Bitcoin is altering hands at $114,299, giving the network a market mark of about $2.27 trillion. Over the last 24 hours, exchanges processed $35.08 billion in spot turnover while costs ranged between $112,770 and $114,883.

Bitcoin

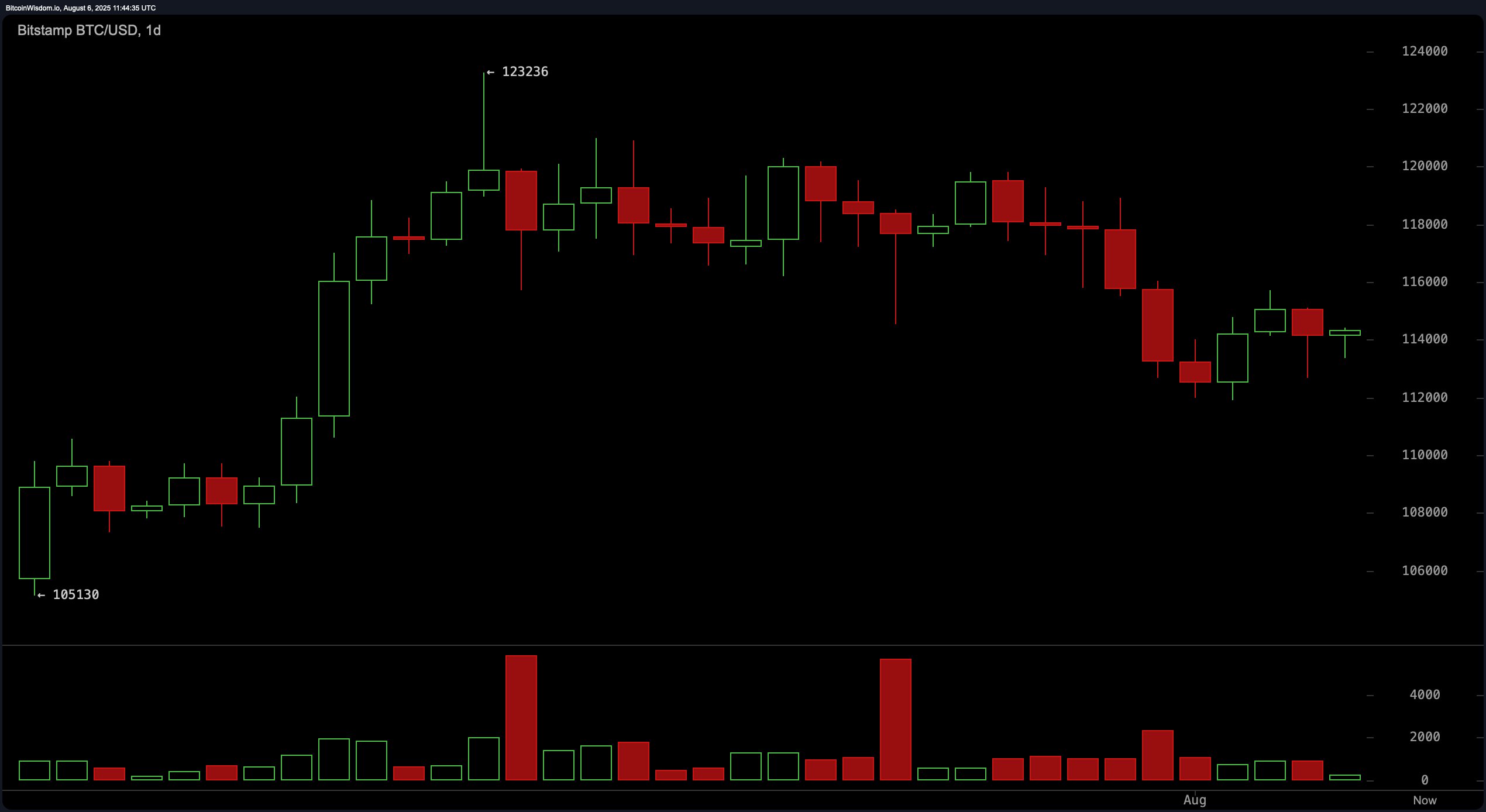

The day by day chart exhibits that bitcoin rallied from roughly $105,130 to a high end to $123,236 sooner than slipping reduction toward the $114,000 instruct. Volume swelled on the cease, hinting at distribution, and mark circulate has since carved decrease highs that resemble a capacity double-high. Key resistance sits in the $118,000–$120,000 band, while the $112,000 zone stays pivotal toughen; a decisive ruin below it can perhaps additionally bustle downside stress. Attain-term bias is bearish, nonetheless the broader day by day pattern stays neutral until investors recapture $118,000.

On the 4-hour timeframe, bitcoin‘s momentum has deteriorated since the Aug. 1 swing high, with a whisk to $111,919 followed by a modest rebound that stalled at $115,000. Promoting quantity continues to outweigh purchasing for all the map in which thru down-strikes, and mark is coiling inner what appears admire a undergo flag. Merchants are gazing $115,500 for a bullish breakout affirmation; failure to possess $113,000 could perhaps additionally invite one more leg decrease toward the day by day toughen zone.

BTC/USD hourly circulate is uneven, producing a descending channel marked by decrease highs and tight ranges. Volume spikes align with red candles, underscoring sellers’ management on instant intervals, but scalpers salvage opportunity between $113,500 and the $114,500–$114,800 resistance shelf. A soar from channel toughen could perhaps additionally just provide instant upside to the upper boundary, whereas a breakdown would seemingly take a look at the $112,000-instruct liquidity pocket acknowledged on the upper-timeframe charts.

Oscillators present a blended fable. The relative strength index (RSI) is neutral at 47, and the Stochastic oscillator sits at 31, additionally neutral. The commodity channel index (CCI) prints −106, flashing a bullish signal, while the usual directional index (ADX) at 19 reflects a frail pattern. The Awesome oscillator exhibits −1,839, indicating neutral momentum, nonetheless the momentum indicator itself is at −5,171, signaling sell stress. The animated moderate convergence divergence (MACD) diploma of 62 likewise points to a bearish bias.

Transferring-moderate (MA) breadth highlights the tug-of-war between instant- and lengthy-term avid gamers. The exponential animated moderate (EMA) and straightforward animated moderate (SMA) for 10, 20 and 30 sessions—clustered between $115,009 and $116,801—flee above spot mark, reinforcing instant-term resistance. Conversely, the EMA 50 at $113,110 and SMA 50 at $112,645 bear flipped to bullish signals, and deeper toughen is buttressed by the EMA 100 at $108,278, SMA 100 at $108,370, EMA 200 at $101,017 and SMA 200 at $ninety 9,456. This stacked structure suggests that while bears possess the end to-term initiative, the longer-term uptrend stays structurally intact.

Bull Verdict:

If bitcoin can reclaim the $115,500–$118,000 resistance zone on solid quantity, it can perhaps additionally trigger a momentum shift that reopens the route toward $120,000 and potentially retests the $123,236 high. Give a grab to from the exponential animated moderate (EMA) 50 and straightforward animated moderate (SMA) 50 strengthens the case for bulls, particularly with the longer-term pattern structure aloof favoring upside continuation.

Endure Verdict:

Failure to possess the $113,000 toughen instruct could perhaps additionally bustle a decline toward the $112,000 day by day toughen zone, with extra effort of sliding toward the $108,000 diploma if promoting stress intensifies. The unusual undergo flag on bitcoin‘s 4-hour chart, coupled with several instant-term animated averages performing as overhead resistance, tilts the rapid bias toward sellers.