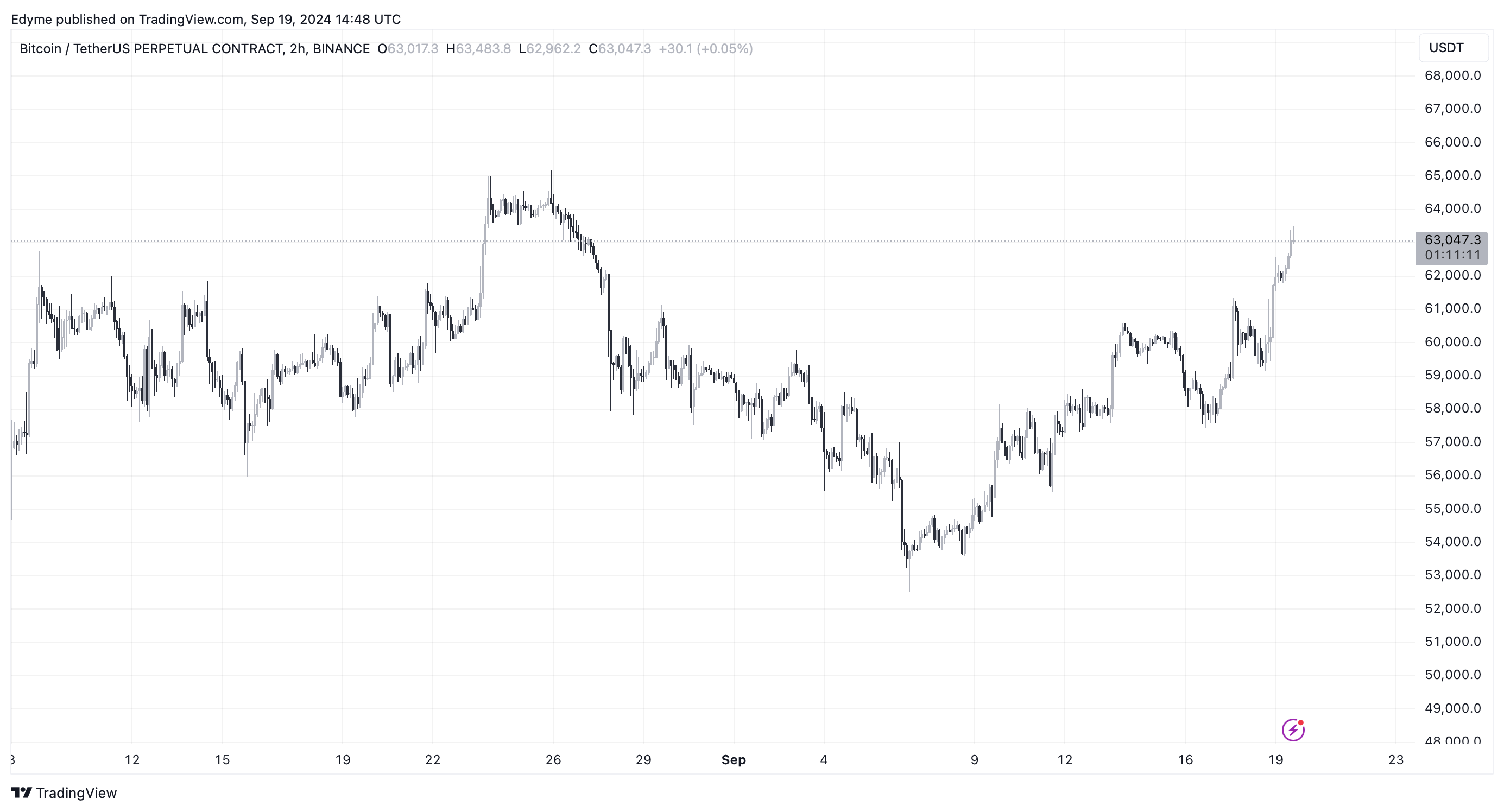

Thus a ways, Bitcoin has viewed a aggregate of bulls and bears genuine within yesterday alone. Even despite the indisputable reality that bulls appear to be taking the lead given its fresh market performance, will this be sustainable?

Earlier than the US Federal Reserve announcement of the rate cuts, Bitcoin experienced a puny dip in its shopping and selling mark. Alternatively, following the announcement, the leading crypto saw a surprising mark surge, reclaiming the $60,000 mark.

Bitcoin continues to clarify bullish strength, shopping and selling at $63,006, reflecting a 5.6% enhance over the previous 24 hours.

Is This Bitcoin Rally For Accurate?

The surprising bullish performance from Bitcoin recorded over yesterday has had loads of traders and analysts sharing their respective outlooks on the asset, with many focusing on the next possible trajectory of Bitcoin’s mark.

No subject the ongoing upward momentum, some specialists flee caution, highlighting underlying market indicators that will affect the sustainability of this bullish trend.

One such expert, crypto trader Josh Olszewicz, shared his insights on this subject, suggesting that while the fresh list seems optimistic, there are silent some considerations to absorb in mind earlier than gazing for a persevered uptrend.

Consistent with Olszewicz, Bitcoin’s fresh circulate led it above the each day Ichimoku Cloud—a technical evaluation indicator old style to gauge market traits—signaling a doable bullish scenario.

Alternatively, he emphasized that this indicator alone does no longer guarantee a sustained upward trend. Specifically, Olszewicz pointed out that the Cloud and the Tenkan-Sen and Kijun-Sen (TK) run are silent in a bearish formation.

$BTC

We are every other time encourage above the each day Cloud, despite the indisputable reality that we silent accept as true with a bearish Cloud and bearish TK run.

Additionally, the old three Kumo breakouts this year accept as true with gone no the place. So despite the indisputable reality that that is a indubitably extra bullish list than just a few days ago, Cloud does… pic.twitter.com/bmlqKM9g6c

— #333kByJuly2025 (@CarpeNoctom) September 19, 2024

What Will Consequence In A Sustainable Rally?

For a extra definitive bullish signal, the Cloud desires to flip accurate into a bullish mode, in conjunction with a bullish TK run, Olszewicz disclosed. This setup would provide a stronger affirmation for a bullish continuation.

Olszewicz additionally notorious that old Kumo breakouts this year accept as true with did not result in critical mark beneficial properties, adding uncertainty to the fresh breakout.

He suggested that examining Bitcoin on a protracted timeframe, such as the two-day Ichimoku Cloud, would possibly provide a clearer viewpoint.

A bullish breakout on this timeframe and an eventual bullish TK run would possibly supply a extra legit indication of a sustained bullish trend for Bitcoin.

Featured list created with DALL-E, Chart from TradingView