Inflows of Bitcoin into accumulation wallets continue, and not using a stress to capitulate or rob profits. Shopping from wallets with over 10 BTC reached their absolute top phases in the yr to this point.

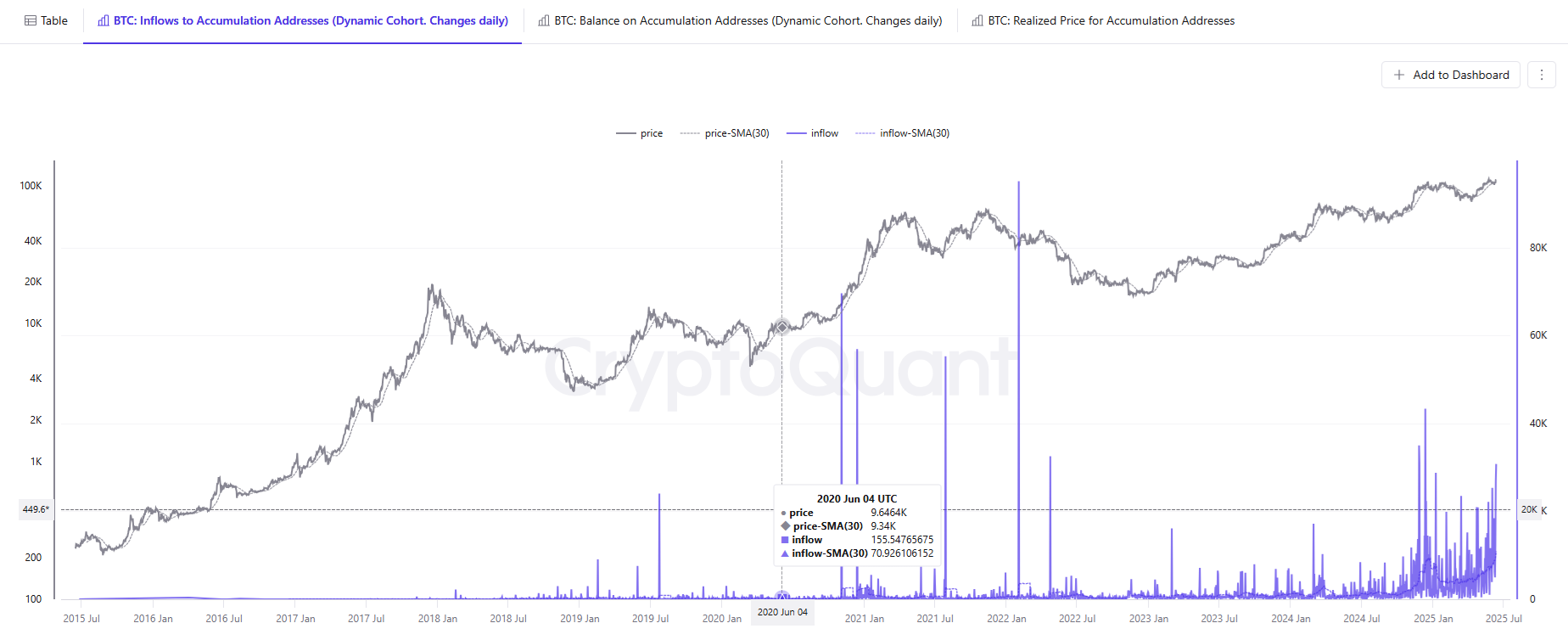

Bitcoin accumulation addresses seen mercurial inflows in the previous few days, despite the tag spike. Over 30K BTC had been sold up and despatched to addresses that had been extremely conservative about transferring their coins.

In whole, accumulation addresses absorbed $3.3B, or 30,754 BTC. For the time being, accumulation and even occasional shopping are intelligent all newly mined coins, whereas moreover drawing down the reserves of OTC desks and exchanges.

The sizzling wave of shopping continued even at prices above $109,000. Bitcoin is still in accumulation mode, even though sinking a bit to $104,578. Accumulation is taking place whereas awaiting a greater rally in 2025, with $120,000 the following target.

Accumulation addresses are moderately mature, and appreciate a median accumulation tag of $64,000. On the opposite hand, more moderen accumulation addresses are moreover added, even near high prices. In accordance to CryptoQuant records, over 2.91M BTC for the time being are held in accumulation addresses with diversified ages.

In 2025, inflows to accumulation addresses exhibited a higher baseline, with extra usual stacking. There is moreover a lisp development in shopping extra Bitcoin, as inflows reached high phases for the yr to this point.

The sizzling records confirms the event where despite the near-high valuations, whales are no longer taking profits. BTC station markets still point out long-timeframe self belief, despite the short-timeframe volatility with derivative trading. The crypto fright and greed index switched to 51 points, signaling a neutral perspective, down from the sizzling phases of grievous greed. On the opposite hand, station accumulation can continue below diversified market conditions.

BTC accumulation boosted by the treasury story

The sizzling Bitcoin shopping is a mixture of anonymous whales and high-profile company patrons. Previous traits showed retail was typically fascinating above $90,000 per BTC, with various the accumulation coming from whales and other orderly-scale wallets preserving between 100 and 1,000 BTC. Corporate patrons and funds can moreover appreciate the funds for to protect intelligent Bitcoin even near high prices.

Treasuries already appreciate 3.41M BTC, with fascinating shopping from one of the most high-profile holders in the previous week. Even smaller company patrons appreciate taken up to 5,000 BTC off the market in a single day.

In the previous month, 20 companies added Bitcoin to their public balances, with extra announcements and plans to finance Bitcoin acquisitions with debt or fairness.

The postulate of a Bitcoin strategic reserve is moreover introduced merit to crypto initiatives. No longer too long up to now, the Polkadot neighborhood raised a proposal to construct a tBTC reserve, shopping and preserving wrapped coins for the very long timeframe.

Segment of the Bitcoin accumulation shall be in consequence of DeFi protocols and other varieties of collateral wallets. As Bitcoin turns into extra treasured, on-chain bellow is slower, whereas some protocols are offering one map to faucet the Bitcoin payment without selling.

Solana is moreover changing into regarded as one of many venues for wrapped Bitcoin. A full of 4,726 BTC is now held on Solana in the have of tBTC, with 75% lisp for the whole of 2025. Additionally, Bitcoin staking and other DeFi protocols are preserving up coins and not using a diagram to sell.