Bitcoin’s sudden surge previous $107,000 just shouldn’t be only correct a bullish chart moment; it is some distance a liquidation event of myth proportions that has grew to became the tables on rapid-sellers in an infinite manner.

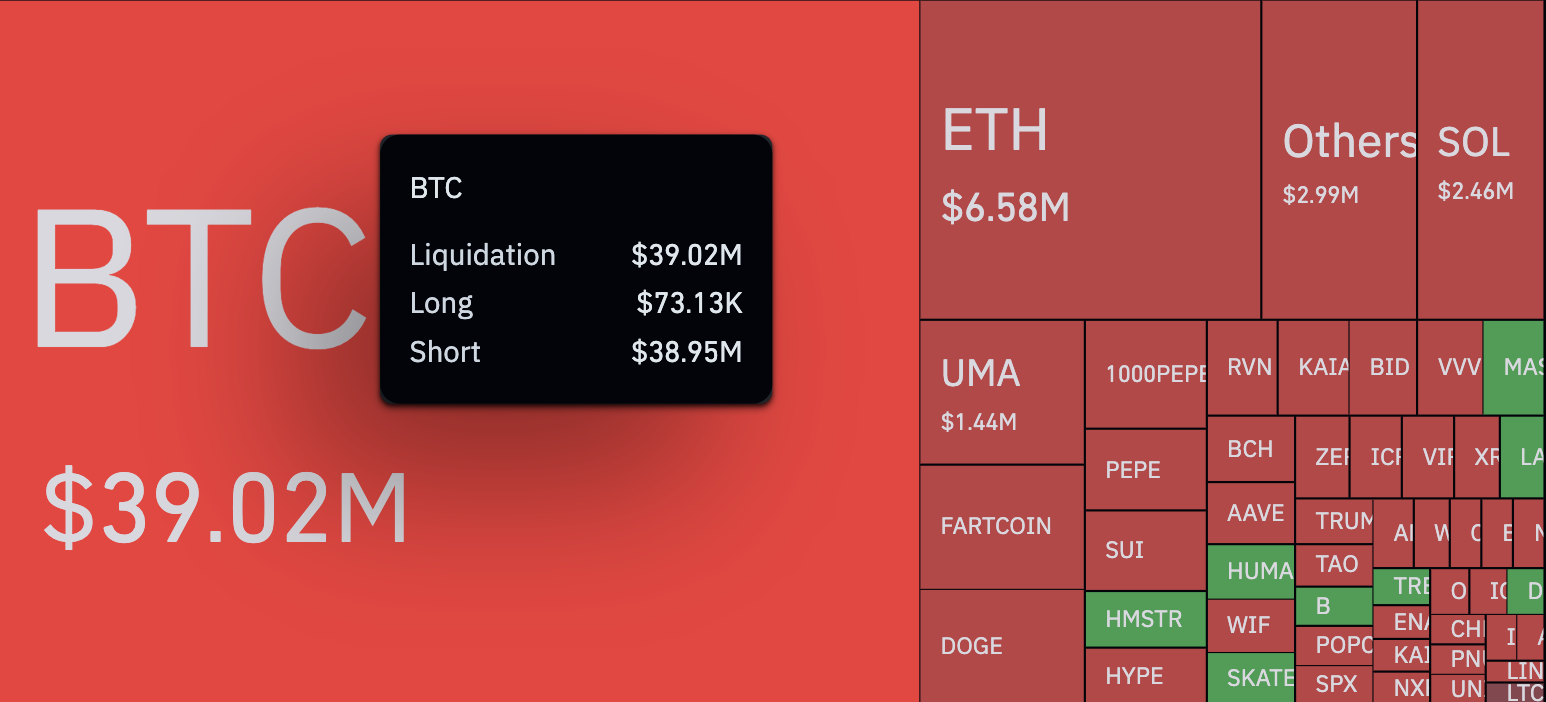

Within the final few hours, BTC’s rapid ascent caused a wipeout of over $39 million in liquidations, with a intrepid $38.95 million from shorts alone, versus a runt $73K in prolonged positions, in accordance with recordsdata visualized on CoinGlass.

That just shouldn’t be only correct imbalanced — it is some distance a 53,247% skew in settle on of prolonged positions, making it one of presumably the most lopsided liquidation snapshots Bitcoin has seen in a while.

Having a scrutinize at the extensive image, we’re seeing a total of $65.49 million in crypto liquidations over the previous four hours, with shorts accounting for over $61.6 million. It is miles obvious that this was once not only correct a BTC legend — it was once a marketwide ache for the bears.

Numerous important names also got caught up, but nowhere with regards to BTC’s scale. Ethereum had $6.58 million in liquidations, while Solana and DOGE had smaller but critical clearing occasions. Nonetheless what’s attention-grabbing is how Bitcoin totally dominated the heatmap, both in uncooked numbers and relative influence. This means a concentrated undergo squeeze.

The liquidation heatmap grew to became a deep coloration of crimson, with shorts lighting fixtures up in every single place. Numerous altcoins like PEPE and SUI adopted breeze well with, exhibiting that shorts all the way thru a amount of narratives were caught off guard by this spicy BTC breakout.

Not like conventional slack climbs, this was once a stout-bustle, parabolic upward push upward, a sudden vertical push doubtless fueled in segment by renewed U.S.-China commerce talks in London, that will believe reenergized international possibility sentiment.