Bitcoin has confronted its first predominant correction since early November, dropping 13% from its all-time excessive of $108,364. This surprising pullback has sent shockwaves for the duration of the crypto market, shifting sentiment from low bullishness to uncertainty and even trouble. The promote-off has been severely brutal for altcoins, heaps of which could perchance possible perchance be bleeding provocative as Bitcoin struggles to win momentum.

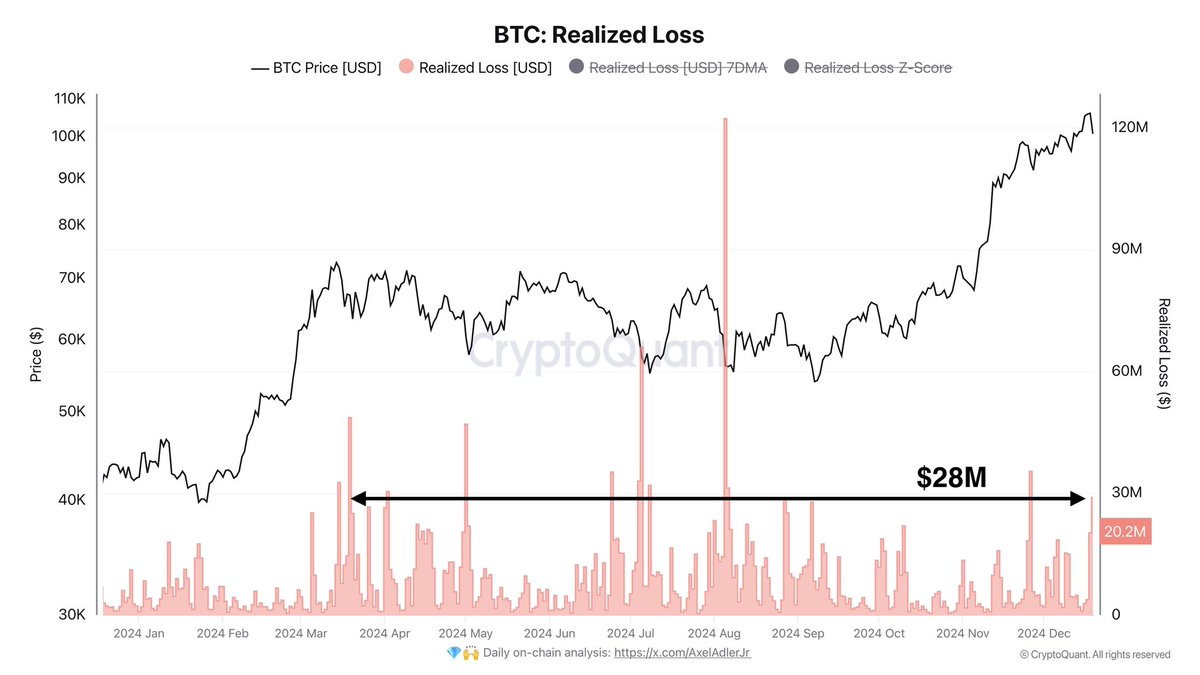

Key metrics from CryptoQuant highlight the gravity of the matter, with realized losses totaling $28.9 million—an alarming 3.2 times better than the weekly common. This spike in realized losses means that some traders exit positions because the market recalibrates after weeks of aggressive upward fade.

The tall inquire of now is whether or no longer or no longer here is merely a healthy correction in an otherwise bullish pattern or the initiate of a bigger downtrend. Merchants are carefully watching Bitcoin’s skill to retain severe give a boost to phases and the behavior of altcoins, which regularly amplify Bitcoin’s designate actions.

For now, the market remains at a crossroads, with the impending days at risk of describe whether or no longer Bitcoin can enhance and resume its uptrend—or if this correction indicators a more prolonged duration of weakness.

Bitcoin Going thru Promoting Stress

Bitcoin is below fundamental promoting pressure after two days of aggressive bearish exercise, marking a pivotal moment for the market. The surprising sentiment shift has introduced about many analysts and traders to flip cautious, with some flipping bearish as Bitcoin’s most modern pattern begins to lose momentum. This correction has left the market questioning whether or no longer the fresh designate fade is a natural cease or a precursor to deeper losses.

Prime analyst Axel Adler no longer too prolonged within the past shared insights on X, supported by compelling on-chain records, highlighting that realized losses maintain surged to $28.9 million. This resolve is 3.2 times better than the weekly common, indicating heightened promoting exercise. Adler’s diagnosis underscores that whereas the promote-off can also seem alarming, it’s per a healthy market correction, severely following Bitcoin’s excellent rally to $108,300.

Adler notes that the fresh dip will maintain to restful no longer trigger apprehension nevertheless as a substitute support as a moment of persistence for prolonged-time duration holders. He emphasized that now is a time to HODL unless extra bearish indicators emerge to counsel a more prolonged downtrend. Corrections love this regularly present the market with the obligatory gasoline for the next leg up, as weaker fingers exit and solid fingers field themselves strategically.

Model action remains severe, with traders watching carefully to search out out whether or no longer this correction solidifies a solid basis for future boost or indicators extra arrangement back.

BTC Preserving Bullish Structure (For Now)

Bitcoin is trading at $94,400 following three consecutive days of aggressive promoting pressure. No matter the obvious bearish sentiment inviting the market, BTC has managed to retain its footing above the most valuable give a boost to stage of $92,000. This give a boost to is very fundamental as it clearly defines the ongoing uptrend. Preserving above this stage suggests resilience and gadgets the stage for a skill solid bounce if traders win administration within the impending sessions.

Whereas the most modern designate action reflects uncertainty, the decline has no longer been as severe because the market sentiment signifies. Detrimental emotions maintain pushed many traders to undertake a cautious stance, nevertheless BTC’s skill to handle above $92,000 reveals underlying energy available within the market structure.

On the opposite hand, sentiment remains a severe market driver. Restoring self belief could be valuable for Bitcoin to reclaim better phases and resume its bullish momentum. If sentiment does no longer strengthen and costs proceed to tumble, the probability of a deeper correction turns into more possible. Dropping the $92,000 give a boost to could well possible perchance pave the advance for a retest of decrease phases, doubtlessly inflicting extra volatility.

Featured image from Dall-E, chart from TradingView