On-chain knowledge reveals that Bitcoin prolonged-term holders private potentially been selling lately, something which will level to BTC’s persisted bearish momentum.

Bitcoin Replace Inflow CDD Has Registered Tall Spikes Currently

As an analyst in a CryptoQuant Quicktake put up defined, extinct cryptocurrency tokens private lately been deposited in colossal quantities in centralized exchanges.

The on-chain metric of hobby right here is the “Replace Inflow Coin Days Destroyed (CDD).” A “coin day” refers to a quantity that 1 BTC accumulates after staying dormant on the blockchain for 1 day.

When a coin that had been sitting collected internal a wallet is at final moved, its coin days counter naturally resets wait on to zero, and the coin days it had been carrying earlier than the transfer are said to be “destroyed.”

The CDD keeps notice of the total quantity of coin days being reset in this form across the network. In the context of the sizzling subject, though, the well-liked CDD isn’t the life like one of focal level, nonetheless rather the Replace Inflow CDD, which handiest keeps notice of the coin days being destroyed thru transactions into wallets connected to exchanges.

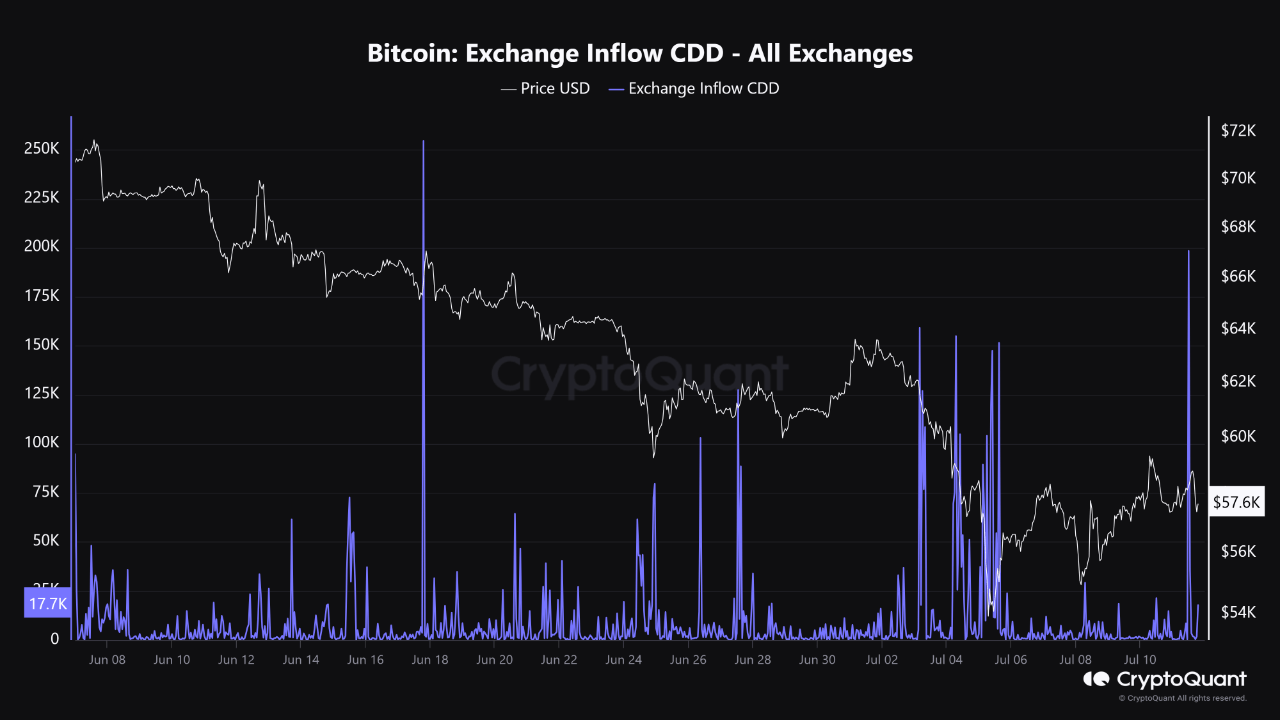

Now, right here is a chart that reveals the building within the Bitcoin Replace Inflow CDD over the previous month or so:

As is seen within the above graph, the Bitcoin Replace Inflow CDD has registered some spikes of appreciable scale this month. This would indicate that many dormant coins private lately seen deposits into exchanges.

Typically, spikes within the CDD correlate to circulate from the prolonged-term holders (LTHs), as these HODLers tend to amass colossal quantities of coin days. Therefore, the most fresh spikes within the Replace Inflow CDD counsel that these diamond palms were transferred to exchanges.

Holders fabricate transactions into exchanges after they’re seeking to make use of life like one of the providers these platforms present, which will consist of selling. The chart reveals that the spikes earlier within the month had strategy when Bitcoin had plunged in opposition to its lows, implying that the selling strain from this cohort might private conducted a role within the smash.

The latest spike, greater in scale than the others, has strategy while BTC has been making an try to open a recovery rally from these most modern lows. To this level, BTC has had no luck, suggesting that the selling from the LTHs has potentially been retaining the coin wait on.

It stays to be seen how the Replace Inflow CDD behaves within the arriving days and if any doable extra spikes would hinder Bitcoin in its route to recovery.

BTC Designate

On the time of writing, Bitcoin is trading at around $57,900, up more than 4% over the previous week.