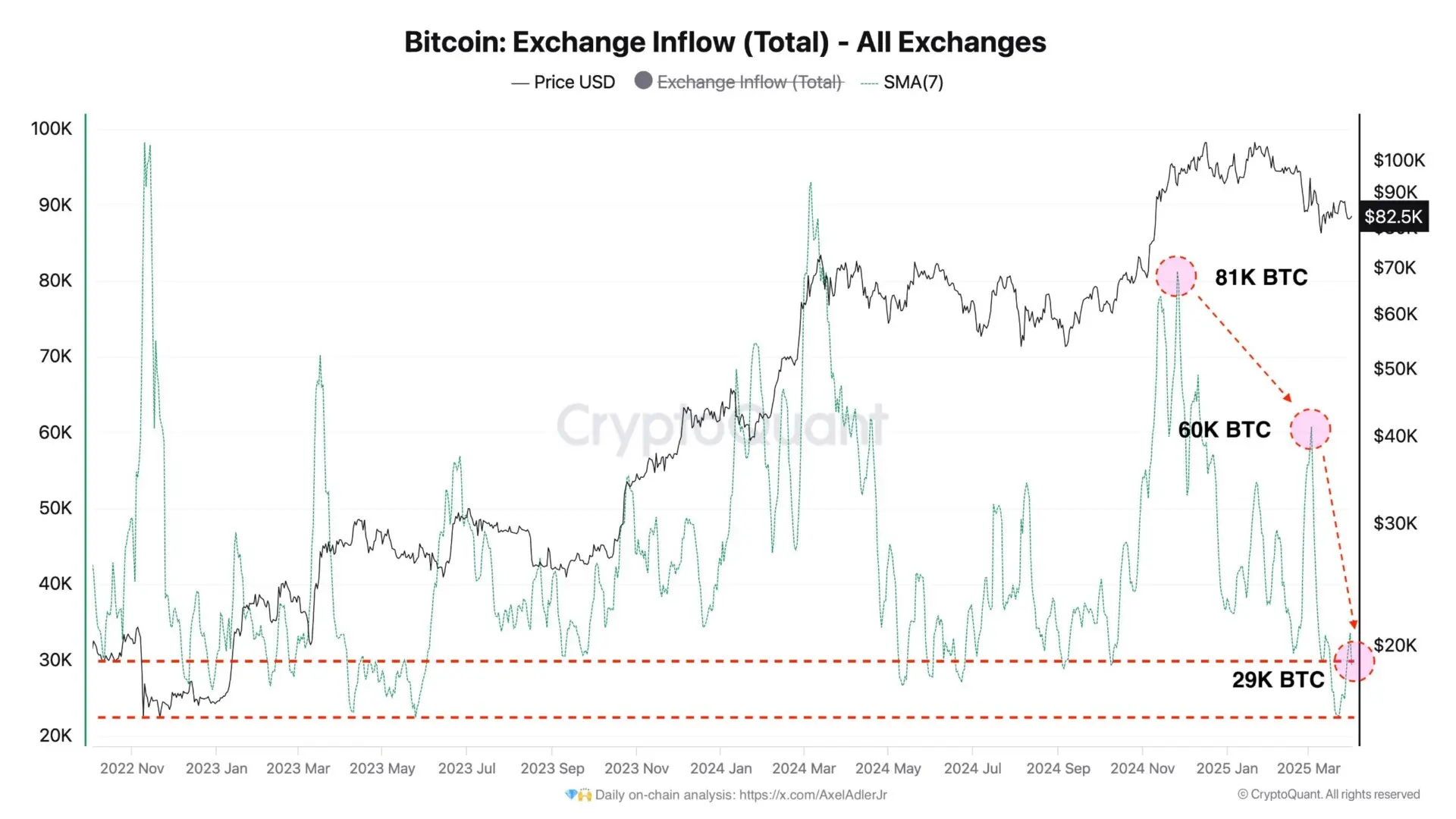

On-chain knowledge from CryptoQuant printed that the moderate Bitcoin promoting stress on prime exchanges has plummeted from 81K to 29K BTC per day. The analytics firm confirmed that Bitcoin sellers had dried up, and traders looked gay with most contemporary mark stages.

CryptoQuant analyst ShayanBTC moreover worthy that BTC reserves on exchanges are rapid reducing. The analyst argued that a decline in replace reserves might per chance per chance perchance per chance station the stage for a supply shock-pushed mark rally, reversing Bitcoin’s most contemporary downtrend.

Bitcoin promoting stress reduces nearing search recordsdata from

The standard promoting stress on prime exchanges has dropped from 81K to 29K BTC per day.

Welcome to the zone of asymmetric search recordsdata from.

The market has successfully absorbed waves of profit-taking following the spoil above $100K.

Sellers be pleased dried up, and traders seem gay with… pic.twitter.com/mgzrCacMMq— Axel 💎🙌 Adler Jr (@AxelAdlerJr) April 1, 2025

CryptoQuant knowledge confirmed the moderate promoting stress on prime exchanges has dropped from 81K to 29K BTC per day. The analytics firm urged that Bitcoin is nearing the zone of asymmetric search recordsdata from as BTC replace inflows manner 2-year low.

Macro researcher at CryptoQuant Axel Adler argued that the digital asset market had successfully absorbed waves of profit-taking following its spoil above $100K. Adler moreover urged that sellers had dried up, and traders looked gay with most contemporary mark stages. He believes that BTC’s most contemporary stage has station the stage for a structural supply shortage.

On-chain knowledge confirmed that Bitcoin is currently exchanging palms at $84,357 on the time of e-newsletter, a 3.5% magnify within the splendid 24 hours. BTC moreover recorded a each day volume of $27.3B, a 37.55 magnify within the past 24 hours.

Adler moreover argued that April to Could per chance perchance moreover might per chance per chance perchance per chance become a consolidation zone, “a restful earlier than the next impulse.”

CryptoQuant analyst Ibrahimcosar posted on March 28 that Bitcoin will most most likely be on the verge of a vital mark rally. He worthy that since February 6, the digital asset has experienced a persistent detrimental bag float across shopping and selling platforms.

The analyst argued that after an incredible amount of BTC is withdrawn from exchanges, it usually implies that traders are staring at for a mark rally. He believes that traders transfer their holdings to cool wallets in anticipation of long-term gains and pay network fees to secure their assets. Ibrahimcosar acknowledged that the habits finally ends up in a detrimental bag float of BTC across exchanges, which is a bullish indicator.

“Historically, such excessive outflows be pleased resulted in vital mark increases in Bitcoin. This means that market volatility to the upside will most most likely be on the horizon.”

–Ibrahimcosar, analyst at CryptoQuant.

Crypto investment merchandise file obvious inflows

On-chain knowledge from CoinShares moreover worthy that Bitcoin drew roughly $195 million in inflows splendid week. The firm moreover acknowledged that BTC seen $2.5 million in outflows for the fourth consecutive week, which urged that bearish bets be pleased been fading.

The analytics firm moreover confirmed that altcoins posted a essential turnaround, with $33 million in inflows after four consecutive weeks of outflows totaling $1.7 billion. Ethereum led with $14.5 million inflows, adopted by Solana with $7.8 million, and XRP and Sui with $4.8 million and $4M inflows, respectively.

CoinShares maintained that it marked essentially the most important week of obvious flows for digital assets in over a month, which highlighted renewed self belief within the sector. The firm moreover printed that world crypto investment merchandise recorded $226 million price of bag inflows splendid week.

CoinShares Head of Research James Butterfill argued in a Monday file that the 2nd consecutive week of inflows urged a “obvious but cautious” investor. He moreover worthy that ETPs had seen 9 consecutive shopping and selling days of inflows, splendid Friday being the exception after recording outflows totaling $74 million. Butterfill believes it became likely in reaction to core deepest consumption expenditure within the U.S. coming in above expectations. He added that the industrial knowledge implied the Federal Reserve became likely to remain hawkish regardless of most contemporary knowledge alluding to frail progress.

Research analyst Ryan Lee mentioned that President Trump’s proposed tariff hikes including a 25% levy on Mexican and Canadian goods efficient April 2 – had resumed replace warfare anxieties. Lee argued that such protectionist measures trigger probability aversion across asset classes, “and crypto has no longer been immune.”

Butterfill moreover printed that Bitcoin ended up falling round 6% at some stage within the last week and essentially the most contemporary mark falls had pushed world BTC investment merchandise’ total assets beneath administration to their lowest stage for the reason that U.S. presidential election in November at $114 billion.

CoinShares knowledge moreover confirmed that U.S. traders led domestically, accounting for $204 million of splendid week’s bag inflows. Switzerland and Germany moreover witnessed obvious flows for the 2nd week in a row, adding $14.7 million and $9.2 million, respectively.