bitcoin rapid-duration of time holders are securing sensible unrealized earnings of seven.9% despite the cryptocurrency’s present designate volatility, per Glassnode records. The Immediate-Time frame Holder Market Set to Realized Set ratio for the time being stands at 1.08. Meanwhile, the favored designate basis for these investors is $86.8K, which has change precise into a key stage in shaping Bitcoin’s native momentum.

Offer: Glassnode

Immediate-Time frame Holder Profitability and MVRV Insights

The STH-MVRV ratio of 1.08 reflects that most rapid-duration of time holders dwell in profit despite market declines. A ratio above 1.0 signifies unrealized beneficial properties, whereas a designate below marks capability losses for holders. This metric, at its present stage, shows that rapid-duration of time holders are tranquil confident about Bitcoin’s medium-duration of time capability.

Bitcoin has skilled though-provoking designate movements all twelve months lengthy, hiking to almost $90K at its top. Nonetheless, the present correction has viewed costs retreat closer to severe technical ranges. The interplay between the STH-MVRV ratio and realized designate suggests that rapid-duration of time investors are navigating the market with warning nevertheless dwell optimistic.

$86.8K: The Key Set Foundation for Bitcoin’s Set Momentum

The rapid-duration of time holder designate basis of $86.8K has change precise into a severe designate stage that influences trader choices and market behavior. Traditionally, such thresholds act as accurate resistance or give a boost to zones precise by sessions of heightened volatility. Analysts at Glassnode highlight that a designate tumble below this stage could well per chance lead to increased promoting stress, doubtlessly pushing costs decrease.

If costs dwell above $86.8K, it will maybe per chance per chance presumably present stronger purchaser passion and affords a boost to a capability bullish recovery. This designate basis also reflects the collective market self belief of rapid-duration of time holders, making it regarded as one of primarily the most-watched ranges within the market criminal now.

Market Context and Immediate-Time frame Traits

The MVRV chart showcases profitability bands ranging between 0.6 and 1.6, providing insights into Bitcoin’s rapid-duration of time holder trends. A designate shut to 1.0 represents a breakeven level for holders, whereas movements above this stage trace sustained profitability. The present ratio of 1.08 shows cautious optimism, though merchants dwell vigilant about capability designate fluctuations.

Glassnode analysts emphasize the significance of monitoring these metrics intently, because the interplay between MVRV, designate basis, and realized designate presents severe insights. These metrics will continue to shape Bitcoin’s rapid-duration of time market trends and investor self belief.