Amid an everyday mark rebound within the Bitcoin (BTC) market, standard market analyst with the X username KillaXBT is predicting one other important correction within the imminent days.

Bitcoin Ancient Info Unearths Recurring Month-to-month 8% Imprint Decline

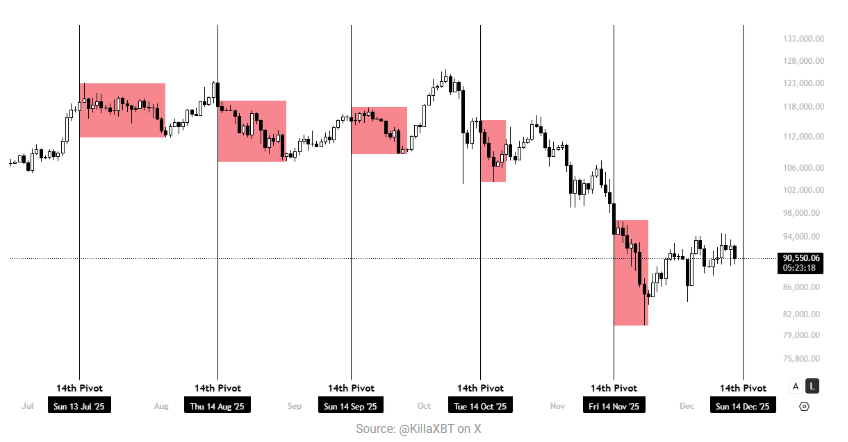

In an X put up on December 12, KillaXBT outlines a cautious market perception that implies Bitcoin is headed for a mark pullback. Primarily based on the smartly-known analyst, the premier cryptocurrency has consistently recorded an 8% mark decline after the 14th day of the closing five months. KillaXBT describes this statement because the 14th Pivot, which now holds important implications for Bitcoin within the quick interval of time. Since hitting a mark bottom of $80,000 in dumb November, BTC has formed an ascending channel, recording an everyday series of greater lows and greater highs.

Source: @KillaXBT on X

Source: @KillaXBT on XOn the exchange hand, KillaXBT’s projection is expected to spoil this channel, doubtlessly halting the nascent uptrend. Going by the recurring mark pattern, the analyst states Bitcoin investors can have to silent await a minimum 5% mark decline after the 14th of December, hinting at a doable retest of the 85,000-$86,000 mark zone.

Given the asset’s broader bullish market construction, this kind of transfer also can signify nothing bigger than a non everlasting pullback. On the exchange hand, the extended correction considered earlier in Q4 has already station a precedent, leaving room for one other fragment of deeper downside can have to silent momentum weaken.

BTC To Bottom Below $50,000?

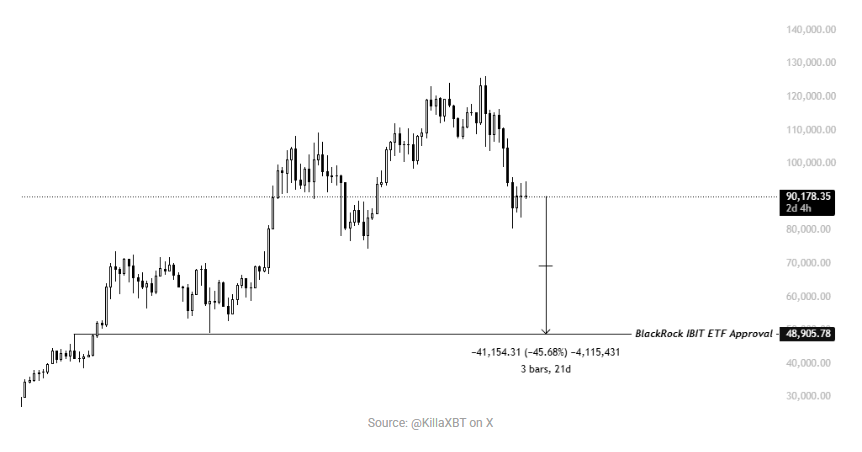

In one other X put up, KillaXBT shares extra bearish projections of the Bitcoin market. This time, the seasoned analyst predicts the crypto market chief will hit a mark bottom of $forty eight,905 despite contemporary mark good points. KillaXBT’s bottom purpose represents Bitcoin’s mark as of the approval of the BlackRock IBIT ETF, alongside 11 other Bitcoin Space ETFs in January 2024. This projection is possible attributable to the customary rationale that the existing bullish urge has been heavily supported by institutional inflows.

Source: @KillaXBT on X

Source: @KillaXBT on XParticularly, the Bitcoin Space ETFs have been central to those institutional inflows, boasting total catch sources of $119.18 billion. The BlackRock IBIT holds over half of this traction because the undisputed market chief with $71.03 billion in catch sources and $62.68 billion in cumulative catch inflows.

If Bitcoin were to return to its pre-ETF approval mark ranges, it would possibly well maybe suggest an estimated 46% decline from contemporary market prices. This form of transfer would possible price a racy reversal in institutional positioning, suggesting that sustained ETF outflows, in preference to retail capitulation, also can emerge because the predominant catalyst for a renewed crypto iciness.

At press time, Bitcoin continues to trade at $90,348, reflecting a 2.18% decline.

Featured picture from Pexels, chart from Tradingview