Continued promoting stress from Bitcoin whales might maybe maybe maybe outcome in the asset falling additional, cautioned analysts at CryptoQuant.

Bitcoin (BTC) substitute inflows reached a high of 9,000 on Nov. 21 because the fee of Bitcoin declined to $80,600 on Coinbase, its lowest in seven months, it acknowledged in a market summary on Wednesday.

When crypto substitute inflows amplify, it’s always a signal that merchants are making ready to promote, whereas the different is the case when substitute outflows are rising.

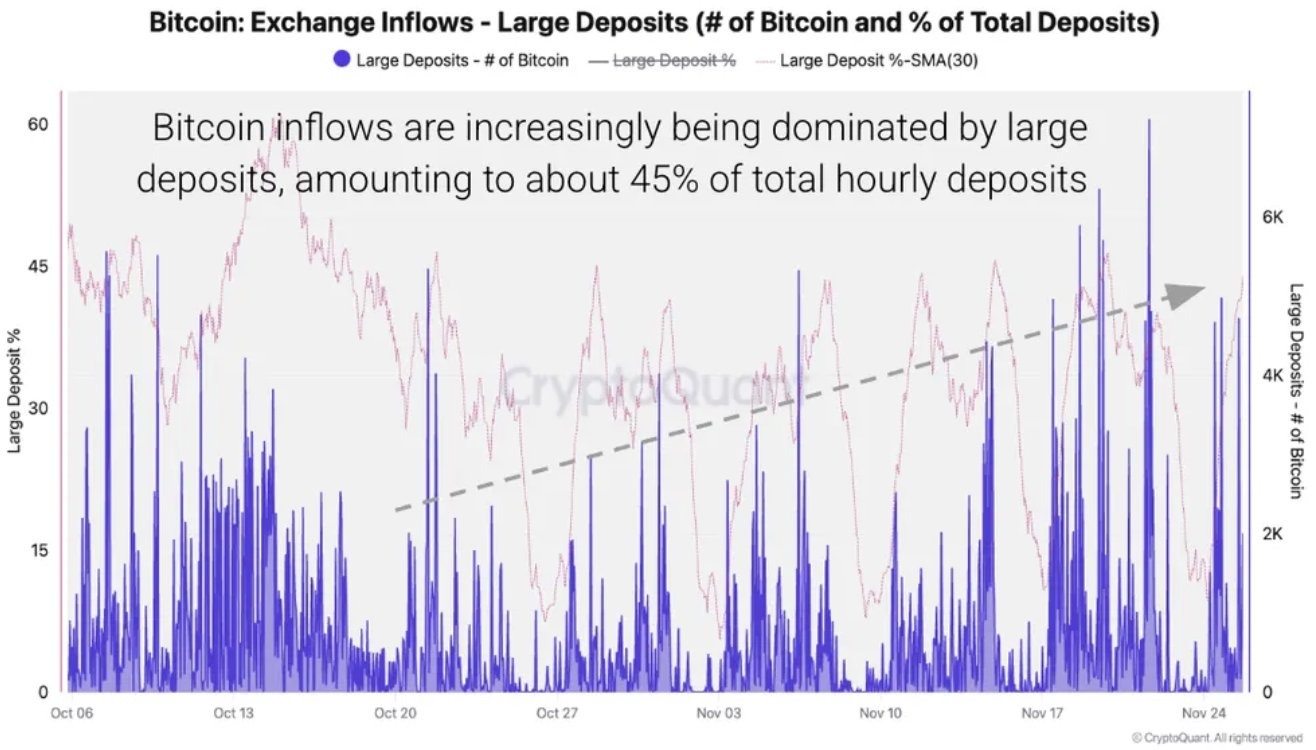

CryptoQuant info indicates that 45% of the entire BTC despatched to exchanges originated from sizable deposits of 100 BTC or more, reaching as high as 7,000 BTC on a single day. This means that the whale cohort has been sending cash to exchanges in preparation to promote.

“This indicates that merchants and merchants proceed to promote Bitcoin in the context of the present mark drawdown, striking additional downward stress on the fee.”

This introduced the in model BTC deposit fee to 1.23 BTC in November, the final discover level in a year, it added.

Binance stablecoin reserves hit high

CryptoQuant also renowned on Wednesday that Binance’s stablecoin reserves appropriate hit a sage $51 billion, the final discover in its historical past, whereas BTC and Ether (ETH) inflows climbed to $40 billion this week, led by Binance and Coinbase.

Excessive stablecoin reserves on exchanges mark rotation from Bitcoin and altcoins into dollar-pegged sources, the assign capital on the entire sits till market participants are ready to re-enter.

Connected: Bitcoin’s Sharpe ratio is form of at zero, a rare possibility-reward signal

Earlier this week, analyst James Take a look at flagged final leverage that had yet to be flushed from markets. “We wouldn’t be too taken aback if we wick into the $70k-$80k zone to flush the final leverage pockets,” he acknowledged.

Meanwhile, BitMine chairman Tom Lee has softened his $250,000 Bitcoin target, now asserting that even returning to an all-time high by year’s pause is now appropriate a “presumably”.

A equivalent influx sample for Ether and altcoins

The analytics platform noticed a equivalent deposit substitute influx pattern for Ether, “though total inflows own no longer spiked unparalleled.”

Other altcoin inflows to exchanges also elevated this month because the promote-off intensified, pushing a range of them lend a hand to undergo market lows.

Earlier this week, 10x Analysis acknowledged that Bitcoin’s “tactical, oversold rebound is level-headed taking half in out,” focused on $92,000 and $101,000 because the important resistance zones to seek for.

BTC has reclaimed $90,000 and is currently trading a small bit of above it at the time of writing.

Journal: Bitcoin $200K soon or 2029? Scott Bessent hangs at Bitcoin bar: Hodler’s Digest