In case you’re feeling dizzy, that’s honest the altitude— bitcoin is flying excessive at $122,087, staking a fearless claim in the six-figure membership. However earlier than you observe toward the moon, take a breath—this ticket action will most definitely be flexing, however the charts are whispering different tales.

Bitcoin Chart Outlook and Tag Prediction

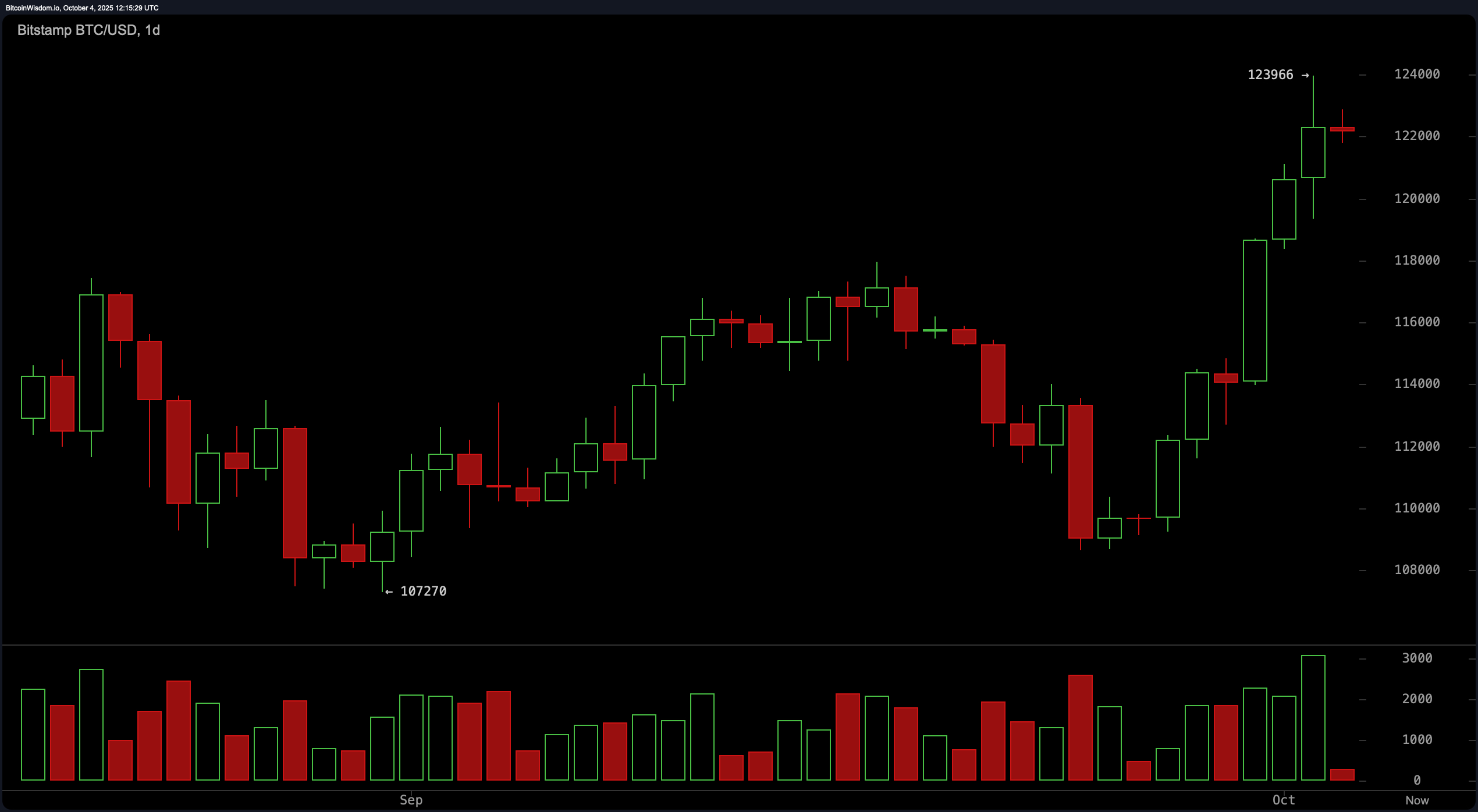

Let’s originate with the day after day chart, where bitcoin (BTC) strutted from $110,000 to almost $124,000 admire it owns the market—on tale of, successfully, it form of does. That 12.6% surge came with volume muscle, confirming that bulls meant change. Silent, with the relative energy index (RSI) parked at 69 and the Stochastic at a sky-excessive 91, overbought territory is having a observe awfully cozy.

The commodity channel index (CCI) at 170 even shouted a warning, whereas the momentum oscillator threw its fingers up at 8,842—also flashing crimson. And probably, the shifting sensible convergence divergence (MACD) clapped attend with a solid momentum imprint, so momentum junkies soundless maintain some hope to dangle onto.

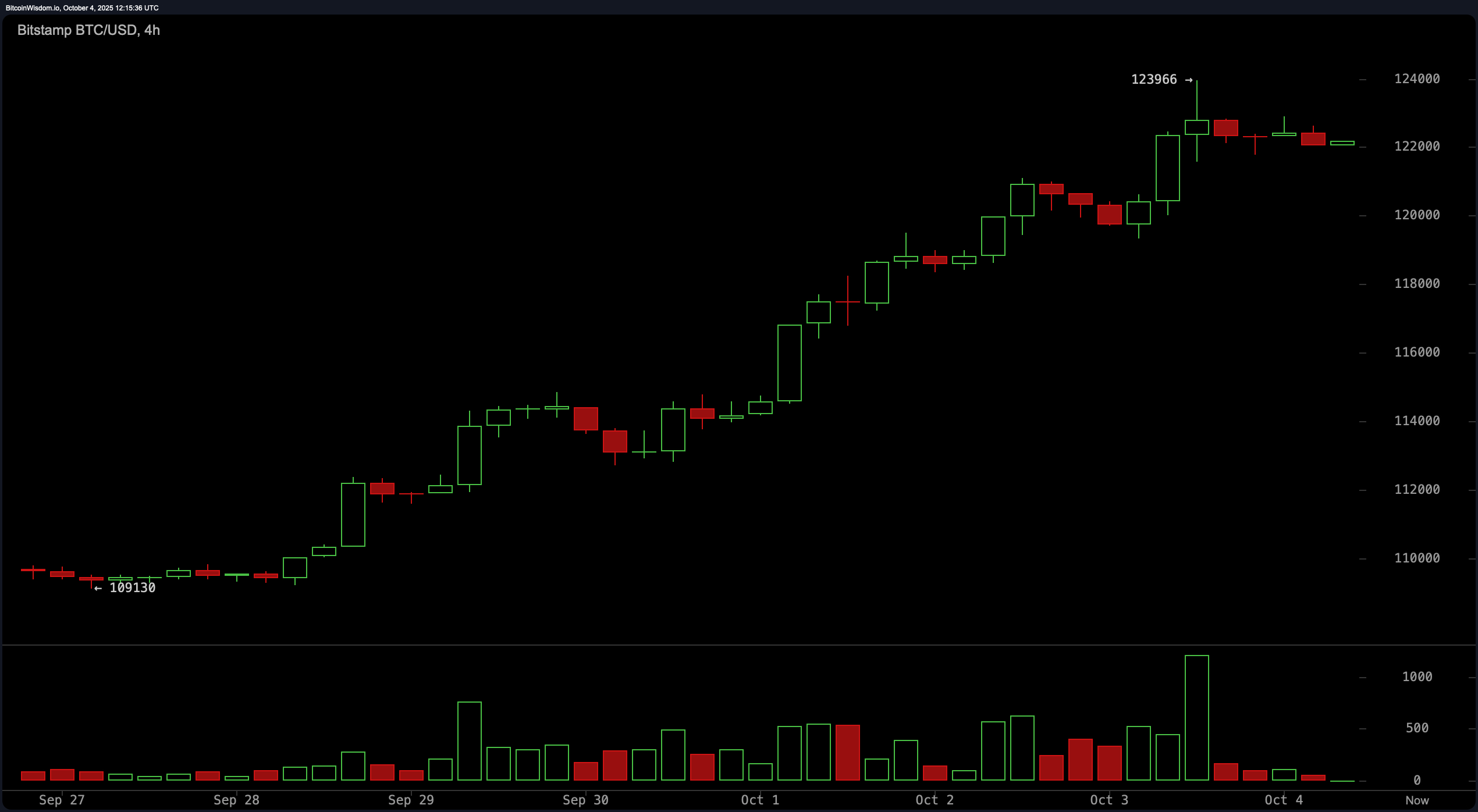

On the 4-hour chart, bitcoin’s uptrend is textbook—higher highs, higher lows, and a ticket tap dance honest below resistance at $123,966. However don’t let that fine make idiot you. The amount already peaked and is beginning to ghost us—traditional imprint that bulls will most definitely be running out of breath. If ticket loses grip at $122,000, brace for a pace toward the $118,000–$119,000 back zone, a level as most well-known factual now as caffeine on a Monday morning.

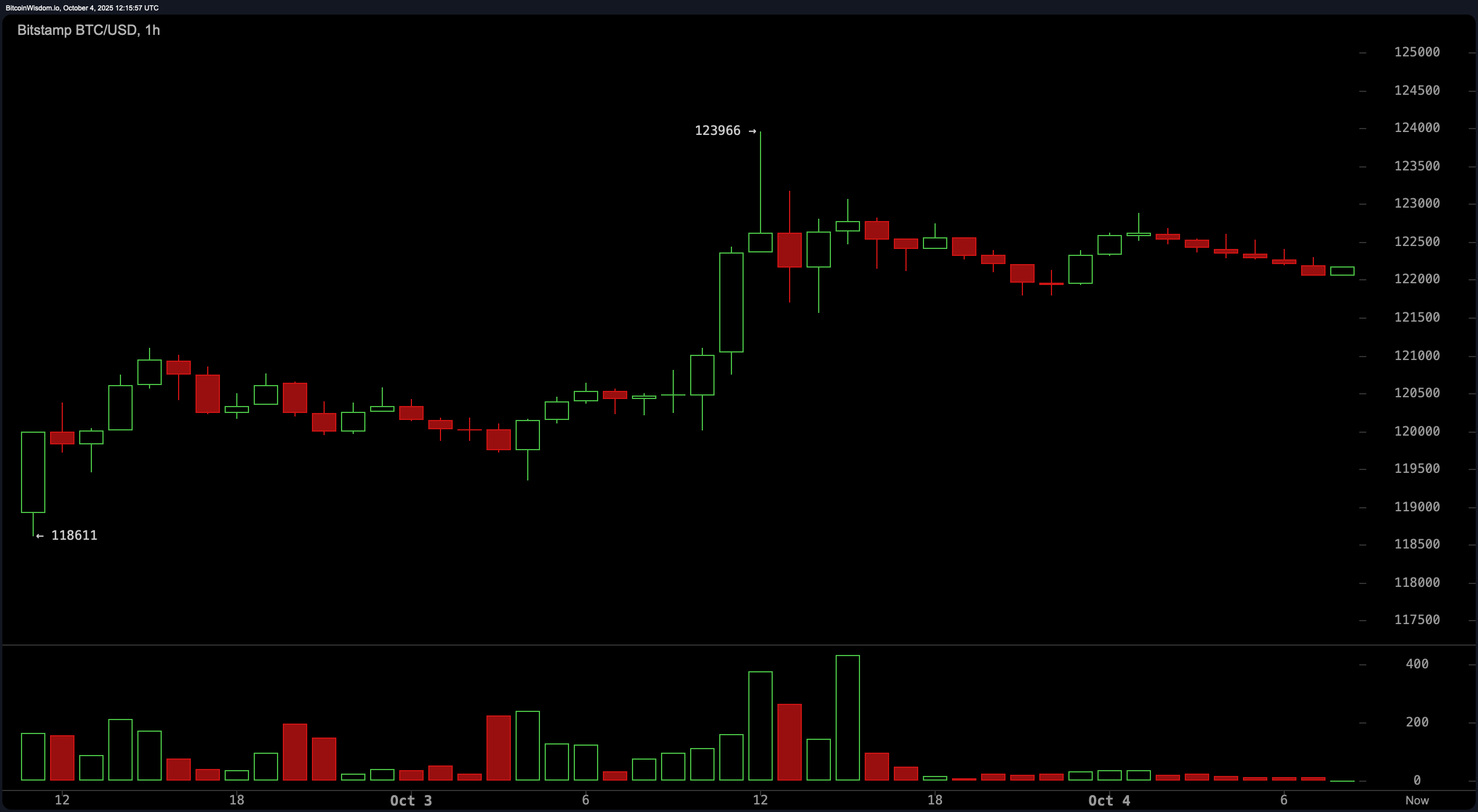

Zoom into the 1-hour chart and the vibe shifts from vitality swimsuit to pajama pants—sideways consolidation with a whiff of weak point. Tiny-bodied candles and crimson bars imprint indecision, whereas vanishing volume screams that bulls maintain left the chat. If the price tumbles below $121,800, things would possibly well well procure though-provoking rapid, with $120,000 or $118,500 playing the half of capacity fetch zones. Appropriate now, the micro-pattern is a gradual grunt, no longer a fearless declaration.

Oscillator indicators are a cocktail of blended emotions. The RSI, stochastic, sensible directional index (ADX), and superior oscillator are all inserting out in “unbiased” territory, probably expecting bitcoin to pick out a mood. Entirely the MACD dares to flash a definite pulse, whereas each the momentum and CCI maintain drawn their bearish traces in the sand. It’s a dance between FOMO and caution—keep your bets accordingly.

Meanwhile, every single shifting sensible—from the ten-length exponential shifting sensible (EMA) to the 200-length easy shifting sensible (SMA)—is flashing green. That’s 12 separate momentum confirmations for somebody counting, and a clear vote of self belief from pattern-followers. However here’s the kicker: we’re in no-man’s land. Tag is a limited off the highs and unsupported by solid within attain stages. So, except you’re trading off sheer adrenaline, this would possibly well well be a swish time to motivate for either a fine breakout or a magnificent dip earlier than rejoining the fray.

Bull Verdict:

Momentum will most definitely be cooling, however the pattern stays your most nice looking excellent friend—and factual now, bitcoin’s is unmistakably bullish. With all main shifting averages signaling “aquire” and no main back breakdown in peep, this can even be only a discontinue earlier than one other leg up. As prolonged because the price holds above $118,000, bulls soundless grasp the self-discipline.

Have Verdict:

Despite the hype and lofty ticket tags, warning signs are stacking up. Oscillators are flashing caution, momentum is leaking, and the price is stalling almost about resistance if it honest hit a ceiling. If bitcoin slips below $122,000 with volume behind it, the autumn to $118,000—or worse—is also swift and inviting.