The Bitcoin (BTC) fee has tumbled bigger than 5% on Tuesday to beneath $60,000 following a disappointing first day of predicament Bitcoin ETF alternate in Hong Kong, and following new US economic info that factors to sticky inflation and strengthens the argument that the Fed ought to wait earlier than lowering interest charges.

Having pushed nearly as excessive as $65,000 in early Asia alternate, Bitcoin used to be final altering arms in the $59,900s.

And as macro/traditional headwinds fabricate, technical evaluation means that BTC shall be headed for a attain-length of time correction into the $50,000s.

Since mid-April, the Bitcoin fee has continuously chanced on resistance at its 21 and 50DMAs, suggesting the bears are in lend a hand watch over.

Moreover, the Bitcoin fee has also fashioned a descending triangle in the outdated couple of weeks. Descending triangles on occasion originate earlier than bearish breakouts.

Would possibly maybe maybe well additionally still Bitcoin damage to the south of its most new fluctuate lows at $60,000, a mercurial retest of $Fifty three,000 is doable. That can maybe mean a 12% attain-length of time tumble from most new ranges.

That can maybe take the Bitcoin fee’s pullback from its March all-time highs attain $74,000 to nearly 30%.

Hong Kong Location Bitcoin/Ether ETF Begin Falls Flat

The delivery of predicament Bitcoin and Ether ETFs in Hong Kong on Tuesday fell flat.

Hong Kong ETF suppliers had been pumping hype earlier than the initiating, claiming that the Hong Kong delivery would possibly maybe surpass the US delivery.

As an different, total shopping and selling volumes amounted to actual beneath $12.5 million, as per Bloomberg info circulated on X. Hong Kong’s new Bitcoin ETFs seen less than $10 million in alternate volumes.

Hong Kong Crypto ETFs possess been predicted to possess $300 million inflows on the first day.

As an different they’d a total of $12.4m in total shopping and selling volume. pic.twitter.com/YUGgD6ugjh

— wallstreetbets (@wallstreetbets) April 30, 2024

That used to be a immense disappointment to the market. It used to be no marvel that the Bitcoin fee seen a tall dip in wake of these numbers popping out.

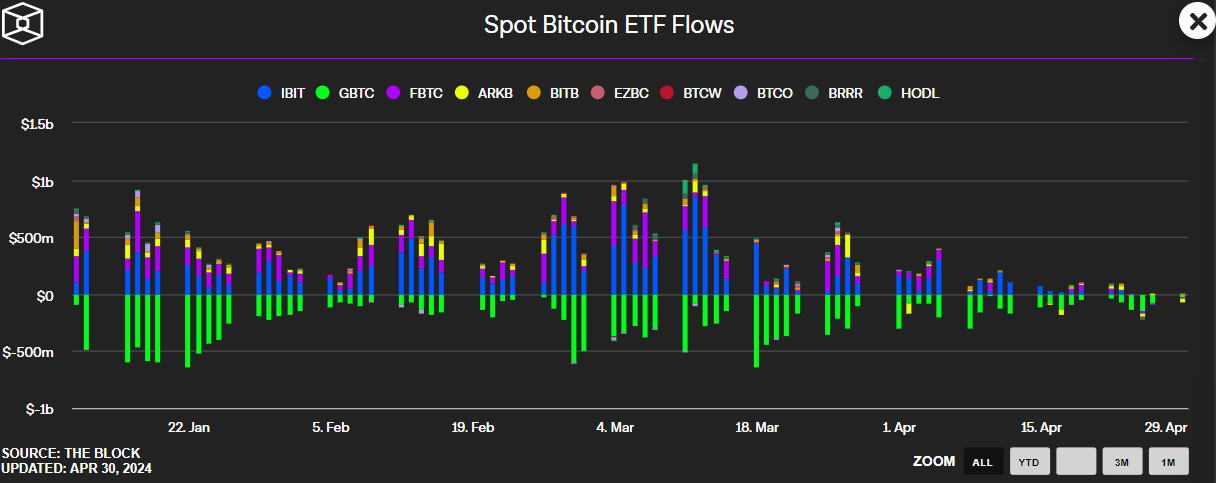

The used Hong Kong ETF debut comes amid a slowing of inflows into predicament Bitcoin ETFs in the US.

Flows possess been rep detrimental since final Wednesday, The Block info reveals.

Calm, the provision of these ETFs in one of many arena’s necessary financial centers is a essential milestone for crypto.

Macro Headwinds Defend Building

Including to the promote pressure catalyzed by the used Hong Kong ETF debut has been a persisted fabricate-up of macro headwinds.

Data concerning to inflation in employment charges in the US came in increased than anticipated for Q1.

Sticky core inflation…

The US Employment Cost Index rose by 1.2% in the first quarter of 2024, accelerating from a 0.9% enhance in the outdated three-month length and beating the market consensus of a 1% verbalize.

Employment charges rose basically the most in 365 days, as wages and… pic.twitter.com/SId678qKuT

— Ayesha Tariq, CFA (@AyeshaTariq) April 30, 2024

This has contributed to considerations that inflation in the US will remain “sticky” above the Fed’s 2.0% target.

It’s no marvel then that Fed policymakers are reputedly jubilant with the market’s most new repricing of Fed fee reduce expectations.

As per CME info, the market-implied likelihood of no fee cuts by September is now 50%. One month ago, the market-implied likelihood of no fee cuts by then used to be totally 6.5%.

Meanwhile, the likelihood of no fee cuts this year has risen to 25%, up from 1% one month ago.

As per Financial institution of The usa (BoA), the Fed is in “wait-and-gape mode until (it) has more clarity on inflation”.

❖ Powell Seen as ‘Delighted’ With Repricing of Fed Expectations: Financial institution of The usa

The Fed’s major message after tomorrow’s fee resolution is liable to be that “coverage wishes more time, the following pass is maybe a fee reduce, and the committee is in a wait-and-gape mode until the…

— *Walter Bloomberg (@DeItaone) April 30, 2024

“We suspect Powell is jubilant with the tall pricing out of cuts this year,” Walter Bloomberg quoted BoA as saying.

Effectively-revered Fed analyst Prick Timiraos also argued in a most new WSJ article that the Fed will signal “it has the abdomen to lend a hand charges excessive for longer”.

It no surprise then that the US Greenback Index and US authorities bond yields are shopping and selling finish to most new highs.

The DXY rebounded above 106 on Tuesday and is eyeing yearly highs at 106.50. The US 10-year used to be final at 4.68% and eyeing a retest of final week’s yearly highs at 4.74%.

Bitcoin tends to carry out poorly in an environment of tightening financial stipulations (i.e. when the market starts looking ahead to increased interest charges and the greenback and yields rise).

Is the Bitcoin Bull Market Over?

Weak point in ETF inflows, tightening financial stipulations plus bearish technicals would possibly maybe ship Bitcoin to the $50,000s imminently.

Would this spell an kill to the Bitcoin bull market that began assist in leisurely 2022?

While there will undoubtedly be somewhat a few FUD on social media platforms adore X, that is terribly now not in point of fact.

To delivery with, assuming Bitcoin is following its normal four-year cycle, there is still roughly 1.5 years of bull market to pass.

That argument is reinforced by basically the most new passing of the Bitcoin halving, a main driver of previous four-year cycles.

The major three Bitcoin halving’s all preceded enormous pumps to new document highs, albeit now not for as a minimum 4-6 months.

#BTC

Compose now not let this retrace distract you from the attach we are in the Bitcoin cycle$BTC #BitcoinHalving #Bitcoin pic.twitter.com/LniRS6xu8u

— Rekt Capital (@rektcapital) April 30, 2024

The ask is, will the fee action following this halving be diversified?

Effectively, the fee action main up to basically the most new halving used to be diversified. Bitcoin used to be ready to hit a brand new all-time excessive earlier than the halving for the first time.

That arguably raised the possibility of a put up-halving correction, which looks to be manifesting wonderful now.

Nonetheless that doesn’t mean we received’t gape new all-time highs after the halving in leisurely-2024 or 2025.

Meanwhile, though fee cuts bets are being pushed assist, interest charges in the US possess maybe peaked. That’s to claim, the ask stays “when”, now not “if” the US starts lowering charges.

And more straightforward financial stipulations forward ought to by some means come in as a tailwind to the market.

Risks are arguably more tilted against economic weakness in the US and decrease inflation, than against energy.

Regardless of every thing, interest charges remain at multi-decade highs and the yield curve has been inverted for nicely over a year.

Would possibly maybe maybe well additionally still the US economy weaken, bringing inflation down faster, this would possibly maybe maybe flee fee cuts.

ETF & Protected-Haven Question To Enhance BTC?

Other factors are also attach to enhance BTC. Most doable merchants of the US ETFs haven’t stepped into the market yet.

Many are required to habits a length of due diligence on the new products earlier than investing. Many don’t possess fetch admission to yet, as the ETFs aren’t yet supplied by their financial institution/wirehouse.

Risks are strongly tilted against a continuation of inflows in the approaching years. That’s to claim, it’s most now not in point of fact most new AUM in predicament Bitcoin ETFs doesn’t continue rising.

Extra broadly, the yarn of Bitcoin as “digital gold” will continue gaining momentum in the approaching years.

BlackRock CEO, Larry Fink, is actually on Fox Replace arguing with the host about why #Bitcoin is the stylish day digital gold, how it protects you from inflation and removes counter fetch collectively possibility linked with governments.

The yarn is altering! 🤯pic.twitter.com/OOSAs4eHjt

— The ₿itcoin Therapist (@TheBTCTherapist) March 9, 2024

It’s likely that more firms and worldwide locations will adopt it as a reserve asset as Wall Boulevard americaits allocation.

Bitcoin would possibly maybe also additionally continue to entice fetch-haven demand, if geopolitical/financial balance considerations resurface.

Fed fee hikes possess build a main stress on many regional US banks – Troubles right here would possibly maybe re-emerge at any moment.

Merchants will bear in mind the March 2023 Bitcoin fee pump as varied banks collapsed.

Disclaimer: Crypto is a excessive-possibility asset class. This article is supplied for informational positive aspects and doesn’t constitute investment advice. You would lose your entire capital.