Bitcoin strutted into ‘Uptober’ bask in it owns the block—because it roughly does. With a market cap of $2.32 trillion, a 24-hour quantity of $61.04 billion, and a ticket peacocking round $116,800, this digital heavyweight isn’t pretty transferring, it’s making strikes. Intraday vary? A titillating $112,819 to $116,900 per coin. Let’s unpack what the charts hang to claim about all that scramble.

Bitcoin

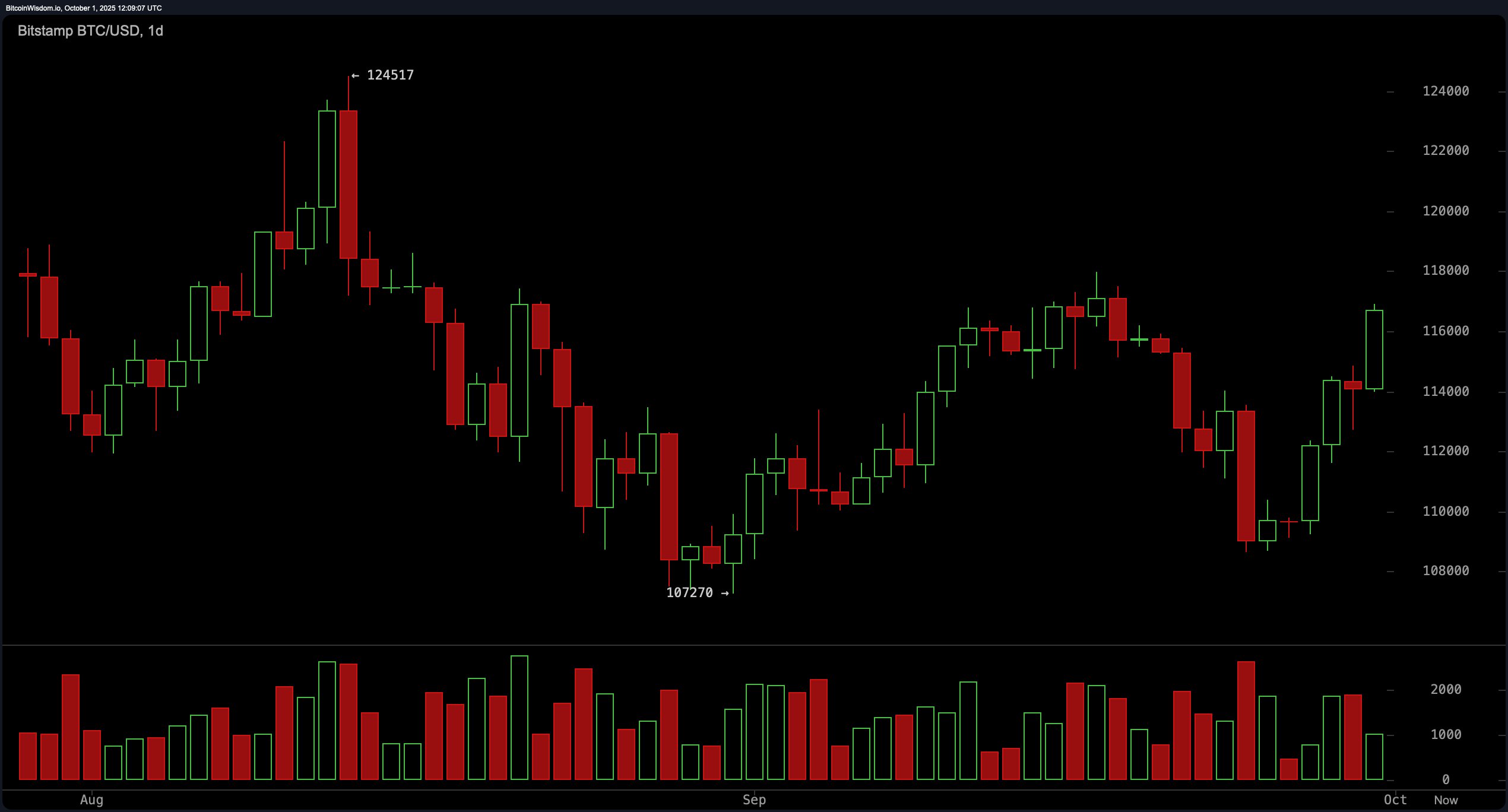

The day-to-day chart unearths bitcoin is toeing the road pretty under a cussed resistance diploma within the $117,000–$118,000 zone, a ceiling it closing flirted with in early September. A series of upper lows for the reason that latest $107,270 bottom hints that momentum is building for a doable breakout.

Bullish candles and rising quantity bolster the case, and that recovery structure implies self belief is returning to the market. Mute, caution hangs within the air—this diploma isn’t pretty a tempo bump, it’s the velvet rope guarding the $124,517 high from August.

Zoom into the 4-hour chart, and bitcoin’s been flexing more difficult. A rounded bottom formed between September 25 and 28 has morphed into a sharp impulse breakout, marked by a strong candle punching up to $116,839. This isn’t your moderate drift upward—it’s a trim structure of upper lows and better highs, suggesting the wise money’s been gathering. If this tempo holds, brief-term watchers can hang their eyes fastened on the $117,500–$118,000 window, which now doubles as both battleground and gateway.

On the 1-hour chart, bitcoin is all about that brief-term sizzle. A sharp breakout candle confirmed with quantity spiked to $116,839, carving a textbook bullish flag. Scalpers eyeing a pullback to the $115,800–$116,000 region would possibly perchance earn alternatives, but tight stops discontinuance to $115,000 are a need to. The setup’s trim, the vitality is palpable, but any exhaustion in momentum would possibly perchance clip the wings of this flight.

Now, let’s focus on technical indicators. Oscillators are playing it coy—neutral indicators from the relative strength index (RSI) at 59, Stochastic at 69, and commodity channel index (CCI) at 58 suggest the asset isn’t overcooked but. The frequent directional index (ADX) at 18 confirms pattern strength stays modest, whereas the Superior oscillator lounges under zero at −260. Nonetheless then momentum pulls a surprise with a strong 1,505 studying, and the transferring moderate convergence divergence (MACD) crosses into bullish territory at −8. Collectively, these indicators train optimism with a wink.

Supporting the bullish thesis, every single main transferring moderate is locked into upward alignment. The 10-duration exponential transferring moderate (EMA) and straight forward transferring moderate (SMA) fly round $113,500 and $112,395, respectively, giving brief-term thrust. Mid-vary and lengthy-vary traits are pretty as flattering: the 20-, 30-, 50-, 100-, and even 200-duration EMAs and SMAs are uniformly positioned under ticket circulate, signaling ample market strength. With the 200-duration straightforward transferring moderate all the manner down at $104,932, it’s trudge this rocket has left the launchpad.

Bull Verdict:

Bitcoin’s chart is dressed to galvanize. With all main transferring averages stacked under the present ticket, bullish momentum building on brief-term timeframes, and momentum indicators pointing north, the setup appears bask in it’s warming up for a breakout dance above $118,000. If quantity shows up to the celebration, we’d pretty ogle bitcoin eyeing that $124,000 zone bask in it’s déjà vu.

Endure Verdict:

Whereas bitcoin’s ticket circulate is turning heads, the $118,000 resistance is no pushover—it’s the velvet rope of this rally. Oscillators are whispering caution, momentum would possibly perchance stall, and a failure to crack this ceiling would possibly perchance ogle the market retreat to the $112,000s. With out stronger quantity, this bullish flirtation risks becoming a classic bull lure in hide.