Bitcoin hovered at $111,092 per coin on Saturday, keeping ground in a slim $110,032 to $111,369 vary despite fading momentum. With a market cap of $2.21 trillion and $22.66 billion in everyday trading quantity, the sector’s greatest cryptocurrency is consolidating as bulls put together for a doable push previous resistance.

Bitcoin

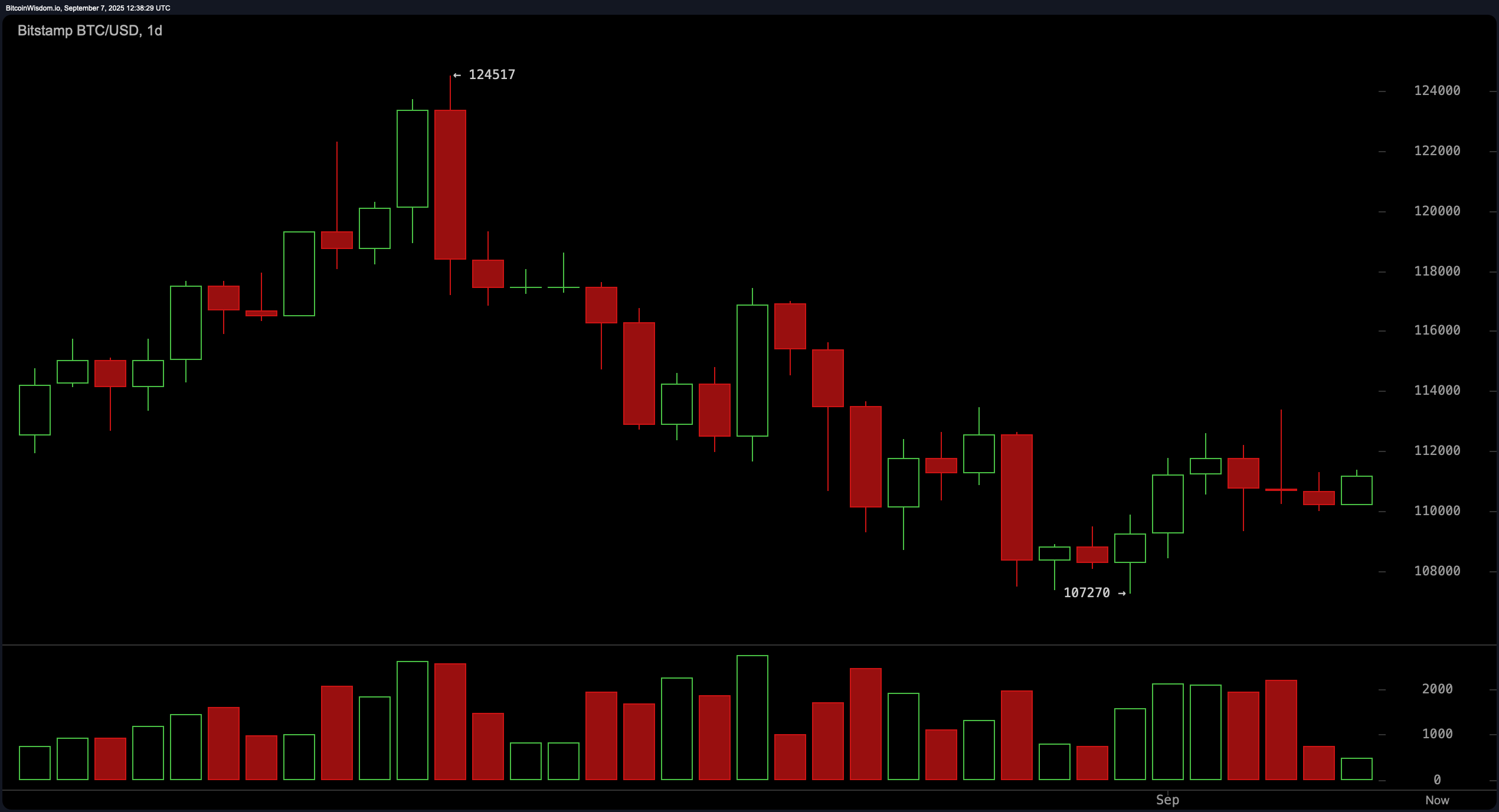

On the everyday chart, bitcoin remains in a corrective part following its most up-to-date high at $124,517. The value declined to a low of $107,270 earlier than staging a modest recovery to present levels. The trend construction—marked by lower highs and lower lows—continues to replicate bearish dominance. Nonetheless, most up-to-date candlestick formations screen a doable irascible forming honest above $110,000. Key resistance lies shut to $114,000, and a breakout above this stage might presumably well pave the model for short-term bullish continuation. A confirmed push previous $112,500 on robust quantity would support as the first impress for an upside reversal, with a keeping stop-loss greatest positioned under $109,000.

The 4-hour bitcoin chart presents a honest a miniature of more constructive outlook, with a mini uptrend rising after a enhance rebound at $107,483. Be aware motion suggests vary-hobble stride between $111,500 and $113,400, the put a double high formation previously signaled resistance. Scalpers might presumably honest glean entry alternatives shut to $111,500 on pullbacks or above $113,400 with tight chance controls. If bullish power sustains and quantity will enhance, upside ability might presumably well purpose $114,000. Nonetheless, merchants must smooth guard towards false breakouts by monitoring designate habits under $110,000—a predominant enhance stage on this timeframe.

On the 1-hour chart, bitcoin has established short-term enhance at $110,021 and rallied posthaste to $111,369 earlier than coming into a consolidation part. The microstructure unearths a local uptrend with modest bullish power, albeit on declining quantity—a doable warning of weakening momentum. Momentary entries shut to $110,800–$111,000 are viable if supported by a bullish candlestick formation, whereas breakouts above $111,400 might presumably honest invite momentum trades toward $112,000. Any pullback breaching under $110,000 might presumably well invalidate bullish setups in the fast term.

Oscillator readings present a blended image. The relative strength index (RSI) at 46, Stochastic at 44, and commodity channel index (CCI) at −28 all describe neutral market momentum. The frequent directional index (ADX) is low at 17, reinforcing the absence of a grand trend. The Superior oscillator and momentum indicator are both detrimental, with momentum signaling a bearish trend, whereas the intelligent average convergence divergence (MACD) stage at −1,344 flashes a bullish impress—indicating doable divergence that merchants must smooth clarify cautiously.

Transferring averages (MAs) are additionally ruin up. The 10-length exponential intelligent average (EMA) and simple intelligent average (SMA) are bullish, whereas the 20-, 30-, and 50-length averages on both EMA and SMA fronts are bearish. Particularly, the 100-length EMA at $110,754 and the 200-length averages—$104,521 (EMA) and $101,760 (SMA)—continue to present broader bullish context. Nonetheless, except bitcoin can ruin above short-term resistance at $113,000–$114,000 with robust affirmation, merchants are told to undertake vary-trading solutions or short-term scalps. Warning is warranted, and any macroeconomic developments, equivalent to inflation files or exchange-traded fund (ETF) news, might presumably well trigger volatility.

Bull Verdict:

If bitcoin can particular the $113,000–$114,000 resistance zone with meaningful quantity, momentum might presumably well shift firmly in prefer of bulls, opening the door to a retest of most up-to-date highs shut to $120,000. The irascible forming above $110,000 gives a grand foundation for a transient-term rally, offered broader market sentiment holds.

Possess Verdict:

Without a decisive breakout above $113,000, bitcoin remains at chance of renewed promoting power. A failure to protect above $110,000 might presumably well trigger a deeper pullback toward the $107,000 zone, keeping the broader downtrend intact and stalling any bullish momentum for now.