Bitcoin trades at $108,413 with a 24-hour buying and selling quantity of $22.57 billion and a market capitalization of $2.15 trillion. Within the previous 24 hours, the cryptocurrency fluctuated between $108,262 and $109,453, displaying tight consolidation inside a slim vary.

Bitcoin

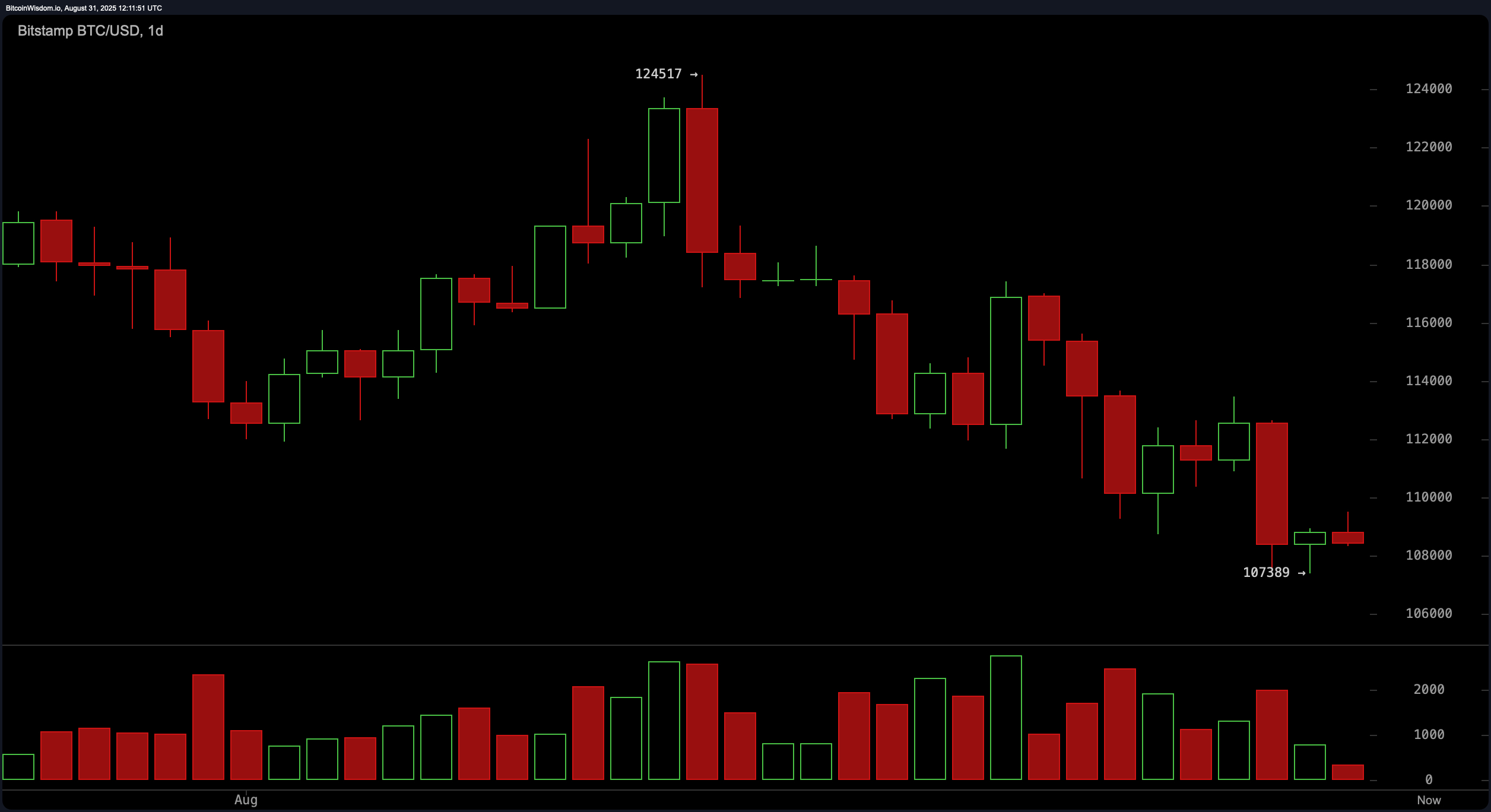

The day-to-day chart reveals a firmly established bearish construction as bitcoin kinds a decrease-excessive, decrease-low structure thru August, culminating in a sharp decline from the mid-month height shut to $124,517. For the time being hovering spherical $107,389, the worth movement is pressured extra by heavy crimson quantity, pointing to chronic promote-side momentum. No bullish reversal pattern has emerged, and a shut under the foremost $107,000 give a increase to would doubtless verify a continuation to the method back. Resistance stays layered between $112,000 and $114,000, suggesting that handiest a decisive day-to-day shut above $114,000 would possibly signal a shift in sentiment.

On the 4-hour chart, bitcoin broke down from $113,473 and has since consolidated in a staunch vary between $107,000 and $109,000. Quantity analysis signifies solid seller dominance, in particular on Aug. 29, when crimson quantity surged all the method in which thru a sharp decline. Candlestick formations, together with more than one dojis and little our bodies, imply indecision, yet the context leans bearish. The worth’s failure to withhold above $109,000 implies that a endure flag would be forming, which would possibly unravel with one other leg decrease upon a breakdown below $107,500.

The 1-hour chart affords extra affirmation of distribution, with bitcoin attempting a like a flash reduction rally from the $107,389 level sooner than stalling staunch under $109,500. Sellers are constantly stepping in on each and each bounce, resulting in a descending triangle formation that facets to extra method back stress. Quantity stays light on upward strikes and heavy on downward ones—basic traits of a market making ready for one other dip. A brief entry shut to $109,000 with a discontinue above $110,000 aligns with the non eternal bearish structure, whereas prolonged scalps would possibly well also impartial aloof handiest be notion to be on a rebound from $107,000 with tight chance parameters.

Oscillator readings give a increase to the underlying bearish account. The relative strength index (RSI) stands at 38, indicating a neutral-to-broken-down momentum. The Stochastic oscillator reads 10, also neutral, whereas the commodity channel index (CCI) at -118 and momentum at -4,032 each and each flash bullish indicators, potentially hinting at oversold stipulations. Nonetheless, the intriguing practical convergence divergence (MACD) prints -1,916, suggesting ongoing bearish momentum. Total, oscillators dwell inconclusive but skew toward continuation of the present construction.

A complete peep on the intriguing averages facets to the prevailing bearish outlook. All brief- to mid-time duration exponential intriguing averages (EMAs) and simple intriguing averages (SMAs)—from 10 to 100 sessions—are correctly above the contemporary mark, issuing negative indicators. Seriously, handiest the prolonged-time duration 200-duration EMA at $104,072 and 200-duration SMA at $101,265 present a bullish signal, suggesting that whereas bitcoin is buying and selling correctly above historic trendlines, fresh momentum stays heavily tilted toward the method back. A shatter below $107,000 with quantity would verify this construction, whereas handiest a solid shut above $114,000 would initiate the door to a bullish reversal.

Bull Verdict:

Whereas prevailing indicators and non eternal momentum want bears, prolonged-time duration intriguing averages and oversold oscillator readings imply the choice of a rebound. A confirmed day-to-day shut above $114,000 would invalidate the bearish structure and would possibly designate the starting place of a broader recovery.

Agree with Verdict:

With mark movement locked in a specific downtrend, decrease highs, and failed breakout makes an strive, the dominant sentiment stays bearish. A sustained tumble below $107,000 would doubtless trigger extra declines, confirming a continuation of the downward trajectory toward deeper give a increase to zones.