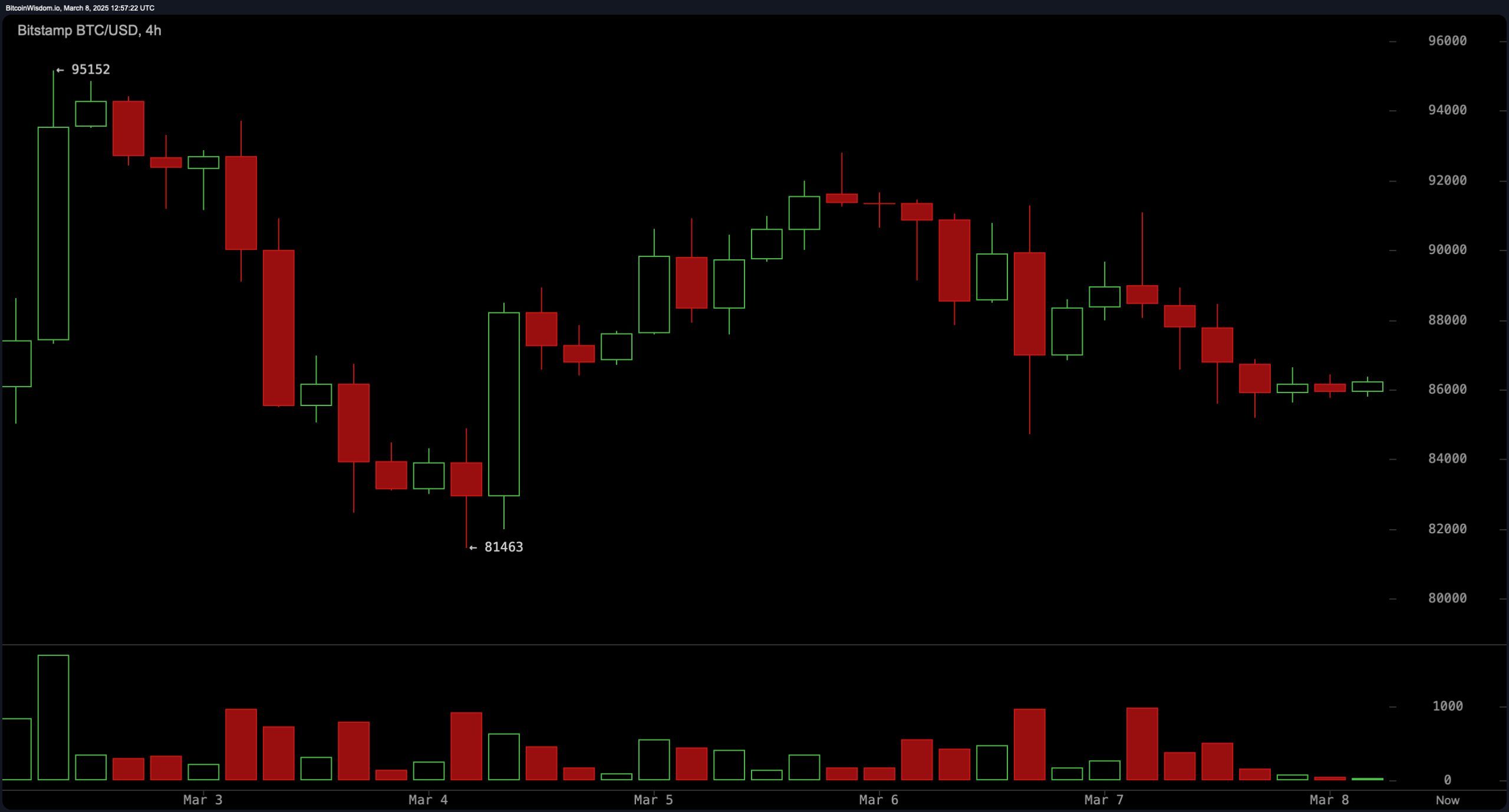

On Saturday, bitcoin traded at $86,189 on March 8, 2025, with a market capitalization of $1.70 trillion and a 24-hour global change quantity of $47.62 billion, fluctuating between an intraday low of $85,109 and a high of $91,081, marking a 20.7% decline from its all-time high on Jan. 20, 2025.

Bitcoin

Bitcoin‘s 1-hour chart indicates a sideways value movement between $85,000 and $87,000, with declining quantity suggesting a lack of robust momentum. A non permanent resistance stage at $88,000 gifts a disadvantage for further beneficial properties, whereas a breakdown below $84,000 might maybe moreover initiating the door for added plan back. The transferring averages enhance a bearish sentiment in the rapid term, because the exponential transferring common (10) at $88,449 and the straightforward transferring common (10) at $87,626 both signal a sell. On the replacement hand, the momentum (10) oscillator stays in purchase territory, indicating the probability of a non permanent upward thrust.

On the 4-hour chart, bitcoin has found crimson meat up shut to $81,463, with a rebound bringing it into the $88,000-$90,000 vary. The value is consolidating between $85,000 and $88,000, suggesting a tug-of-struggle between investors and sellers. The failure to post higher highs raises considerations about continued weakness except a decisive breakout happens. The transferring averages defend a bearish stance, with all key levels from the exponential transferring common (20) at $90,374 to the straightforward transferring common (50) at $96,459 pointing to selling stress. A spoil above $90,000 might maybe moreover lead to a bullish breakout, whereas a failure to sustain levels above $88,000 might maybe moreover trigger a retest of $81,000.

The day to day chart reflects a broader downtrend, though a fresh recovery strive from $78,197 has supplied probably looking out to search out curiosity. Tough crimson meat up exists spherical $78,000, whereas resistance at $90,000 has proven robust to beat. The relative energy index (RSI) sits at 41, signaling impartial momentum, whereas the transferring common convergence divergence (MACD) stage at -2,565 indicates a probably purchase signal. A push above $90,000 would be essential to verify a reversal, whereas a spoil below $78,000 might maybe moreover lengthen losses further.

The oscillators provide a blended image, with the commodity channel index (CCI) at -71, the superior oscillator at -5,662, and the Stochastic at forty eight all registering impartial readings. The popular directional index (ADI) at 35 confirms a lack of robust fashion path. The transferring averages live predominantly bearish, with rapid- and mid-term averages signaling sell stipulations, whereas the exponential transferring common (200-day) at $85,836 and the straightforward transferring common (200-day) at $83,174 offer a purchase signal, suggesting long-term crimson meat up stays intact.

Overall, bitcoin’s value action stays vary-certain, with a probably breakout above $90,000 required to shift sentiment in desire of the bulls. Conversely, a failure to defend key crimson meat up levels at $84,000 and $81,000 might maybe moreover lengthen the downward fashion. Until a decisive switch happens, value action is probably to oscillate between key resistance and crimson meat up zones, with merchants carefully looking out ahead to quantity affirmation to dictate the next important switch.

Bull Verdict:

If bitcoin can spoil and sustain a switch above $90,000, bullish momentum might maybe moreover trip up, pushing the value in direction of $95,000 and past. The transferring common convergence divergence (MACD) stage and momentum oscillator present a probably upward thrust, whereas the 200-duration transferring averages suggest long-term crimson meat up stays intact. An impressive breakout with rising quantity might maybe moreover assign the initiating of a brand original uptrend.

Bear Verdict:

Bitcoin’s failure to reclaim $90,000, blended with the predominance of bearish transferring averages, suggests continued plan back probability. If crimson meat up at $84,000 and $81,000 fails to defend, a fall in direction of the $78,000 stage—or decrease—becomes extra and further probably. The market stays inclined to selling stress except a determined reversal sample emerges with sustained looking out to search out quantity.